- Swaap Labs intends to use the seed funding to build Swaap, a Next-Generation Market Making Protocol.

- Swaap v1, launched in July 2022, has already demonstrated profitable market-making on-chain.

- Swaap v2, set to revolutionize the DeFi landscape, will feature advanced market-making models and architecture that improves data latency.

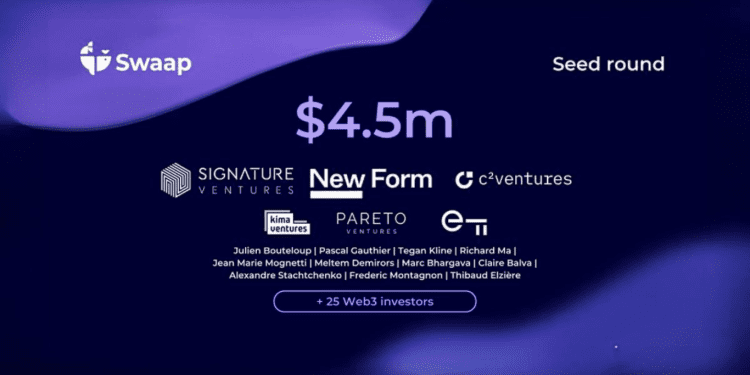

Swaap Labs, the company behind Swaap, has raised over $4.5 million in seed funding. Swaap develops the Next-Generation Market Making Protocol, which uses oracles and dynamic spreads to achieve sustainable yields and lower trading costs.

Its novel approach aims to provide liquidity providers (LPs) with passive and profitable market-making strategies while addressing the critical issue of impermanent loss, which is prevalent in DeFi.

Swaap v1, which debuted on Polygon in July 2022, has already demonstrated that profitable market-making on-chain is possible. Its WBTC/WETH/USDC pool, powered by Chainlink price feeds, has experienced less than 0.1% impermanent loss.

Swaap v2 is set to revolutionize the DeFi landscape with new enhancements and features that will improve on v1. It employs the most advanced market-making models in DeFi, developed in collaboration with the Louis Bachelier Institute, a leading Math Research Institute.

Swaap v2 also features innovative architecture that significantly reduces data latency, improving the platform’s overall performance. Furthermore, this new architecture gives users access to a wide range of tokens, including yield-bearing options, expanding the platform’s capabilities and solidifying Swaap v2 as a frontrunner in the DeFi space.

Signature Ventures led the seed funding round, which included participation from high-profile investors such as New Form Capital, C2 Ventures, Kima Ventures, Pareto Ventures, Entrepreneur First (where Swaap’s co-founders met), and renowned business angels such as Julien Bouteloup (Stake Capital), Pascal Gauthier (Ledger CEO), Richard Ma (Quantstamp CEO), Tegan Kline (The Graph), Meltem Demirors (Coinshares CSO).

According to Cyrille Pastour, the co-founder of Swaap Labs, “We are thrilled to have the support of our investors as we work to democratize DeFi and create a more efficient environment for Liquidity Providers. This funding will enable us to accelerate the development and release of Swaap v2, which promises to deliver even more value to LPs and traders in the DeFi ecosystem.”

“We are proud to work with the outstanding team at Swaap Labs and to be a part of their journey. We think Swaap’s Market Maker protocol is a true game-changer for decentralized finance,” stated Dr. Georg (Juri) Stricker, Tech Partner at Signature Ventures.

“Building upon the progressively more scalable public chain infrastructure and more transparent and robust oracle infrastructure, Swaap is setting new standards in DEX efficiencies for liquidity providers and traders.

By offering more stable yields and sustainable returns, we believe Swaap is an essential building block in the evolution of DeFi towards a financial system.”

Swaap invites users to sign up for its upcoming v2 release by joining the waitlist. Visit swaap.finance/waitlist to be among the first to gain access to the new platform and enjoy exclusive benefits. Zealy (previously Crew3) powers the waitlist, ensuring a smooth and efficient onboarding experience.

About Swaap

Swaap is reshaping the DeFi landscape with cutting-edge market-making models, improved performance, and access to a diverse range of token options, including yield-bearing assets.

Swaap, created in collaboration with the Louis Bachelier Institute, provides an enhanced experience for Liquidity Providers by utilizing the innovative AMM (automated market maker) simulator.