- BitMine holds over 4.37M ETH and stakes ~69% for yield

- MAVAN reframes ETH volatility into uptime, yield, and operational execution

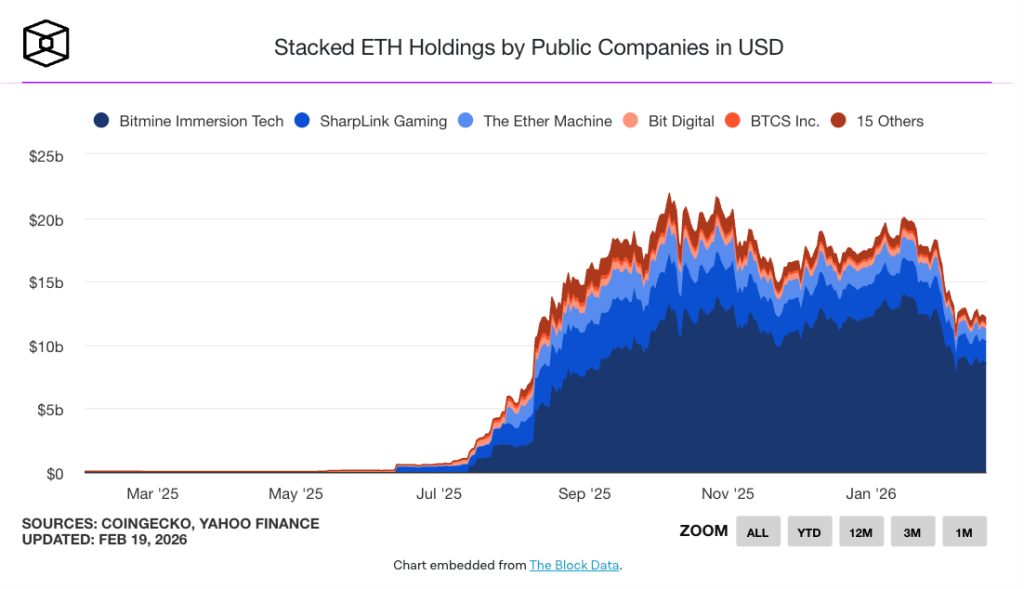

- Equity markets still don’t know how to price staking-native crypto companies

BitMine’s Ethereum position looks absurd at first glance. Over four million ETH on one balance sheet reads like peak-cycle behavior, the kind of thing you’d expect right before a blow-off top. But the mistake is treating this like a speculative bet. BitMine isn’t trading ETH. It’s industrializing it.

The company is running Ethereum like infrastructure. Staking at scale turns ETH from an idle asset into a productive one, and that changes how risk should be framed. Instead of living and dying on price alone, the treasury starts behaving more like a business model, one where revenue is tied to network participation.

MAVAN Turns Volatility Into an Operating Variable

The Made in America Validator Network, MAVAN, is the part of this story that quietly changes everything. Once ETH is staked, price swings still matter, but they’re no longer the whole story. The risk set shifts toward uptime, validator performance, yield stability, and protocol economics. That’s a very different framework than the usual crypto narrative of “number go up.”

Tom Lee has been right about one key point: volatility isn’t a flaw in this model, it’s the raw material. BitMine is effectively betting it can earn through cycles instead of timing them. If that works, staking revenue becomes the cushion that allows the treasury to hold through drawdowns without turning into a forced seller.

Equity Markets Still Haven’t Figured Out How to Price This

BitMine’s stock has been weak even as its ETH holdings have expanded. That disconnect says more about the market than the company. Public equities are comfortable pricing miners, banks, and software firms. A staking-native balance sheet sits awkwardly between all three.

Analysts don’t yet have a clean template for valuing a company that holds a massive crypto treasury, earns yield through staking, and operates validator infrastructure at scale. Until the market decides whether BitMine is closer to a utility, a yield vehicle, or a leveraged ETH proxy, the valuation multiple will stay messy.

This Is the Ethereum Version of Strategy, With a Key Difference

BitMine is increasingly being framed as the Ethereum version of Strategy, but the comparison only goes so far. Bitcoin treasuries depend heavily on price and narrative. Ethereum treasuries can generate cash flow. That difference matters because it introduces patience into the model.

But it also raises the bar. Execution becomes more important than macro. If staking revenue is the story, then uptime, slashing risk, validator reliability, and operational scaling become the real battleground. This stops being a pure market bet and starts becoming a business.

BitMine Is Asking Investors to Believe in Operations, Not Just ETH

BitMine isn’t asking investors to believe Ethereum will pump next week. It’s asking them to believe that staking can be run like an industrial process, and that MAVAN can scale cleanly. If staking revenue holds and the validator network performs, BitMine begins to look less like a crypto trade and more like a new corporate category.

Ethereum treasuries are evolving. They’re not just holding assets anymore. They’re producing yield, building infrastructure, and trying to turn crypto volatility into something that looks like revenue.