TrueUSD (TUSD) ranks sixth by market cap in the stablecoin category and is 100% fiat-collateralized. Launched in 2018, TUSD has a market cap of approximately $1.2 billion, totaling around 52 thousand holding addresses. Upon launch, TUSD aimed to be “…the first independently-verified digital asset redeemable 1-for-1 for US Dollars.”

TrustToken, launched in 2017, is the parent company of TUSD, with Rafael Cosman at its helm as the CEO and co-founder. The blockchain company, based in San Francisco, offers a range of products, mainly the TrustToken app, the TrueCurrencies, and TrueFi, all revolving around a cluster of stablecoins they have built, which they refer to as TrueCurrencies. These are TUSD (US dollar), TGBP (British pound), TAUD (Australian dollar), TCAD (Canadian dollar), and THKD (Hong Kong dollar).

This first product launched by the company is based on a straightforward collateralized model with actual money sitting in banks via partnerships and fiduciary entities. TUSD works with Silvergate Bank, Signature Bank, First Digital Trust, Prime Trust, and BitGo. Even though USDT, USDC, and BUSD follow a fiat-collateral model, TUSD is different because its business model prioritizes a blend between traditional banking and Defi.

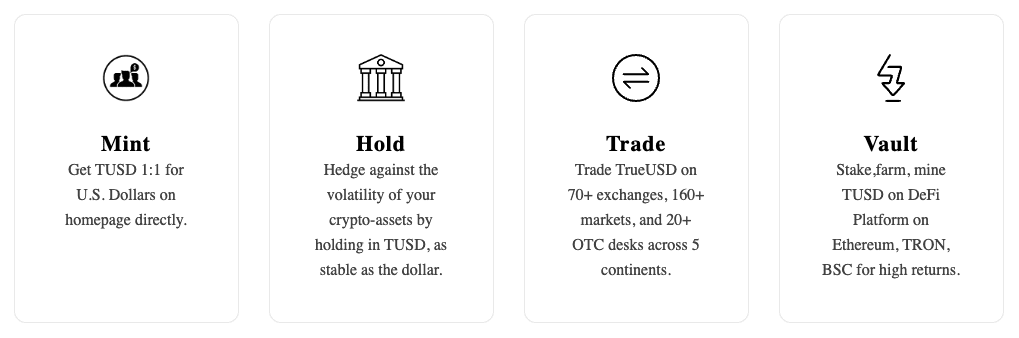

To use TUSD, clients send a wire to one of TUSD’s banking partners, who verifies the funds.

The equivalent amount is then minted in TUSD coins. The minted TUSD coins are by default fully backed because the fiat money lies safe at the bank. When TUSD is sent back to TrustToken, this TUSD is burned and taken out of circulation. This offers companies an alternative to heavy fees incurred with fiat money transfers.

In the TUSD ecosystem, trust is one of the highest priorities. In March 2019, TrustToken partnered up with Armanino to provide TUSD users with real-time attestations of their reserves. In 2020, a partnership with Chainlink was sealed to provide online proof of reserves and supplies. This enables users to have instant access to information. TUSD has had quite some wild swings in its peg, with the highest price reaching $1.62 in August 2018 and the lowest going down to $0.88 in March 2020. Available in over 70 exchanges, TUSD is an ERC-20 token and is live on +EthereumChain, TronChain, BinanceSmartChain, BinanceChain, and AvaChain, with 30+ Defi integrations.

In November 2020, TrustToken launched TrueFi, a protocol for uncollateralized or undercollateralized lending, where users can lend, borrow, stake, and farm. Since the loans are not based on collateral, lending is only available to institutions that undergo verification and a vetting system and require at least $10 million in net unencumbered assets. This permits higher interest rate requests, earning crypto lenders a higher yield.

In the main lending pools, holders of the TRU token, which is the governance token of the protocol, collectively assess the creditworthiness of borrowers and individual loans through staking TRU. By voting on loan requests, TRU stakers signal the creditworthiness of each loan request on TrueFi’s credit prediction market. In the past eighteen months since its inception, the protocol has processed an impressive $1 million in loan originations without any over-collateralization and any defaults, all of which are transparent and available in their analytics section.

Lenders deposit their stablecoins into one of the lending pools, and in return, the lender receives the TrueFi version of that token, which can then be farmed for additional TRU.

Any stablecoins deposited in the pools not being loaned out are put to work in major Defi protocols like Aave and Compound. Risk mitigation measures to protect lenders include staking, a “Know your business” workflow, and an on-chain credit score incorporating both on-chain and off-chain data.

Last January, TrustToken announced the launch of the TrueFi Lending Marketplace, permitting asset managers to launch financial products and access a vast international pool of lenders and borrowers and TrueFi’s other products and services. This opened the doors to non-crypto financial partners to borrow and lend on the protocol, who benefit from greater speeds, lower costs, and accessibility to blockchain tech. Two heavyweights have recently been added to the team to enhance fund architecture, lead asset manager relationships, product management, design, and marketing.