- Cardano’s 70M ADA budget proposal passed 53% approval, putting it on track for full acceptance.

- ADA price was rejected at $0.44 and slipped to $0.41 as sell pressure increased.

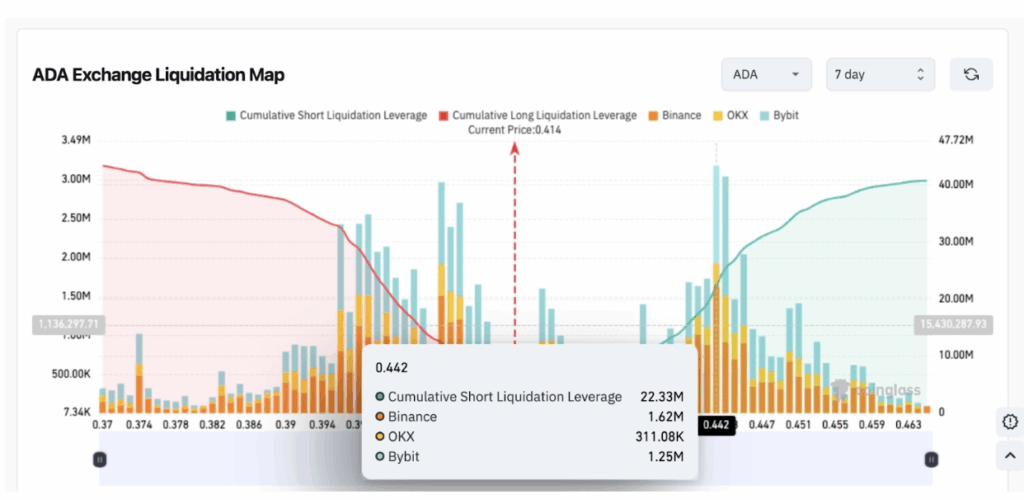

- A $22M short cluster at $0.44 now forms a major resistance wall blocking further upside.

Cardano spent the weekend wobbling just above $0.41, trying to hold its footing after getting rejected hard at $0.44 earlier in the week. At the same time, a major governance vote asking the community to release 70 million ADA from the treasury crossed the 53% approval line — a milestone that should’ve boosted sentiment, but instead the market feels stuck in a weird limbo. Traders are watching ADA press against a growing wall of sell-pressure, and the timing honestly couldn’t be more tense.

A 70M ADA Budget Request Gains Momentum, but Price Momentum Fades

The Cardano team kicked off a governance action asking for 70 million ADA to fund critical integrations — things like tier-one stablecoins, custody tools, analytics systems, bridges, all those infrastructure pieces Cardano’s been missing for years. Founder Charles Hoskinson and big ecosystem players such as IOHK, EMURGO, Intersect, and Midnight threw their support behind it, which pretty much pushed the proposal toward majority approval early. Voting data shows 2.94 billion ADA (53.14%) cast by DReps in favor, with most of the rest either abstaining or simply not voting yet. Stake pool support is showing up too, even though the Constitutional Committee hasn’t voted at all. With voting open until December 30, the initiative looks almost certain to pass.

Price Action Slows as Market Hit Resistance at $0.44

Even with the governance tailwind, ADA couldn’t hold its Thursday strength. It bounced to $0.44 during the broader market rebound sparked by Bitcoin’s run from $82,000 to nearly $93,000 — but the momentum just kinda melted afterward. As selling pressure stacked up, ADA dropped back to the $0.41 range, trimming its weekly gains to 3.4%. The rejection at $0.44 wasn’t random either; derivatives traders have built a dense cluster of short exposure right there, creating a $40M sell-wall that keeps blocking every breakout attempt.

Derivatives Show a Tight Battle — But Shorts Guard the Ceiling

Coinglass data reveals long positions sit around $43 million, slightly above the $40 million in shorts. Technically that gives bulls a tiny edge, but the positioning isn’t clean. The single biggest point of tension is at $0.44 — a liquidity pocket holding around $22M in short leverage. These clusters act like magnets for volatility; if ADA pushes through sharply, short-sellers get forced to buy back and fuel a breakout. But more often, if volumes stay light, this kind of cluster just sends price bouncing downward again. Right now, ADA doesn’t have the firepower to slice through $0.45 without a serious boost in participation.