- A previously bearish trader opened $325M in long positions across BTC, ETH, SOL, and XRP.

- The exposure is broad and sized for conviction, not short-term trading.

- Major assets remain range-bound, with Solana and XRP showing relative strength.

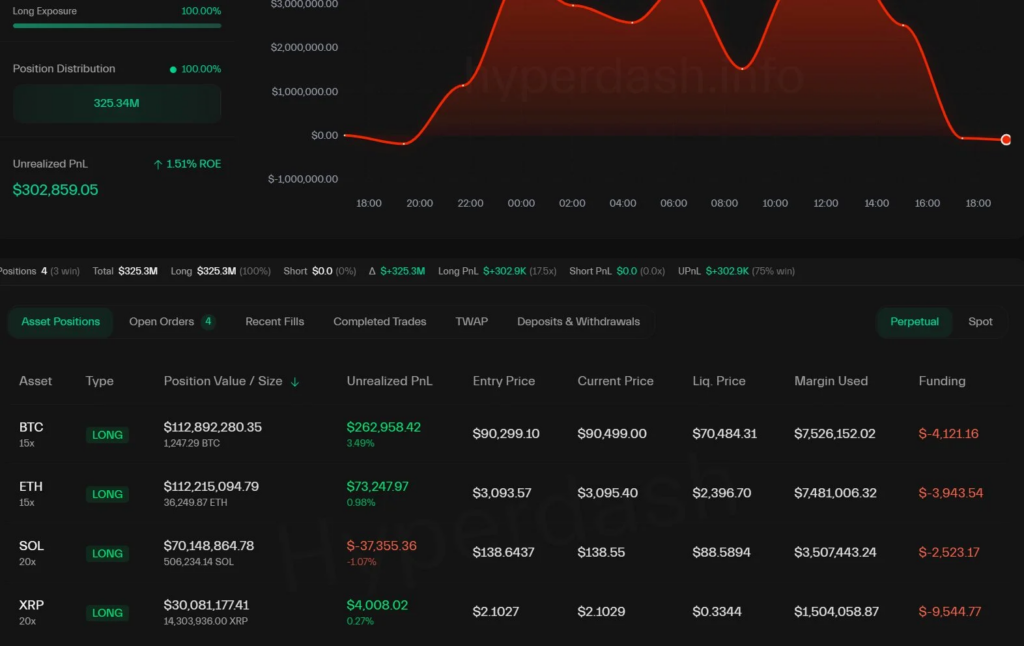

A crypto trader once known for aggressively shorting Bitcoin and Ethereum made a sharp reversal on Friday, opening more than $325 million in long positions across major assets. According to data tracked by HyperDash, the trader built exposure across Bitcoin, Ether, Solana, and XRP in a single coordinated move. That kind of size doesn’t slip into the market quietly, especially when it comes from someone with a public history of betting the other way.

The Positions Are Broad, Not Tactical

The breakdown shows intent, not a one-off trade. The trader went long 1,247 BTC valued at roughly $113 million, alongside 36,249 ETH worth about $112 million. On top of that, the position includes more than 506,000 SOL valued near $70 million and over 14 million XRP totaling around $30 million. At the time of writing, unrealized profits sit just above $300,000, modest relative to size, suggesting this is positioning rather than a quick scalp.

Price Action Remains Calm, For Now

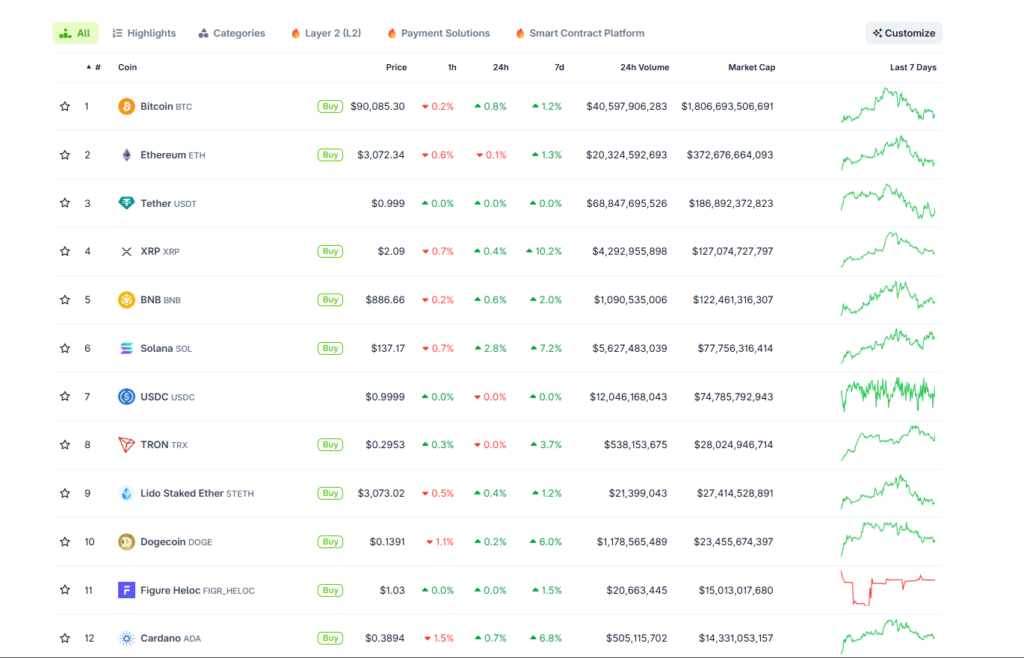

What makes the move stand out is the backdrop. Bitcoin has been trading mostly flat while holding above the $90,000 level, with price action remaining muted despite recent volatility elsewhere. Ether has also been moving sideways near $3,100. In contrast, Solana and XRP have shown more relative strength over the past week, posting gains of roughly 7% and 10%, respectively.

Why This Flip Matters

When traders with a strong bearish track record suddenly flip long, markets take note. It doesn’t guarantee upside, but it often signals a reassessment of risk rather than pure speculation. Broad exposure across multiple large-cap assets suggests confidence in the market structure, not just a single narrative or catalyst. These kinds of shifts tend to show up before momentum becomes obvious on the charts.

What to Watch Next

The key question isn’t whether this trader is right immediately. It’s whether follow-on positioning confirms the shift. If price continues to hold key levels while large players reposition quietly, it strengthens the case that downside pressure is being absorbed. For now, the trade adds another data point to a market that looks calm on the surface, but increasingly active underneath.