- SHIB remains deep in a long-term downtrend despite renewed community optimism

- On-chain data shows neutral activity, not aggressive accumulation

- Long-range forecasts hinge on ecosystem growth and regulatory tailwinds

Shiba Inu’s price action has been testing patience for a long time now. The token is currently trading around $0.000006533, down roughly 59% over the past year, and still far from reclaiming any meaningful highs. For many holders, SHIB feels stuck in place, drifting without momentum while broader crypto narratives move on.

That stagnation has fueled skepticism across the market. Despite its massive community and name recognition, SHIB continues to project a low price ceiling in the near term. Price hasn’t collapsed outright, but it hasn’t inspired confidence either, and that middle ground can be exhausting.

Community Signals Return, but Metrics Stay Neutral

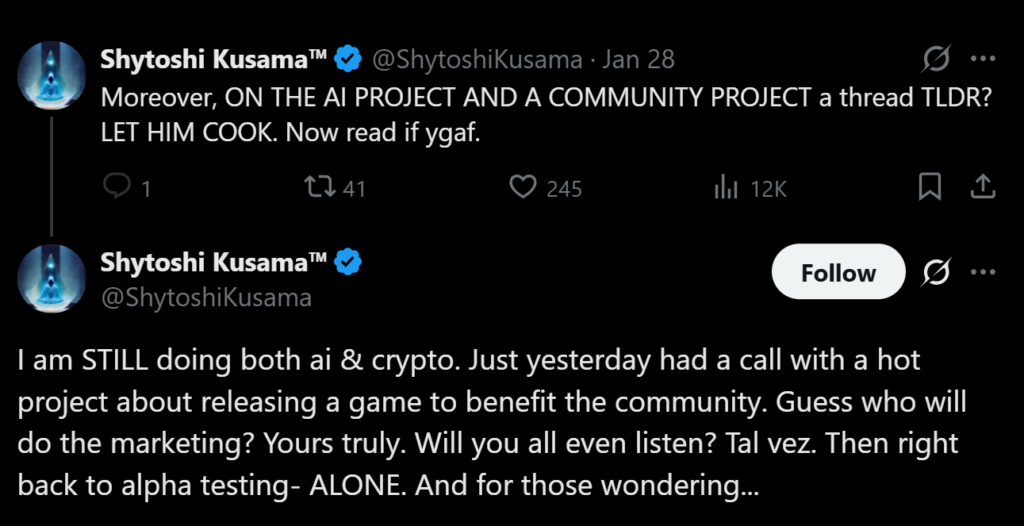

Some optimism returned after Shytoshi Kusama reappeared on X, hinting at a new AI-related initiative that could indirectly support the SHIB ecosystem. The messaging sparked renewed discussion inside the Shib Army, especially after months of relative silence. Community energy, at least briefly, picked up again.

Still, on-chain metrics aren’t confirming a major shift yet. Whale activity remains fairly neutral, and price-related indicators suggest calm rather than conviction. Analysts like Javon Marks continue to argue SHIB has unfinished business, pointing to potential upside toward the $0.000081 range, but that outlook assumes conditions change meaningfully.

The $0.0004 Prediction Looks Far Into the Future

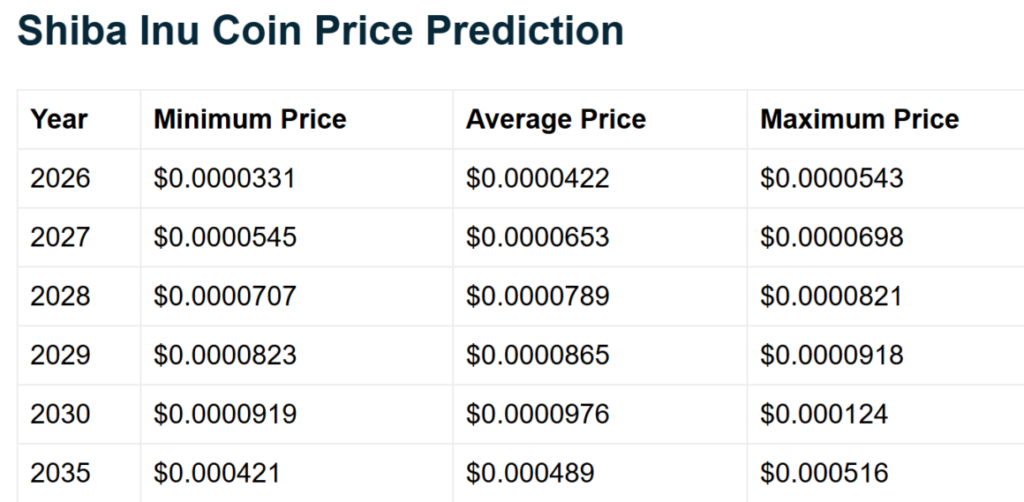

More ambitious forecasts have also resurfaced. According to long-range projections from Telegaon, SHIB could eventually reach prices near $0.0004, driven by ecosystem expansion and broader market recovery. These models lean heavily on long-term assumptions, including stronger adoption and clearer US crypto regulation.

In that scenario, SHIB’s average price could climb significantly by the mid-2030s, with optimistic projections extending even higher during favorable market cycles. Bearish cases are still acknowledged, though, underscoring how conditional these targets really are.

Hope Exists, but Time Is the Real Variable

For now, Shiba Inu remains a token defined more by belief than by momentum. Holders are waiting for something tangible to change, whether that’s ecosystem utility, market structure, or sustained demand. Until then, price predictions remain just that, predictions.

SHIB may still have time to work through its inconsistencies, but the path forward looks slow rather than explosive. The longer it stays quiet, the more patience becomes the deciding factor.