- ClashPicks crossed $2.41M in volume in under two weeks, with real daily repeat activity

- Sports markets are already validating the model beyond crypto-native users

- Rapid product upgrades show the platform is iterating based on real usage

Twelve days in, ClashPicks is moving like a platform that already knows what it wants to become.

In less than two weeks, we have seen real usage, real volume, and real momentum across multiple categories, not just crypto. The early numbers are strong, but what matters more is what they prove: people are showing up daily, placing picks, and coming back.

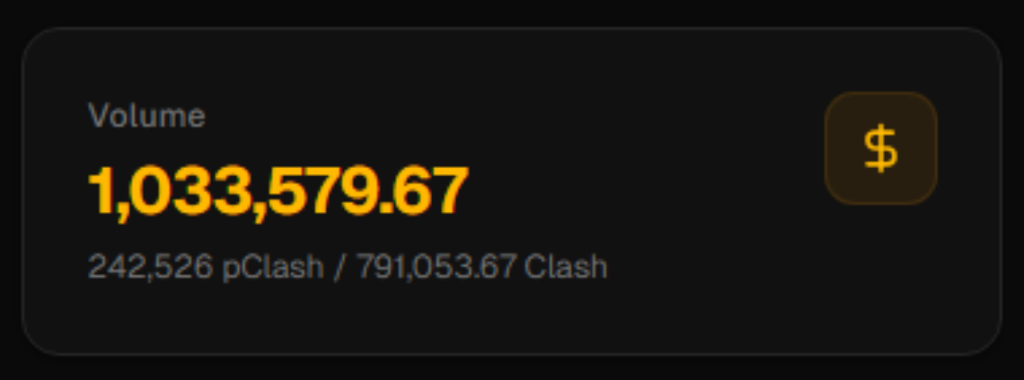

The Traction: Volume That Showed Up Fast

The first week set the tone immediately.

ClashPicks pulled in $1,033,579.67 in total volume in week one alone and then over the next 5 days, the total combined volume has climbed to over 2.41M!

Sports Proved the Model: 200K+ Events and Daily Action

One of the clearest early confirmations came from sports markets.

Multiple sports events crossed 200K+ in volume, proving that ClashPicks works beyond crypto-native predictions. This is critical, because it transforms the platform into something people can use every day.

Today, ClashPicks is already running events across:

- Basketball

- Boxing

- Hockey

- Soccer

- UFC

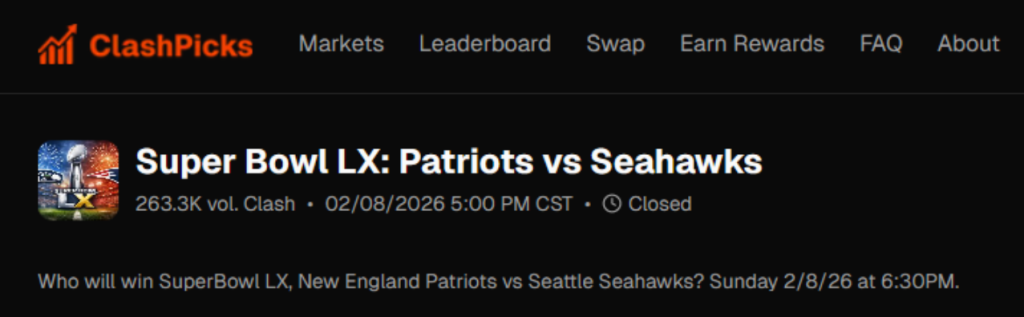

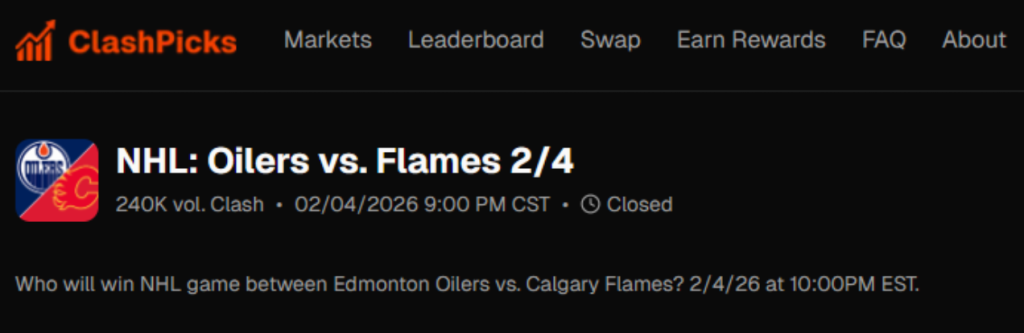

Two early standouts:

Super Bowl LX: Patriots vs Seahawks (2/8) reached 263.3K volume

NHL: Oilers vs Flames (2/4) closed with 240K volume

That level of participation, this early, shows real demand.

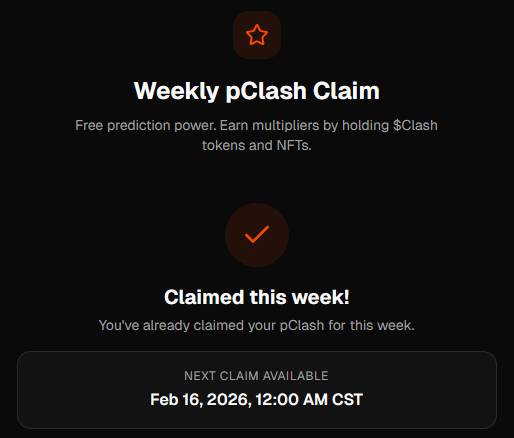

Play Free, Earn Real Rewards

Accessibility is built into ClashPicks.

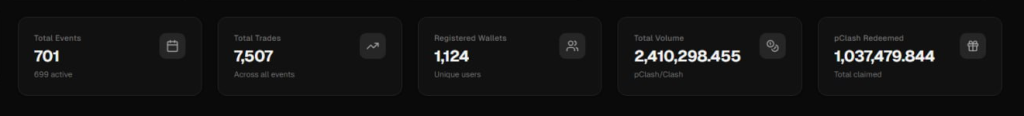

So far, 700+ users have claimed free pClash, with over 1M pClash redeemed in total. This is not just available, it is actively being used.

And yes, you can win real rewards with pClash.

The Top 5 weekly leaderboard players share 5% of the fees collected from Clash pools, with rankings based on profit and ROI for the week.

One more reminder:

pClash is free to claim every week, making it easy to jump in, compete, and stay active from day one.

Upgrades Driven by Real Usage

ClashPicks has not stood still since launch. Several meaningful upgrades have already gone live based on real usage.

Sniper Shield: Protecting Fair Play

The introduction of Sniper Shield adds anti-snipe protection to crowded pools.

If one option reaches 80%+ of the pool, new entries on that side pause temporarily and reopen once balance returns. This:

- Reduces last-minute pile-ons

- Rewards early conviction

- Keeps outcomes fairer for all participants

Better Transparency and Cleaner UX

The Latest Activity feed now highlights whale bids, making it easier to see where large positions are forming in real time.

Several UX improvements are already live:

- “My Trades” renamed to “My Predictions”

- Clickable source links inside event descriptions

- Clearer navigation across Markets, Leaderboards, and Rewards

All of this reduces friction and makes onboarding smoother.

Less Friction, More Flow: Swap for $CLASH Inside ClashPicks

One of the most impactful upgrades so far is the ability to swap for $CLASH directly inside ClashPicks, powered by JupiterExchange.

This removes extra steps, improves conversion, and keeps everything in one place:

- Discover events

- Claim pClash

- Swap into $CLASH

- Lock in predictions

All without leaving the platform.

What the First 12 Days Show

This is not just about volume. It shows consistent daily engagement, strong multi-category demand, and fast iteration based on real user behavior, with free weekly pClash providing a clear onboarding path.

In just 12 days, ClashPicks has reached:

- 1,100+ unique wallets

- 700+ events

- 7,500+ trades

- 2.41M+ total volume

This is what early traction looks like when a product resonates. ClashPicks is still early, but the foundation is already strong and the momentum is just getting started.

Twelve days in, ClashPicks has proven it works. Now comes growth: bigger markets, more users, daily action, and an ecosystem built to expand. Behind the scenes, conversations are already underway with conferences and brands to explore collaborations that bring ClashPicks to a wider audience.

Official Links

Website: https://www.clashpicks.com/

X: https://x.com/ClashPicks

Facebook: https://www.facebook.com/clashpicks

Discord: https://discord.gg/georgeplaysclash