- BTC remains under the True Market Mean near $79,000

- Ongoing ETF outflows are draining a key demand source

- Liquidity remains tight, keeping rallies fragile

Bitcoin slipping below its onchain “line in the sand” isn’t just a technical detail traders can ignore. According to Glassnode data, the True Market Mean around $79,000 has historically separated expansion phases from slower, grinding consolidation. Right now, BTC is sitting between that upper boundary and the Realized Price near $54,900.

That middle zone tends to be uncomfortable. It often produces sideways movement, short-lived rallies, and bursts of optimism that fade quickly. It’s not panic territory, but it’s not strength either. It’s compression.

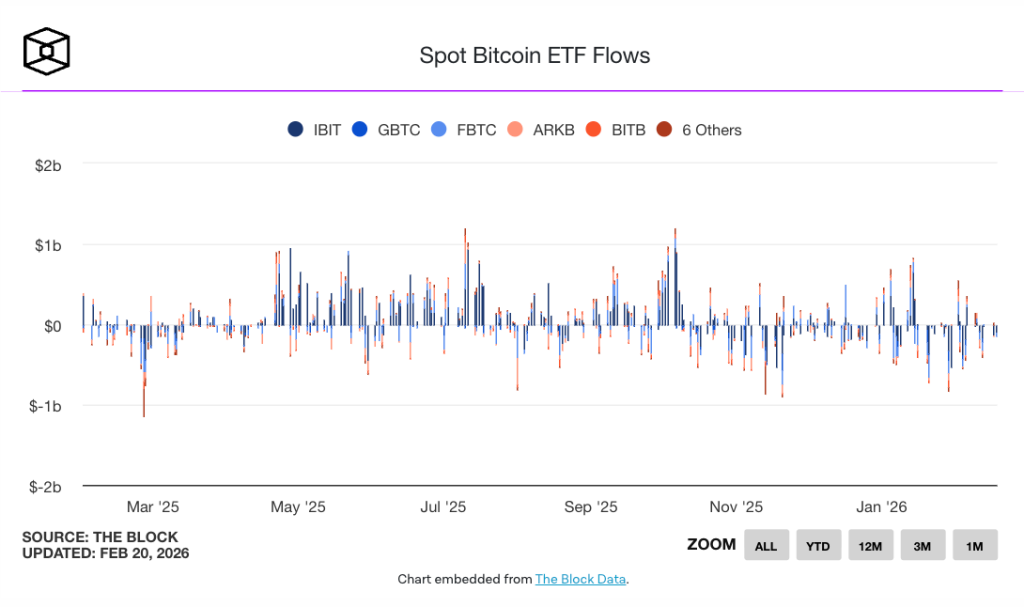

ETF Outflows Changed the Market Structure

For much of the previous cycle, U.S. spot Bitcoin ETFs acted as a quiet but steady bid. That structural demand provided stability during dips. Now, that flow has flipped. Persistent net outflows are replacing accumulation, and the absence of that institutional demand is noticeable.

This isn’t a fear-driven liquidation cascade. It’s thinner participation. Without ETF inflows absorbing supply, price action becomes more reactive and fragile. Markets don’t just fall because of sellers. They fall because buyers disappear.

Calm Derivatives Don’t Equal Bullish Conviction

Options markets show implied volatility easing, which might look like stability. But reduced volatility doesn’t automatically mean bullish positioning. Traders appear less interested in panic hedges, yet they’re not aggressively positioning for upside either.

Bottoms usually require liquidity to expand, not just sentiment to reset. Right now, liquidity still feels constrained. That’s why even modest rallies struggle to sustain momentum.

Macro Pressure Is Still the Backdrop

The Federal Reserve’s hawkish tone continues to influence broader risk appetite. Bitcoin has not decoupled from macro conditions. It reacts to rate expectations, dollar strength, and broader liquidity signals just like equities do.

As long as macro remains restrictive, Bitcoin is unlikely to stage a clean breakout. Structural demand needs space to breathe, and tight monetary conditions limit that breathing room.

Patience Over Predictions

Bitcoin isn’t collapsing, but it isn’t building strong upside structure either. It’s stuck in a holding pattern defined by thin liquidity and cautious positioning.

Until ETF flows stabilize and macro conditions soften, rallies are likely to remain vulnerable. In this environment, patience matters more than bold forecasts. The next expansion phase will likely begin with improving liquidity, not with louder optimism.