- Bitcoin’s perp market remains heavily bearish, with funding rates negative and shorts paying longs.

- Long/Short and Taker ratios confirm sellers are still dominating and traders expect more downside.

- While negative funding can hint at a bottom, momentum indicators still show bears in control for now.

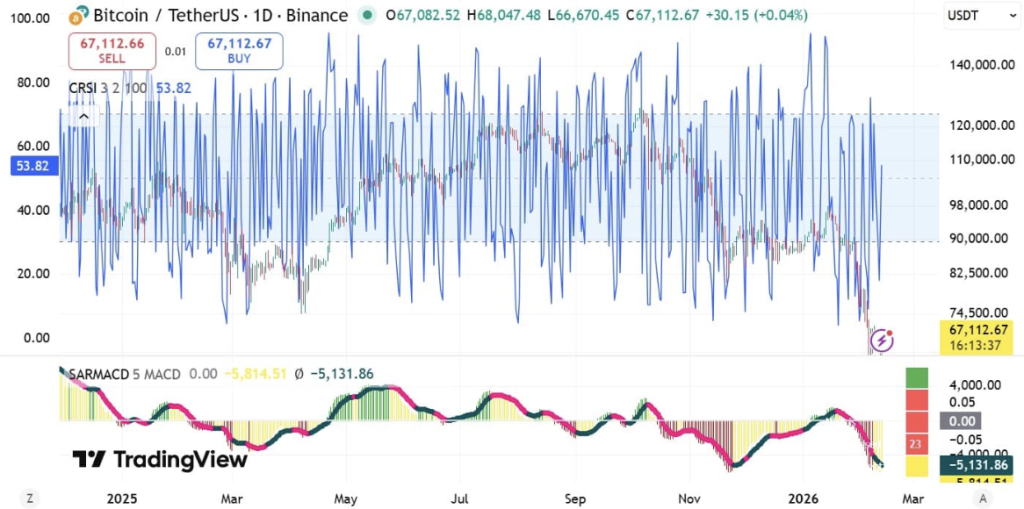

Bitcoin has been stuck in a rough stretch lately, and the chart is starting to feel heavy again. BTC extended its bearish run, sliding to a low of $65,766 before bouncing back to a local high near $67,827. At press time, it was trading around $67,164, down just 0.09% on the day, but the small daily change doesn’t really tell the full story. The bigger theme is volatility, and it’s leaning to the downside.

What makes this drop feel more serious is the way futures traders have positioned themselves through the decline. Spot buyers may still be cautiously stepping in, but in the perp market, the bias has been overwhelmingly bearish. And when futures traders crowd one side too hard, the market usually responds in a way that surprises them, just not always right away.

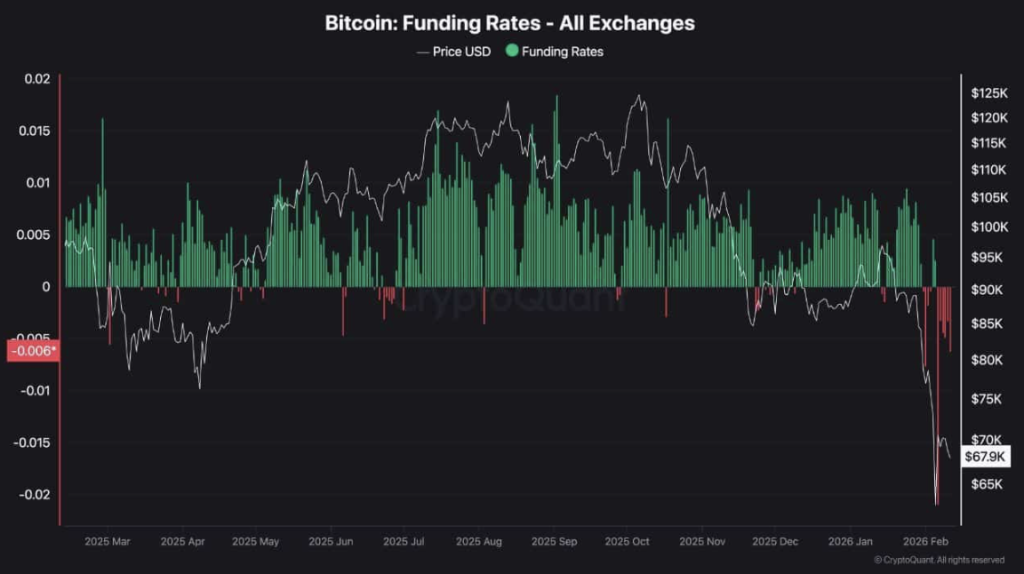

Bitcoin Perp Futures Are Still Crowded on the Short Side

According to analyst Cryptorus, the market is currently packed with short positions. One of the clearest signals is Bitcoin’s Funding Rate, which dropped as low as -0.006, meaning shorts are paying longs to maintain their positions. That’s a classic sign of bearish conviction, because traders are literally willing to bleed fees just to stay short.

Even after Bitcoin dipped and bounced off the $60,000 zone, funding has stayed negative. That’s important. A quick recovery would normally flip funding positive again, but it didn’t, which suggests derivatives traders are still expecting more weakness ahead. In simple terms: they don’t believe the bottom is in.

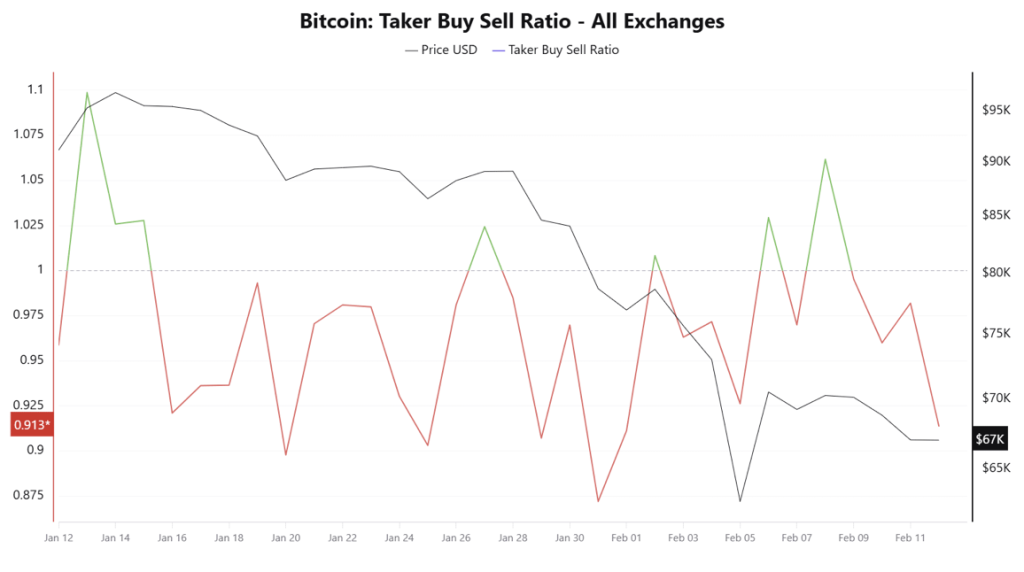

Long/Short Ratio Confirms Bears Are Still Leaning In

This bearish view isn’t just visible in funding. The Long/Short Ratio has stayed below 1 for four straight days, showing that short positions have consistently outweighed longs. At the time of writing, the ratio sat around 0.98, which may not look extreme at first glance, but it still shows the balance of capital is tilted toward shorts.

When this happens for several days in a row, it tells you the market has become one-sided. Traders aren’t hedging anymore, they’re committing. And commitment can be dangerous in crypto, because all it takes is one sharp move up to force a fast unwind.

Sellers Are Still Dominating Aggressive Market Orders

The bearish pressure also shows up in the Taker Buy/Sell Ratio. After BTC dropped below $70,000, this ratio fell under 1 and hovered around 0.9 for four consecutive days. That’s a strong confirmation that sellers have been more aggressive than buyers, especially in market orders.

When the taker ratio stays below 1, it usually means the market is being driven by sell-side urgency. Not just people placing limit orders and waiting, but actual traders hitting bids and closing positions aggressively. It’s the kind of behavior you see when sentiment is strained and confidence is thin.

Negative Funding Can Signal a Bottom, But Not Always

Here’s the twist though. Cryptorus also noted that prolonged negative funding during consolidation has historically tended to appear near local bottoms. That happens because traders overlearn the downside, piling into shorts after the move has already happened. At that stage, the market can become primed for a squeeze, since shorts are paying to stay in and any upside push can force them out.

So yes, negative funding can be a reversal ingredient. But it’s not a reversal guarantee. It’s more like dry wood, it still needs a spark.

Momentum Indicators Still Show Bears in Control

Right now, the broader market conditions don’t really support an immediate trend reversal. At press time, downside momentum still looked strong, and indicators like the SARMACD reflected that. The MACD remained negative, while the SAR sat above it, which is generally a sign of active bearish momentum still driving the move.

In other words, sellers haven’t lost control yet. They’re still pressing, and the market still looks strained, which raises the risk of another leg down before any real recovery begins.

Key Levels: Sideways at Best, Lower at Worst

In the best-case scenario, Bitcoin stabilizes and trades sideways, but even that comes with a ceiling. The $71,000 level remains the key resistance, and Connors RSI is not showing a clean mean-reversion signal yet. That’s important, because without mean reversion, bounces tend to be weak and easily sold into.

On the flip side, if sellers keep dominating the perp market, BTC could slip below $65,000 again. In that case, $62,383 becomes a critical support zone to watch, because a break there could trigger another wave of panic and forced unwinds. Crypto loves doing that when everyone’s already tired.