- Bitcoin has erased all gains made so far in 2026

- Geopolitical tension and ETF outflows are pressuring price action

- Forecasts still point to a potential rally later in Q1 if conditions improve

Bitcoin’s price action in early 2026 has been anything but calm. After swinging sharply higher at the start of the year, BTC has now given back those gains, dragging market sentiment with it. Investors who watched Bitcoin peak near $120,000 in 2025 are once again asking the same question, just framed differently this time. When does the next real rally begin, and what needs to change for it to happen?

Why Bitcoin Has Struggled So Far in 2026

The opening weeks of the year have been dominated by uncertainty rather than conviction. Rising geopolitical tension, particularly around U.S. trade policy and Greenland-related headlines, has pushed investors into a more defensive stance. At the same time, expectations around further interest rate cuts have pressured the dollar and distorted risk positioning across global markets.

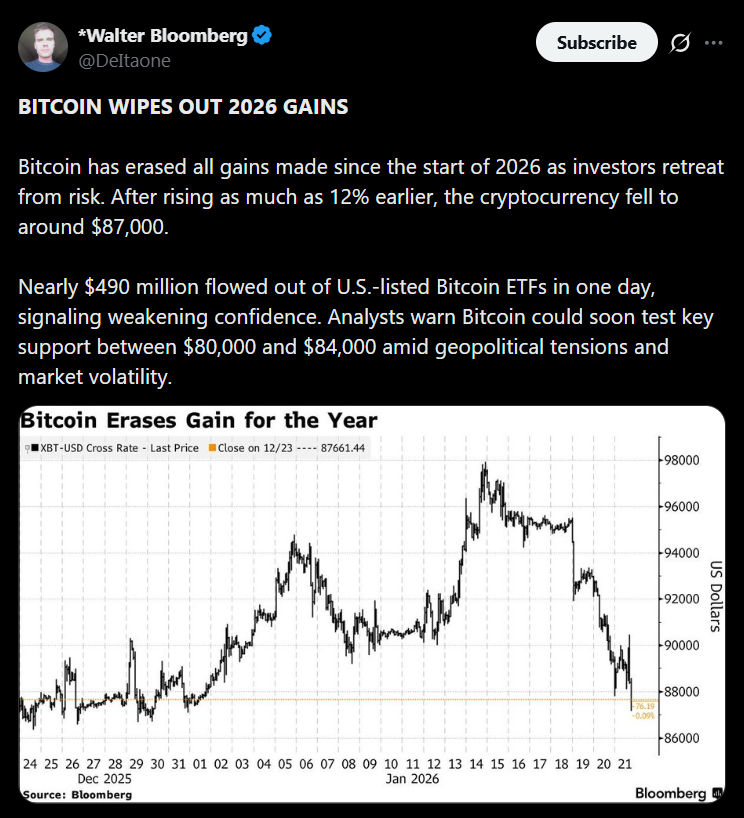

Bitcoin hasn’t been immune to that stress. After briefly climbing earlier in the year, BTC has now wiped out all of its 2026 gains, slipping back toward the mid-$80,000 range. Large outflows from U.S.-listed Bitcoin ETFs have reinforced the sense that institutional confidence is taking a pause rather than leaning aggressively long.

ETF Outflows and Risk-Off Sentiment

One of the clearest signals of the current mood has been the sharp pullback in ETF flows. Nearly half a billion dollars exited Bitcoin ETFs in a single session, underscoring how quickly sentiment can flip when volatility rises. This kind of move doesn’t necessarily signal long-term abandonment, but it does show that risk appetite is fragile.

Analysts are now watching key support zones closely. A sustained breakdown could open the door to a deeper test toward the low-$80,000 range, especially if macro pressure continues to build.

Why the Bullish Case Hasn’t Disappeared

Despite the drawdown, longer-term forecasts remain constructive. Some models suggest Bitcoin could regain momentum as early as February 2026, with upside targets pushing back toward the $100,000 level. Even with sentiment sitting in extreme fear territory, historical patterns show that Bitcoin often finds its footing when pessimism peaks.

The key difference this time is patience. A meaningful rally will likely require stabilization in macro conditions and a return of steady liquidity, not just a short-term bounce fueled by leverage.

What to Watch Next

For now, Bitcoin is caught between fear-driven selling and longer-term accumulation narratives. If ETF flows stabilize and geopolitical pressure eases, BTC could reclaim lost ground relatively quickly. Until then, volatility is likely to remain part of the landscape, testing both traders and long-term holders alike.