- Ethereum price remains bullish as it trades above the $1,700 level on Tuesday.

- A large percentage of ETH total supply is held in self-custody with only 10.31% left on exchanges.

- The technical setup projects Ethers return to $2,200.

Ethereum’s price is back above the $1,700 level amid decreasing supply on exchanges. The technical setup reveals that ETH is displaying a similar price action to the one painted in July last year that saw it rally 30% afterward. If history repeats itself, Ether may rise from the current levels to revisit the $2,200 supply level.

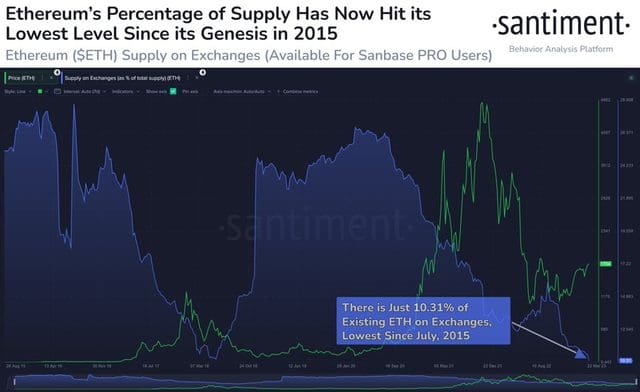

Only 10.31% of the Total ETH Supply is on Exchanges

An asset’s “supply of exchanges” is an on-chain metric used to measure the percentage of its total supply held in known wallets of all centralized exchanges (CEXs). When this indicator’s value drops, investors are taking the crypto out of these platforms.

Investors move their digital assets from CEXs when they want to hold onto them in anticipation of price increases in the future. This usually places a bullish outlook on the asset’s price as it signals ongoing accumulation in the market.

According to data from Santiment, an on-chain data analysis firm, the current ETH supply on exchanges has hit all-time lows. The firm posted the following chart on Twitter showing the trend in the Ethereum supply on exchanges since its launch in 2015.

As displayed in the chart above, an ample percentage supply of “Ethereum is now being held in self-custody and away from exchanges.” It is “at the highest level since the week the token was introduced nearly eight years ago,” Santiment explained. This means that the amount of ETH on exchanges has hit its lowest level since 2015, at 10.31%.

Santiment said:

“This essential all-time low ratio of $ETH on exchanges (10.31%) indicates confidence from holders.”

Ethereum Readies For A 30% Move Up

At the time of writing, Ether was hovering around $1,745, up 0.44% daily. Apart from the bullish on-chain data, the technical setup pointed to Ethereum’s upside. The crypto’s price action between March 5 and 28 is similar to the one between July 7 and 222 last year. When this happened last year, ETH went on to climb 30% from $1,360 to areas above $1,780.

If the same scenario continues, the second largest cryptocurrency by market cap may move 30% up from the current levels to $2,226.

ETH/USD Daily Chart

Also supporting Ethereum’s positive outlook was the robust support its price enjoyed on the downside. These were areas defined by the major moving averages and the $1,500 and $1,400 psychological levels. These areas might provide safe havens for bulls if the price moves lower.

The upward-facing moving averages and the northward-pointing Relative Strength Index (RSI) added credence to ETH’s bullish narrative. The price strength at 56 suggested that there were still more buyers than sellers willing to scale the price higher.

On the other hand, things may go awry for Ether bulls if the price turns down from the current levels to produce a daily candlestick close below the $1,700 immediate support level. If this happens, it may trigger massive sell orders that would see ETH revisit the 50-day Simple Moving Average (SMA) at $1,643, the 100-day SMA at $1,531, and the 200-day SMA at $1,435.

The smart contracts giant may drop toward the $1,200 psychological level in highly bearish cases. This would represent a 31% drop from the current price.