- A whale withdrew nearly 20,000 ETH worth $40M, adding to prior large accumulation, signaling deliberate capital deployment.

- Ethereum exchange reserves fell 6.47%, tightening available supply and reinforcing accumulation trends.

- Binance top traders show a 3.33 Long/Short ratio while funding rates remain positive, reflecting sustained leveraged demand for ETH.

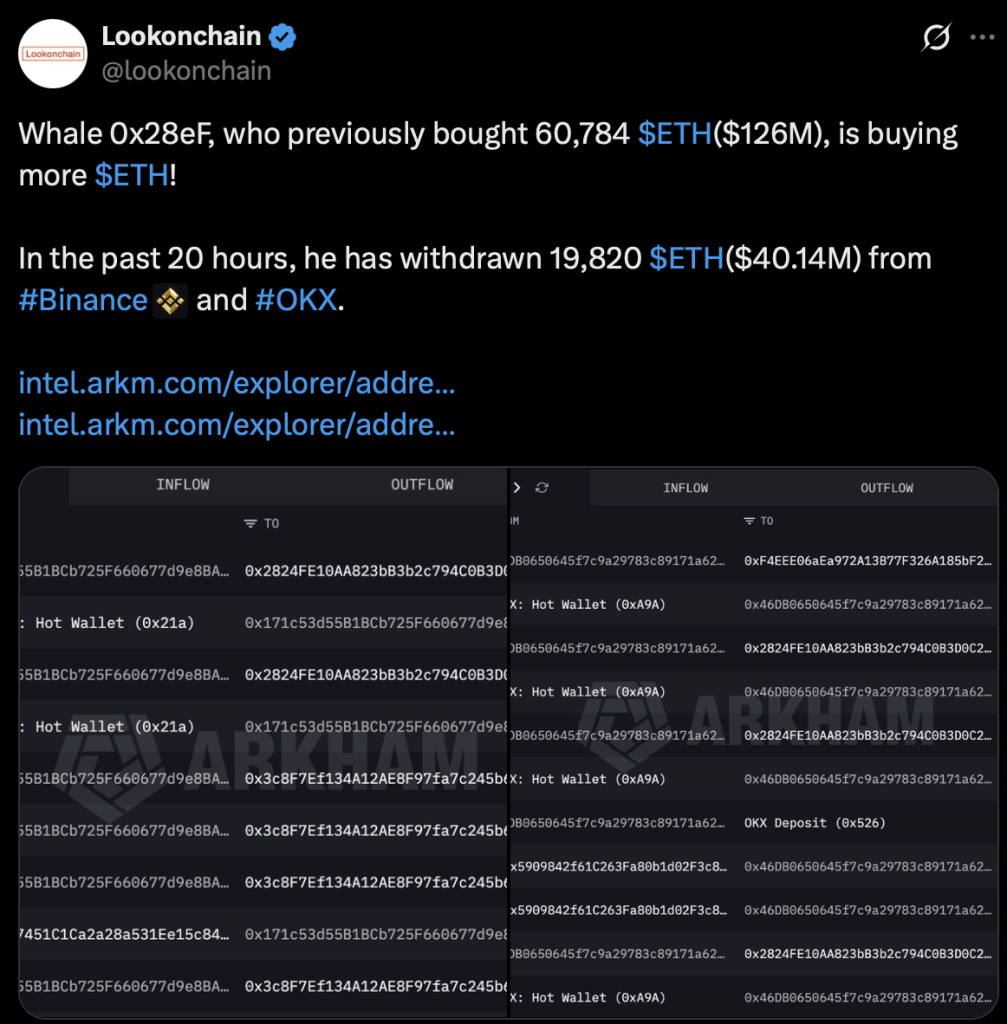

A major Ethereum whale just made another move, and it wasn’t small. Roughly 19,820 ETH, worth about $40.14 million, was withdrawn from Binance and OKX, stacking on top of an earlier 60,784 ETH purchase valued near $126 million. That kind of sequencing doesn’t look like casual dip-buying. It looks planned.

At the same time, another large trader pushed $1 million USDC onto Hyperliquid and opened a 20x leveraged ETH long. Yes, that same trader also holds a 20x SOL long, but this fresh capital was pointed straight at Ethereum. When spot accumulation and high-leverage derivatives exposure line up like that, it’s rarely random. It suggests structure. Intent.

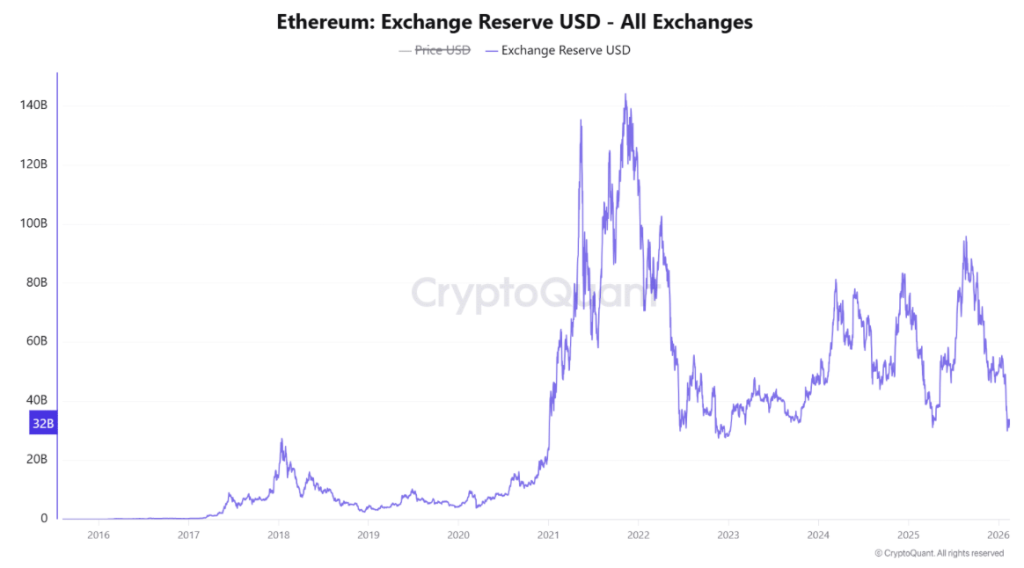

Exchange Reserves Keep Shrinking

Ethereum’s exchange reserves now sit around $31.843 billion after dropping 6.47%. That decline might not sound dramatic in isolation, but context matters. When whales pull assets off centralized exchanges, they reduce the immediately tradable supply. Fewer coins sitting on exchanges means less inventory ready to be sold on short notice.

And that shifts the balance.

Sustained reserve declines often align with longer-term holding behavior. Large investors don’t typically withdraw tens of millions in ETH just to flip it tomorrow. More often, it’s about custody, consolidation, or strategic positioning. The recent drop in reserves mirrors the observed whale withdrawals, reinforcing the idea that this is not opportunistic churn. It feels deliberate.

Exchange balances naturally fluctuate, sure. But when the direction stays consistent, the narrative strengthens. Ethereum is quietly migrating into fewer, more concentrated hands.

Top Binance Traders Lean Heavily Long

Binance data adds another layer. Around 76.91% of top trader accounts are holding long positions, compared to just 23.09% short. That creates a Long/Short ratio of 3.33, which is a noticeable skew.

Now, account-based ratios don’t measure exact capital size. They reflect positioning distribution, not necessarily total dollars deployed. Still, these “top trader” accounts aren’t random retail wallets. They tend to manage risk carefully and move size strategically.

A ratio this tilted toward longs signals conviction. It’s not just mild optimism. But here’s the catch: when positioning becomes crowded, volatility risk increases. If sentiment flips unexpectedly, those same aligned positions can unwind quickly. For now though, advanced traders appear comfortable leaning long rather than hedging defensively.

Funding Rates Confirm Leveraged Appetite

Funding rates are also telling a story. At press time, Ethereum funding printed 0.007286, up nearly 21%, meaning longs are paying shorts to maintain positions. That’s how perpetual futures markets balance themselves. When demand for long exposure exceeds short interest, funding turns positive.

The current rate isn’t extreme. It’s elevated, but not overheated. That distinction matters.

Positive funding, rising Open Interest, declining exchange reserves, and visible whale withdrawals all lining up together is not common coincidence. It points toward coordinated positioning across spot and derivatives layers. Traders aren’t just holding ETH passively. They’re adding exposure and absorbing leverage costs to do it.

Strategic Conviction or Tactical Setup?

When deep spot accumulation, shrinking exchange reserves, dominant long positioning, and rising funding converge, it paints a clear picture. Large players appear to be structuring Ethereum exposure intentionally. This doesn’t look like reactive trading. It looks methodical.

Of course, markets can surprise anyone. Crowded longs carry risk. But these kinds of aligned behaviors rarely develop by accident. Whether it’s long-term conviction or a calculated tactical bet, Ethereum is attracting serious capital in a structured way.

And when whales, leverage, and liquidity dynamics start moving in sync, it usually means something bigger is being built beneath the surface.