- Bitcoin fell 3.5% to $66,000 as short-term volatility on Binance surged

- Seven-day volatility hit its highest level since 2022, per CryptoQuant

- Longer-term metrics suggest this may be a burst of stress, not a regime shift

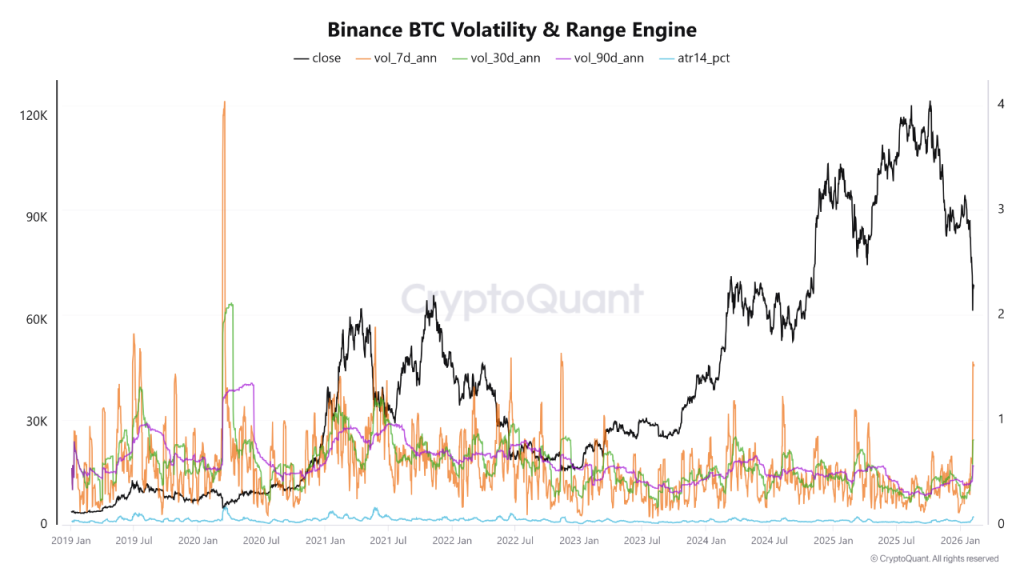

Bitcoin fell to $66,000 on Wednesday, shedding more than 3.5% in 24 hours as short-term volatility jumped sharply on Binance. According to CryptoQuant, seven-day annualized volatility climbed to 1.51, its highest reading in nearly three years. That kind of spike usually grabs attention fast, especially when traders remember what 2022 felt like.

The trigger this time wasn’t crypto-specific. Stronger-than-expected US employment data cooled expectations for aggressive Federal Reserve rate cuts, which tends to pressure speculative assets. When rate-cut optimism fades, risk assets wobble, and bitcoin still sits squarely in that category for many allocators.

Volatility Looks Violent Up Close

CryptoQuant noted that similar short-term volatility levels were last seen during major market restructurings and broad deleveraging phases. That comparison alone is enough to spook traders. When volatility compresses for months and then suddenly snaps higher, positioning usually unwinds in waves.

Ether dropped to around $1,925, Solana slid near $80, and XRP fell to $1.35. Total crypto market capitalization declined roughly 3.8% in 24 hours, according to CoinGecko. The move felt sharp, even if US equity indexes like the Nasdaq remained largely flat.

Zoom Out and the Structure Looks Different

Here’s where it gets interesting. While short-term volatility exploded, longer-duration metrics tell a calmer story. The 30-day annualized volatility sits around 0.81, and the 90-day reading is even lower at 0.56. That declining pattern across broader timeframes suggests the current turbulence is concentrated in isolated bursts rather than spreading into a structural regime shift.

In other words, the market is reacting quickly, but it hasn’t yet transitioned into sustained instability. That distinction matters. Short squeezes and liquidations can spike volatility without changing the bigger trend.

A Burst or a Breakdown?

The key question now is whether this is the beginning of a deeper deleveraging cycle or simply a volatility shock tied to macro repricing. For now, the data leans toward the latter. Isolated bursts of stress often fade once positioning resets and traders digest the macro headline.

Bitcoin at $66,000 feels heavy, especially after recent optimism. But until longer-term volatility curves start rising in tandem, this still looks more like a fast reaction than a structural break. In crypto, the difference between those two states is everything.