- Early emails show XRP was viewed as a direct challenge to Bitcoin-aligned interests

- Ripple vs Stellar debates shaped adoption, trust, and developer alignment

- Pushback wasn’t technical alone, it was strategic and political

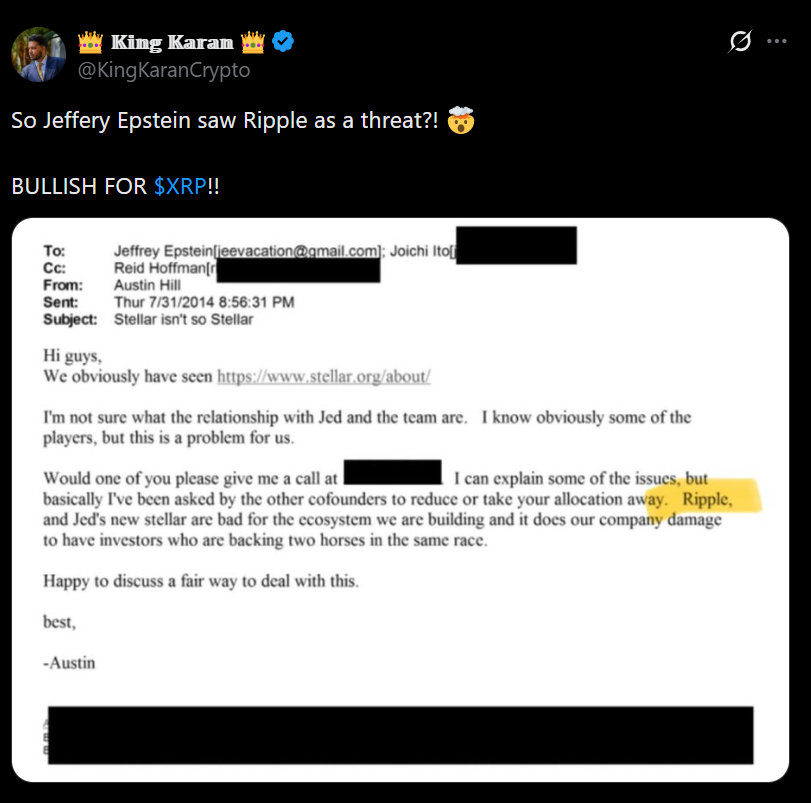

Recently surfaced emails involving Jeffrey Epstein have reopened an old chapter in crypto history, shedding light on how Ripple and XRP were viewed by early industry insiders. One of the most telling exchanges came from Austin Hill, a Blockstream co-founder, who warned that supporting Ripple or Stellar alongside Bitcoin interests would effectively make someone an adversary. The concern wasn’t about code quality alone. It was about choosing sides in what many already saw as a zero-sum race for influence over global payments infrastructure.

David Schwartz later contextualized these emails, noting that Hill’s stance likely reflected a broader sentiment shared privately across the industry. Supporting Ripple meant alienating Bitcoin-focused stakeholders, which made early institutional and developer backing far more complicated than public narratives suggested at the time.

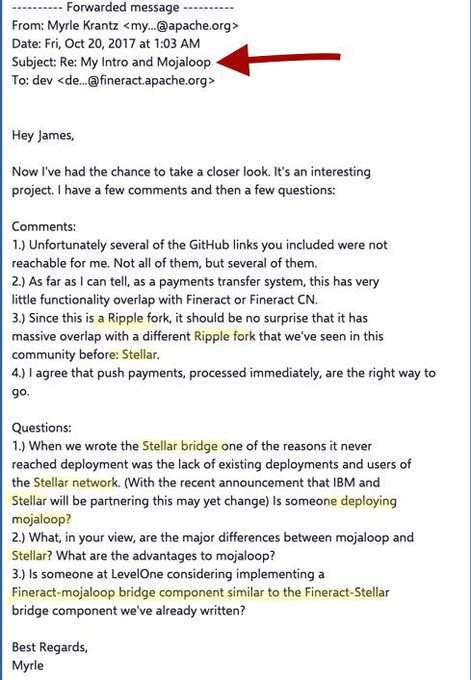

Mojaloop’s XRP Evaluation and the Ripple vs Stellar Divide

Additional leaked discussions tied to Mojaloop evaluations provide more texture. Mojaloop was described internally as resembling a Ripple fork, with Stellar offering heavy functional overlap. The core appeal across these systems was push payments and near-instant settlement, features that were still rare at the time.

However, adoption issues quickly surfaced. Integration challenges with systems like Fineract and concerns around interoperability slowed momentum. While the technology impressed on paper, real-world deployment highlighted that payments networks live or die by trust, coordination, and ecosystem buy-in, not just throughput or settlement speed.

Adoption Friction Was Strategic, Not Just Technical

Taken together, the Epstein-related emails and Mojaloop assessments point to a consistent theme. Ripple’s early struggles were less about whether XRP worked and more about whether the industry wanted it to work. Bitcoin-aligned investors viewed XRP’s cross-border payments vision as disruptive to their thesis, creating resistance that shaped perception for years.

These early signals help explain why Ripple’s path to adoption was uneven despite technical promise. XRP wasn’t just another token. It represented an alternative financial rail that forced stakeholders to pick a side, and many hesitated.

Conclusion

The resurfacing of these emails doesn’t rewrite XRP’s history, but it clarifies it. Ripple faced resistance not because it lacked ambition or capability, but because it challenged entrenched narratives early. Understanding that context makes today’s debates around XRP adoption, regulation, and utility far easier to interpret.