- BlackRock moved over $320 million worth of Bitcoin and Ethereum to Coinbase Prime.

- Its Bitcoin and Ethereum ETFs both recorded sizable outflows amid mixed market sentiment.

- Continued redemptions point to ongoing institutional caution across crypto markets.

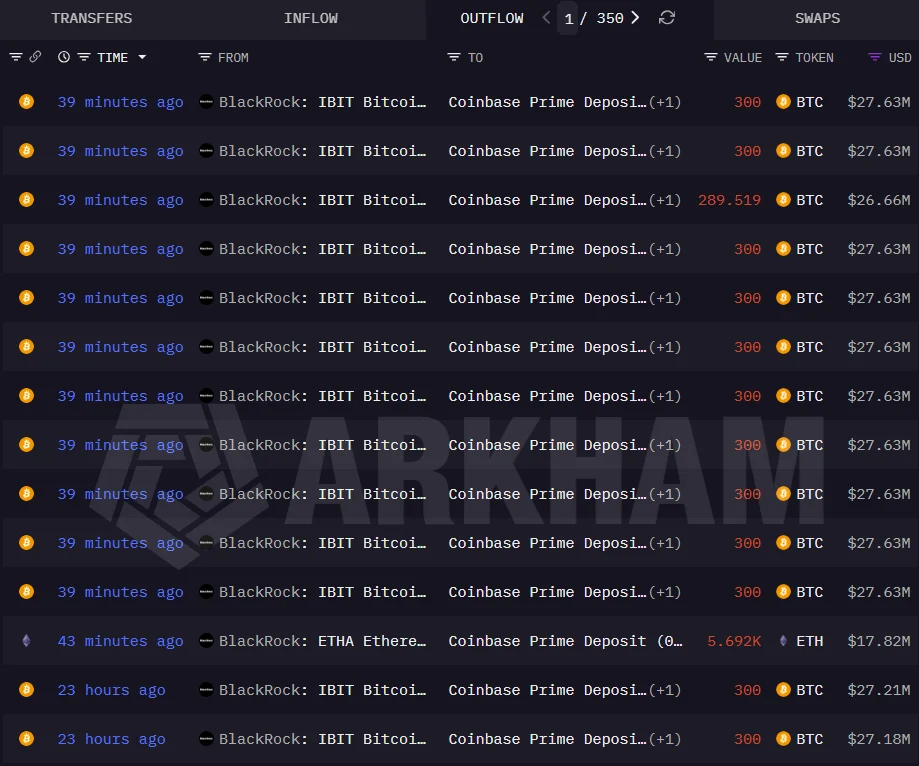

BlackRock transferred 3,290 Bitcoin, worth roughly $303 million, along with 5,692 Ethereum valued near $18 million, to Coinbase Prime earlier today, according to on-chain data from Arkham Intelligence. The timing stands out as institutional sentiment across crypto ETFs remains uneven, with investors continuing to pull capital amid choppy market conditions. While large transfers don’t always confirm selling activity, moves of this scale tend to attract attention, especially during periods of sustained outflows.

ETF Redemptions Continue to Weigh on Sentiment

The deposits follow another day of withdrawals from BlackRock’s spot crypto ETFs. Data from Farside Investors shows the firm’s Bitcoin ETF, IBIT, recorded nearly $71 million in net outflows yesterday, extending its streak to four consecutive days of redemptions. At the same time, BlackRock’s Ethereum ETF saw around $80 million exit the fund, adding to the broader pressure facing US-listed crypto ETFs. These persistent outflows suggest institutional caution remains firmly in place.

Market Uncertainty Shapes Institutional Positioning

Recent weeks have been defined by mixed signals across the crypto market, with price volatility and macro uncertainty shaping investor behavior. As a result, large asset managers appear to be actively repositioning, rather than committing fresh capital. Transfers to Coinbase Prime may indicate preparation for liquidity management, portfolio adjustments, or internal rebalancing as market conditions evolve. Until ETF flows stabilize, institutional activity like this is likely to keep traders on edge.