- Ethereum is stuck in a tight range as supply and demand remain evenly matched

- Heavy staking activity is reducing liquid supply, with total staked ETH nearing record levels

- Rising leverage and long positioning increase the risk of a bull trap if demand fails to follow

Risk assets continue to drift in a tight range, with supply and demand pulling in opposite directions. In this kind of environment, clean breakouts are rare. Instead, price tends to chop until a clear bid–ask imbalance emerges. According to AMBCrypto, how large-cap assets handle this tension will likely decide their next major move.

Ethereum is already showing early signals. The familiar debate of “buy the fear or sell the strength” is back, and some large players appear to have made their choice. BitMine recently staked another $340 million worth of ETH, pushing its total staked holdings to roughly $3.69 billion. That kind of commitment doesn’t happen on a whim.

Staking Activity Tightens Supply Beneath the Surface

The staking pipeline continues to fill. Around 2.16 million ETH are currently queued to be staked over the coming days. If those deposits go through without major exits, total staked Ethereum could approach 37.8 million ETH, a new high for this period.

That steady lock-up of supply creates a subtle squeeze. Ethereum hovering around the $3,000 zone starts to resemble a textbook breakout setup, at least on paper. Bids are present, staking is draining liquid supply, and price refuses to break down. The risk, though, is whether this strength is real or simply setting the stage for a trap.

Derivatives Positioning Heats Up, but Risks Remain

Liquidity in derivatives markets is thickening fast. CoinGlass data shows nearly $2.95 billion in short positions sitting at risk if ETH moves another 11% higher. At the same time, Binance’s 4-hour perpetual contract is now roughly 70% long, suggesting late bullish positioning is catching up.

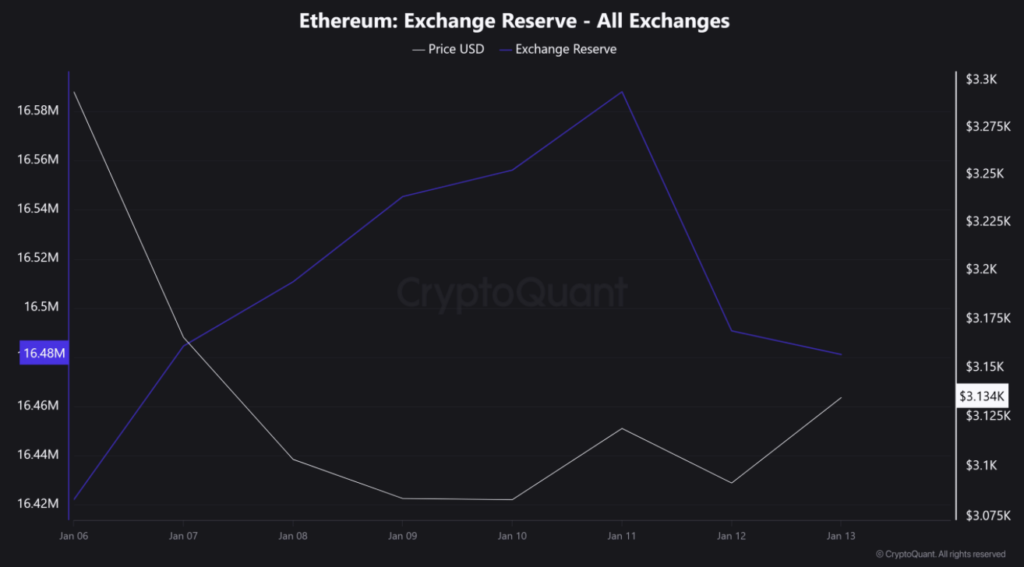

That bias aligns with Ethereum’s improving technicals and ongoing staking flows. Still, it’s not a clean supply squeeze yet. Roughly 160,000 ETH moved back into reserves just this past week, a reminder that sellers haven’t stepped aside completely. Another BlackRock-related deposit has also hit the network, adding to the complexity.

Open Interest is climbing as well, rebounding toward levels last seen in early October. Rising OI usually means traders are crowding in, which often leads to sharper moves, but not always in the expected direction.

Is Ethereum Setting a Trap Near $3,000?

Here’s where the bid–ask imbalance matters most. Staking continues to reduce available supply, but sell pressure still exists. Long exposure is building faster than confirmed spot demand, leaving the bid somewhat fragile.

As a result, Ethereum’s sideways grind remains exposed. Instead of a clean breakout, the current setup could evolve into a bull trap if momentum fades and crowded longs unwind. The structure looks promising, but until demand clearly takes control, the chop around $3,000 may have more to say.