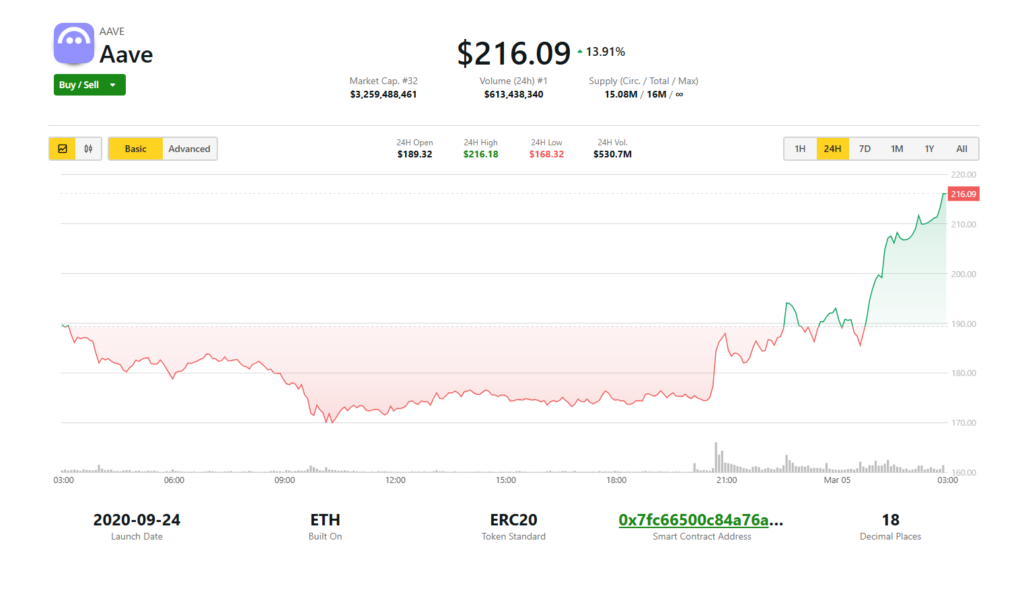

- AAVE surged 10.84% after Marc Zeller proposed major updates to tokenomics and liquidity management.

- The plan includes a $1 million per week AAVE buyback program and a new Anti-GHO fee-switch mechanism.

- If approved, the proposal will move through community discussion, an off-chain Snapshot vote, and an on-chain governance process.

AAVE surged 10.84% after Marc Zeller, founder of the Chan Initiative, introduced a new proposal on Tuesday aimed at revamping the platform’s tokenomics. The Aave Request for Comment (ARFC) outlines key changes, including enhancements to AAVE tokenomics, redistribution of protocol revenue, liquidity management updates, and the official retirement of LEND.

“After half a decade of hard work, we at the ACI are proud to present the updated Aavenomics proposal to the Aave DAO,” Zeller shared on X. “This is, in our view, the most important proposal in Aave’s history. We welcome all feedback.”

ACI, a key delegate and service provider within Aave’s decentralized governance, is responsible for strategy, governance participation, and proposal creation. This proposal follows the Aavenomics temp check, which gained approval in August 2024, potentially setting the stage for a fee switch that redirects excess protocol revenue back to key users. If passed, it could also pave the way for Aave protocol restaking, a move that would introduce additional revenue streams.

Aave’s strong financial position supports this major update. Since the temp check, Aave’s cash reserves have jumped 115%, reaching $115 million. This gives the protocol a solid foundation to implement changes while maintaining its competitive edge, Zeller explained.

$1 Million Weekly AAVE Buyback Plan

A significant aspect of the proposal is the creation of the Aave Finance Committee (AFC), a new entity responsible for overseeing treasury holdings and liquidity strategies. The AFC would launch a $1 million per week AAVE buyback program, running for six months, with future expansions contingent on financial health and additional governance approvals.

Additionally, secondary liquidity incentives will undergo optimization, cutting Aave’s $27 million annual liquidity costs. Instead of distributing AAVE as rewards, the protocol would shift toward a more sustainable model using staking and active management while gradually increasing buybacks from the market.

Another major change involves the introduction of an Umbrella safety module designed to protect users from bad debt—potentially up to billions. Meanwhile, the current GHO discount system would be replaced with Anti-GHO, a new fee-switch mechanism that redistributes a portion of GHO stablecoin revenue to AAVE stakers.

The proposal also calls for the formal deprecation of the LEND-to-AAVE migration contract, reclaiming approximately 320,000 unclaimed AAVE tokens (valued at around $65 million) for the ecosystem reserve. LEND was Aave’s original governance token before it was upgraded to AAVE in 2020.

What Comes Next?

The next step is community discussion, with the goal of reaching consensus before proceeding to an off-chain Snapshot vote. If that passes, it will move to a formal on-chain governance proposal (AIP) before execution.

Zeller emphasized that the proposal has undergone thorough peer review, involving all key delegates. While he expressed strong confidence in its approval, he acknowledged that in decentralized governance, no outcome is ever fully guaranteed.

Following the announcement, AAVE’s native token spiked 7.8%, climbing from $174.10 to $187.71, according to The Block’s AAVE Price page.