- Citi completed a tokenization proof-of-concept on Solana, signaling institutional experimentation with real-world assets.

- Solana processes roughly 3x more daily transactions than Ethereum and its Layer 2 networks combined.

- SOL ETFs saw inflows despite an 11% weekly price drop, hinting at long-term investor conviction.

Big institutions are quietly building on Solana, even while SOL’s price has been wobbling. At the same time, the network is pushing out enormous transaction numbers, almost like nothing happened. So what’s actually going on here? Because on the surface, price and usage seem to be telling two very different stories.

Let’s unpack it.

Solana Just Got a Nod From Citi

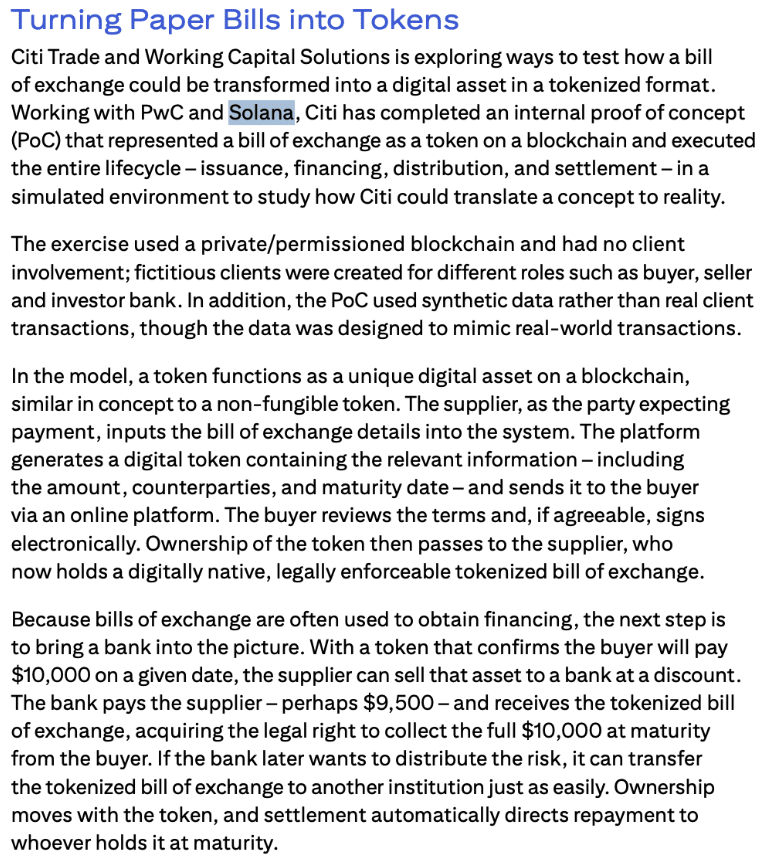

In a move that probably didn’t get enough attention, banking giant Citi completed an internal tokenization proof-of-concept on Solana, working alongside PwC. This wasn’t a marketing stunt. The test simulated the full lifecycle of tokenized bills of exchange, from issuance to distribution and final settlement, all inside a controlled environment.

The purpose? To see how traditional financial instruments might actually function on blockchain rails in a real-world setting. Not theory. Not whitepapers. Execution.

When a global bank experiments with tokenization on a specific chain, that says something. It doesn’t guarantee adoption, of course. But it shows that Solana is at least being taken seriously in rooms that don’t usually care about crypto narratives.

Solana Is Quietly Outpacing Ethereum in Transactions

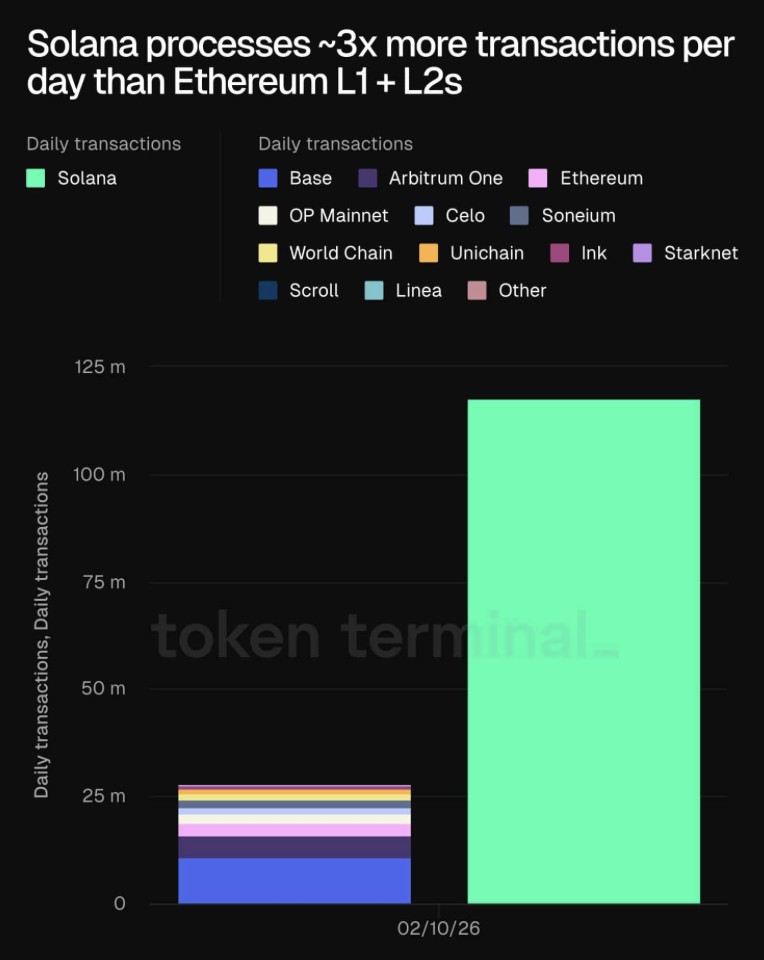

While price charts have been flashing red, Solana’s network activity has been flexing. Data from Token Terminal recently showed that Solana processes roughly three times more daily transactions than Ethereum. And not just Ethereum mainnet. Ethereum plus all of its Layer 2 networks combined.

That’s not a small gap. It’s structural scale.

Now, critics will argue that raw transaction count doesn’t equal economic value, and that’s fair. But usage still matters. Networks that aren’t being used tend to fade. Solana, at least by this metric, isn’t fading.

TVL Is Lower, But Activity Is Still Strong

According to DeFiLlama, Solana’s total value locked sits around $6.36 billion. That’s below its late-2025 highs, so yes, some capital has pulled back. But it’s not empty either.

DEX activity remains solid, with roughly $3.72 billion in decentralized exchange volume. That’s meaningful flow. Perpetual futures trading is also notable, sitting near $1.45 billion. Even in a volatile environment where SOL’s price has dipped, users haven’t abandoned the ecosystem.

And that consistency is important. Networks survive downturns through activity, not hype.

ETFs Are Seeing Inflows Despite Price Weakness

Here’s where it gets interesting. After several red weeks, SOL spot ETFs recorded about $8.89 million in weekly inflows, pushing total assets under management to roughly $673.99 million. This happened during a week where SOL itself dropped around 11%.

That kind of divergence usually signals something. When price falls but capital still flows in, it suggests investors are looking beyond short-term volatility. They’re positioning for the longer-term thesis.

It doesn’t mean the bottom is in. But it does mean conviction isn’t disappearing.

The Bigger Vision: Internet Capital Markets

Zheng Jie Lim, Research and Data Engineer at Artemis, summed up Solana’s ambitions pretty directly. According to him, Solana leads in users, transactions, developer growth, trading volume, and fees. That’s a bold claim, but the metrics do show Solana sitting near the top across multiple categories.

His bigger point was that this is how Solana becomes “the internet capital markets.” That phrase isn’t just branding. It implies a blockchain that supports trading, settlement, issuance, and financial activity at internet scale.

And when you step back, you can see the pieces lining up. Institutions like Citi are experimenting. Developers are building. Users are transacting. Investors are allocating capital even during dips.

That combination doesn’t happen randomly. It usually signals that something structural is being built underneath the noise.

Now, whether SOL’s price catches up to that reality in the near term is another question. Markets can stay disconnected from fundamentals for longer than people expect. But the activity on Solana suggests the story isn’t slowing down just because the chart looks tired.