- Ethereum surged over 7% in 24 hours, leading major crypto assets higher.

- Softer inflation data and rate-cut expectations boosted risk appetite.

- Short covering in derivatives markets likely amplified the rally.

Ethereum finally gave investors something to smile about.

Over the past 24 hours, ETH has climbed more than 7%, trading around $2,048 as of late afternoon. That kind of move might not sound extraordinary in crypto terms, but considering how sluggish — and honestly painful — the past four months have been, it feels significant. There just haven’t been many clean green days lately, so when Ethereum jumps this fast, people notice.

And it’s not just Ethereum moving. The broader crypto market is flashing green across the board, but among the top five digital assets by market cap, ETH is leading the charge today. That leadership matters. It tends to signal that investors are leaning back into risk a little more confidently.

A Relief Rally After Months of Pressure

Ethereum had been beaten down hard. At one point, it was sitting more than 55% below its previous peak, which is the kind of drawdown that forces even long-term believers to second-guess things. When an asset with Ethereum’s track record falls that much, though, some investors start viewing it differently — not as broken, but as discounted.

Today’s move also coincided with a softer-than-expected Consumer Price Index (CPI) reading. Inflation came in lighter than many feared, and that small shift in data can change sentiment quickly. If inflation keeps cooling and the labor market shows signs of slowing, the argument for lower interest rates becomes stronger over time. And lower rates tend to favor speculative, high-growth assets like crypto. Ethereum sits near the top of that list.

So part of this rally feels macro-driven. It’s not just technical noise. It’s the market starting to price in a slightly more forgiving environment.

Ethereum’s Role in DeFi Still Carries Weight

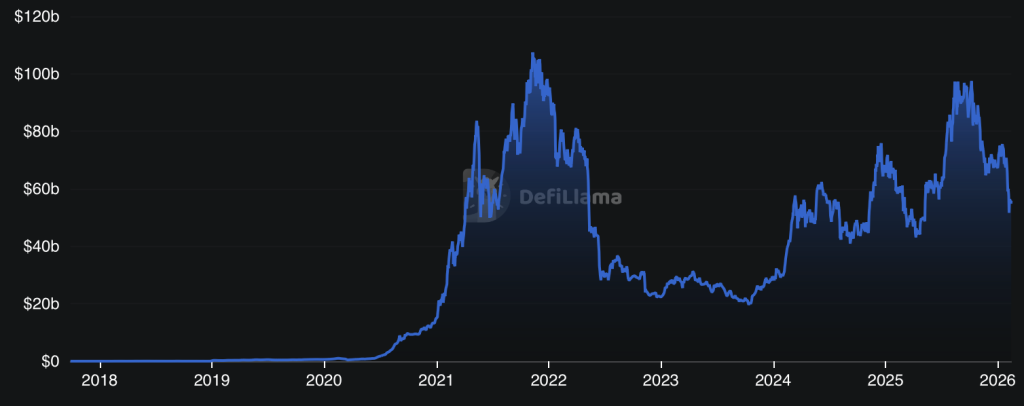

Beyond macro factors, Ethereum’s structural importance can’t be ignored.

It remains the dominant force in decentralized finance, with deep liquidity, strong developer activity, and massive network effects. When risk-on sentiment returns, even briefly, Ethereum often reacts more aggressively than some of its peers because so much of the derivatives and DeFi ecosystem runs through it.

That outperformance isn’t random. It reflects Ethereum’s position at the center of a lot of crypto infrastructure. When traders rotate back into higher-beta plays, ETH is usually one of the first major assets to benefit.

Short Covering May Be Fueling the Surge

There’s also a mechanical element at play here.

A wave of bearish bets had built up in Ethereum’s perpetual futures and derivatives markets over recent weeks. When price starts moving against those positions, traders are forced to close shorts — which means buying back ETH. That buying pressure can create a feedback loop, accelerating gains faster than spot demand alone would justify.

In other words, some of today’s rally likely comes from short covering. And once that process starts, it can move quickly.

Looking ahead, the key question is whether momentum holds. Ethereum had been deeply oversold by many technical measures, so there’s room for a continued recovery without immediately flashing overbought signals. But if this rally extends too far, too fast, traders may start locking in profits just as quickly.

For now though, the tone has clearly shifted. Ethereum isn’t out of the woods, not yet, but today’s move shows that when sentiment turns — even slightly — it can turn fast.