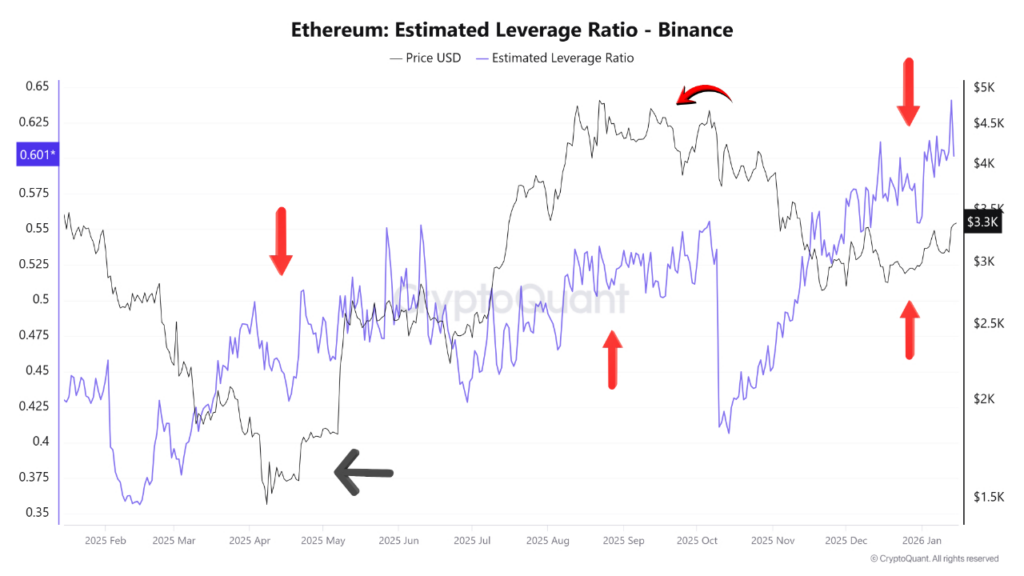

- Rising leverage on Binance has repeatedly preceded short dips and strong ETH rallies.

- Current leverage remains elevated, signaling persistent risk appetite.

- A pullback toward the $3,050–$3,170 zone could set up the next upside move.

Ethereum’s price action may not be done testing traders just yet. Crypto analyst Pelin Ay has highlighted a recurring structure in ETH’s leverage dynamics that has played out several times before. When leverage on Binance rises sharply ahead of price, it often leads to a brief downside wick that flushes out overleveraged long positions. What tends to follow is a strong upside reaction, once excess risk is cleared from the system.

A Pattern That Repeated Throughout 2025

This leverage-driven sequence appeared multiple times last year, notably in February, April, September, and November. A similar setup also unfolded in October, when a sudden spike in leverage triggered a quick dump before the broader uptrend resumed. In each case, leverage expansion created fragility, and price needed a short reset before moving higher again.

Right now, ETH’s estimated leverage ratio on Binance sits near 0.60, which is relatively elevated. What stands out is that leverage hasn’t meaningfully declined despite recent price gains. That signals persistent risk appetite among traders. Historically, pullbacks from these leverage levels have preceded rallies in the 10% to 25% range, suggesting Ether may still be setting up for upside after one final liquidity sweep.

Spot Holder Behavior Tells a Different Story

While leverage remains elevated, on-chain data paints a more cautious picture among spot holders. Glassnode analyst Sean Rose noted that even though Ether has outperformed Bitcoin since the January lows, ETH’s spent-output profit ratio remains below 1. In simple terms, realized losses across the network still outweigh realized profits. That contrasts with Bitcoin, where holder conviction appears stronger, and suggests ETH investors may be quicker to sell into strength.

Why a Short-Term Dip Still Looks Likely

Ether recently printed its highest daily close since November 12, 2025, settling around $3,324. A 25% rally from that level would push ETH above $4,100, but the near-term probability of a pullback remains elevated. On the daily chart, ETH formed an order block between roughly $3,050 and $3,170 during the latest impulse move.

That zone aligns with the point of control on the Visible Range Volume Profile, an area where the most trading volume has occurred since September 2025. Prices often revisit these regions as the market seeks fair value, especially when leverage is stretched.