- NFT financing is revolutionizing borrowing and lending by using digital assets as securities, enabling borrowers with low liquidity to access financial loans.

- NFT financing enables fractional ownership of high-value assets, expanding their borrowing possibilities.

- NFT financing creates new streams of revenue for artists and creators hence selling their works directly without middlemen

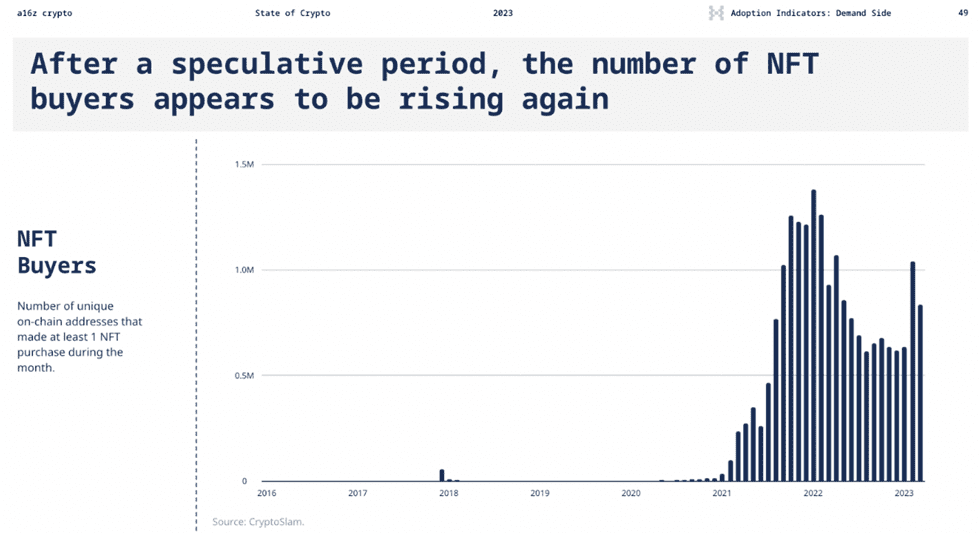

In the dynamic world of finance, NFTs are rapidly gaining momentum through leveraging new possibilities and applications. The report by A16z research shows an increase in NFTs with a recent emerging presentation leading to growth in their values.

The NFTs report of 2023 also shows that there is a positive increase in NFT purchases demonstrating market maturity over the period with an annual growth of 53.1%, wherein 2023, it was estimated at $32.89 billion from $21.48 billion in 2022

Reshaping Lending and Borrowing

NFT financing shows excellent signs of reshaping the financial landscape of borrowing and lending in several ways:

NFT lending has become an emerging market for financial products with new investments for all individuals and organizations.

The international tokenization market is estimated to grow to $ 4.8 billion by 2025, with an average annual growth rate of 19.5%. The surge in digital assets will likely disrupt traditional markets and increase sales of NFTs by 2025 projections.

Firstly, they are the newest collateral facility that increases borrowing options for digital asset owners. The borrowers will access loans in the form of stablecoins or cryptocurrency and repay them later as agreed with interest without needing to dispose of their crypto assets.

Secondly, the introduction of NFTs in financing makes individuals own part of high-value assets enabling them to accrue dividends over time. The fractioning of high-value assets makes them affordable to small investors with limited financial resources.

The small portion of ownership experienced in NFT sales allows the minor investors to obtain loans using them as collateral.

The NFT has attracted significant interest due to high-profile sales spurred by joint sales like that of LeBron James’s epic dunk and Jack Dorsey’s first tweet. The high-profile market dynamics have popularised the NFT sales to new expansions over the last year, where it recorded the highest growth.

Thirdly, applying NFTs creates a new revenue stream for artists and creators. The artists are provided with an avenue to tokenize their work digitally as NFTs which they can sell to other investors to increase their share of returns.

Tokenization has been a feature in the virtual gaming industry where the NBA introduced a Top Shot crypto collectible that makes fans trade officially licensed videos, as shown by the sales of NFT of LeBron James doing a dunk sold for over US$200,000 by 2021 records as shown below:

| Moment | Price |

| LeBron James’ “Cosmic” Dunk | $208,000 |

| Zion Williamson “Holo MMXX” Block | $100,000 |

| LeBron James “From the Top” Block | $100,000 |

| LeBron James “Throwdowns” Dunk | $100,000 |

| LeBron James “Holo MMXX” Dunk | $99,999 |

| Steph Curry’s “Deck the Hoops” Handles | $85,000 |

| Giannis Antetokounmpo “Holo MMXX” Dunk | $85,000 |

| LeBron James “From the Top” Dunk | $80,000 |

| LeBron James “From the Top” Block | $78,000 |

| LeBron James “From the Top” Dunk | $71,455 |

The creators will also accrue royalties by signing new smart contracts forming an unknown percentage of revenue streams through NFT sales. Introducing NFTs in innovation and creativity enables creators to accrue financial stability over time.

In another form, NFTs enhance traceability and transparency in borrowing and lending. All transactions are recorded on the blockchain creating a transaction history and an immutable record of ownership. Transparency minimizes fraud risks, simplifies diligence for lenders, and increases trust.

Implications

NFTs are now very essential in digital financing, but they still grapple with many considerations and challenges.

The NFT market is volatile and risky to both the borrower and the lender since its value fluctuates significantly. These risks highlight the need to have reliable NFT valuations and standard procedures.

To address these risks, lenders and borrowers must apply best practices by thoroughly examining the liquidity and value of the NFT collaterals. To minimize underlying risks, the borrowers must give relevant data on their NFTs and the debt-to-income ratios.

Additionally, the regulatory landscape surrounding NFTs is still developing, which requires the establishment of frameworks and standards that protect investors to sustain their growth.

As we look forward, NFTs’ integration into the financial landscape exhibits promising implications. There is ever development of adaptive regulatory frameworks, robust monitoring of market trends, and refined risk management strategies, which are essential in reshaping NFT financing.

Through these progressive measures, NFT financing keeps revolutionizing lending abilities in the financial markets.