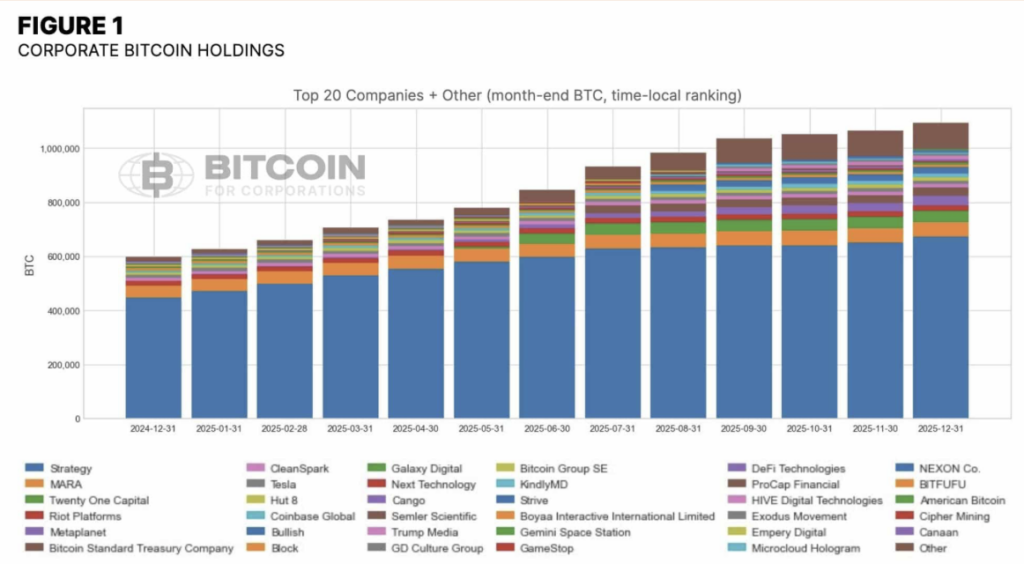

- Corporate Bitcoin treasuries added roughly 494,000 BTC in 2025, bringing total holdings to 1.13 million BTC

- Treasury firms now control about 5.1% of Bitcoin’s total supply, led by Strategy

- Bitcoin price remains muted as ETF demand stays weak despite reduced selling from long-term holders

Bitcoin treasuries had a busy year, even if the price action didn’t exactly cooperate. In 2025, corporate holders led by Michael Saylor’s Strategy accumulated roughly 494,000 BTC, pushing total treasury holdings to about 1.13 million coins. That’s a sizable chunk, especially considering how the year played out.

According to data from Bitcoin For Corporations (BFC), these firms kept buying even as Bitcoin closed 2025 down 6.4%, underperforming every major asset class, including gold and silver. It wasn’t a great year on paper, yet treasury players clearly weren’t shaken out.

What’s notable is that buying activity did slow later in the year as the market correction deepened. Still, the key point is what didn’t happen. These firms didn’t dump their BTC. Holdings kept climbing steadily, suggesting conviction stayed intact even while prices sagged and sentiment cooled.

New Capital Strategies Replace Old Playbooks

BFC also highlighted a shift in how these treasuries raised capital. Instead of leaning heavily on convertible debt, firms increasingly turned to preferred stock structures, sometimes described as “digital credit,” offering variable interest rates.

Strategy rolled out five preferred stock products, which have now overtaken its convertible debt offerings in size. That move effectively reduced bankruptcy risk while keeping its Bitcoin accumulation engine running. Elsewhere, Metaplanet introduced its Mars and Mercury vehicles, while Strive issued SATA preferred stock to expand its own capital war chest. Different names, same idea, keep stacking BTC without stressing balance sheets.

Treasury Holdings Reach 5% of Total Supply

Thanks to these mechanics, corporate treasury firms now control about 5.1% of Bitcoin’s total supply, according to Bitbo. Strategy alone accounts for roughly two-thirds of that, holding around 709,715 BTC, or about 3.3% of all coins that will ever exist.

ETFs, however, still sit ahead. As of early 2026, spot Bitcoin ETFs control around 7.1% of total supply, nearly 1.5 million BTC. That gap matters because it’s made Bitcoin’s price increasingly sensitive to ETF flows, sometimes more so than what treasuries are doing.

Why Price Still Feels Stuck

When you look at demand more broadly, the picture gets a bit murkier. The 30-day average Apparent Demand Growth (ADG), which tracks combined activity from ETFs and treasury firms, has remained negative since December. In simple terms, even if treasuries are accumulating, ETF outflows can still outweigh that demand and drag on price.

Interestingly, selling pressure from long-term holders, investors who’ve held BTC for more than five months, has eased significantly over the past few months. That’s usually a constructive sign. Yet ADG staying negative shows that ETF demand hasn’t returned in force.

During the Q2 2025 rally, when Bitcoin ripped from around $74,000 to over $120,000, the turning point came when ADG flipped positive. Until something similar happens again, the data suggests BTC could remain capped, struggling to push decisively above $100,000.

In short, treasuries are still buying, holders are calmer, but the market is waiting on one thing. Sustained demand, especially from ETFs. Until that shows up, Bitcoin’s next big move may stay on pause.