- Monero is outperforming most crypto assets during the current market crash.

- Capital rotation from ZCash appears to have boosted XMR demand.

- The rally is cooling but remains structurally stronger than the broader market.

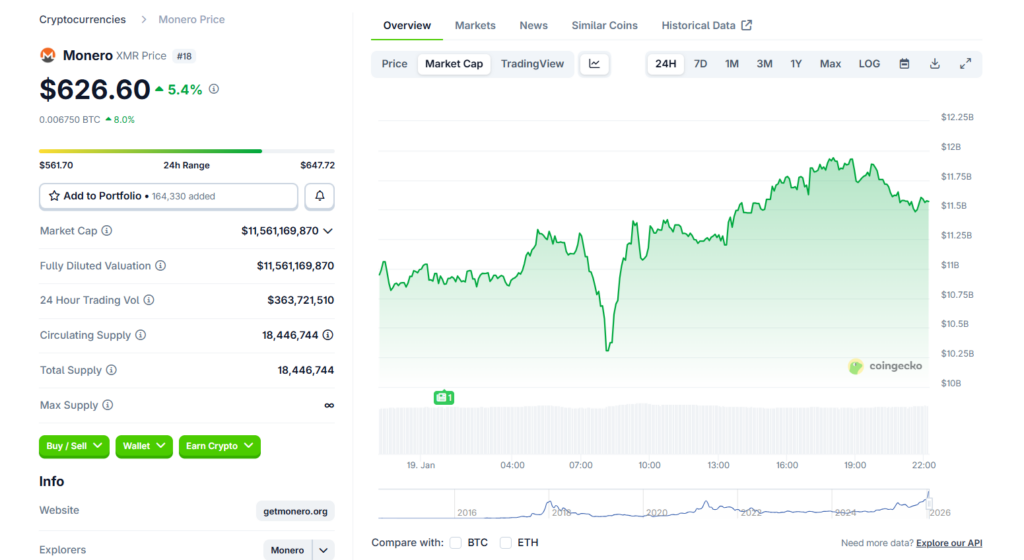

While most of the crypto market is bleeding, Monero is quietly doing the opposite. XMR is trading in the green across every major time frame, standing out as one of the strongest performers during the ongoing market correction. According to CoinGecko, Monero is up 7.1% over the last 24 hours, 9.3% on the week, more than 47% across the past two weeks, nearly 40% over the last month, and close to 186% since January 2025. In a market dominated by drawdowns, that kind of performance naturally raises questions about what’s driving the move.

Why Monero Started Running in the First Place

Monero’s bullish turn began in late 2025, as interest in privacy-focused cryptocurrencies started to accelerate. Privacy tokens gained traction as users grew more sensitive to surveillance, compliance pressure, and centralized controls. ZCash initially benefited from that trend as well, but its momentum collapsed after the project’s core development team resigned en masse following internal disputes. That exit appears to have triggered capital rotation, with investors shifting funds from ZEC into Monero, which remains operationally stable and ideologically consistent.

A Rally That’s Cooling, Not Breaking

Monero hit a new all-time high of roughly $797.71 on January 14, but has since pulled back about 21.5% from that peak. While the rally has clearly slowed over the past week, price action hasn’t fully rolled over. Instead, XMR appears to be consolidating strength rather than collapsing outright, a rare pattern during a broader market downturn.

Macro Pressure Is Still a Real Risk

That said, Monero isn’t immune to macro stress. Bitcoin’s drop from $97,000 to $92,000 has dragged most digital assets lower, and geopolitical tension is amplifying risk-off behavior. Ongoing disputes between the US and NATO allies over Greenland, paired with fresh tariff threats from President Trump, have rattled investor confidence. Those dynamics could eventually weigh on Monero as well, especially if global markets remain defensive.

Can XMR Keep Outperforming?

Monero’s resilience reflects a mix of narrative strength, capital rotation, and growing demand for privacy tools. But rallies that decouple from the broader market rarely last forever. If geopolitical uncertainty intensifies or Bitcoin continues sliding, XMR could face renewed selling pressure. For now, though, Monero remains one of the clearest examples of selective strength in an otherwise fragile crypto environment.