- A large whale has accumulated nearly $13.5M worth of AAVE despite sitting on unrealized losses.

- AAVE is testing a critical resistance near $154, with $165 as a potential upside target if it breaks.

- RSI and MACD indicators suggest momentum is stabilizing and beginning to tilt bullish.

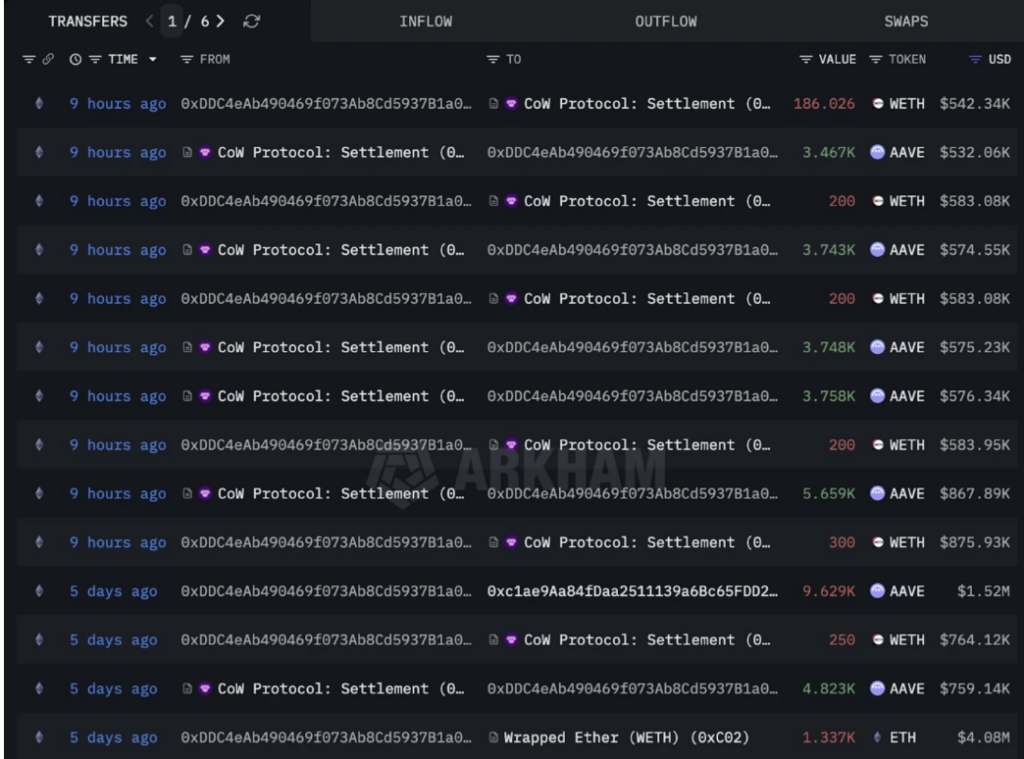

A large Ethereum wallet labeled 0xDDC4 has once again made waves, spending 1,086 ETH, roughly $3.13 million, to scoop up 20,375 AAVE tokens. This wasn’t a one-off move either. Since December 3, 2024, the same wallet has accumulated close to 59,588 AAVE, putting total exposure near $13.47 million at an average price of about $226 per token.

That strategy hasn’t paid off yet, at least on paper. The position is currently sitting on an unrealized loss of around $4.3 million, which makes the continued buying all the more interesting. It suggests conviction, not short-term trading, and a belief that AAVE’s longer-term value hasn’t been fully priced in yet.

Market Watches Whale Conviction Closely

Moves like this tend to grab attention fast. When a large holder keeps adding despite losses, it often sparks speculation about what they might be seeing ahead. In this case, the bet appears to be on AAVE’s recovery and the broader DeFi sector regaining momentum once market conditions improve.

Whether that confidence proves justified is still an open question. But historically, sustained accumulation during weak periods has often preceded stronger price phases, though timing is never clean in crypto, and patience is usually tested.

AAVE Eyes a Key Breakout Level

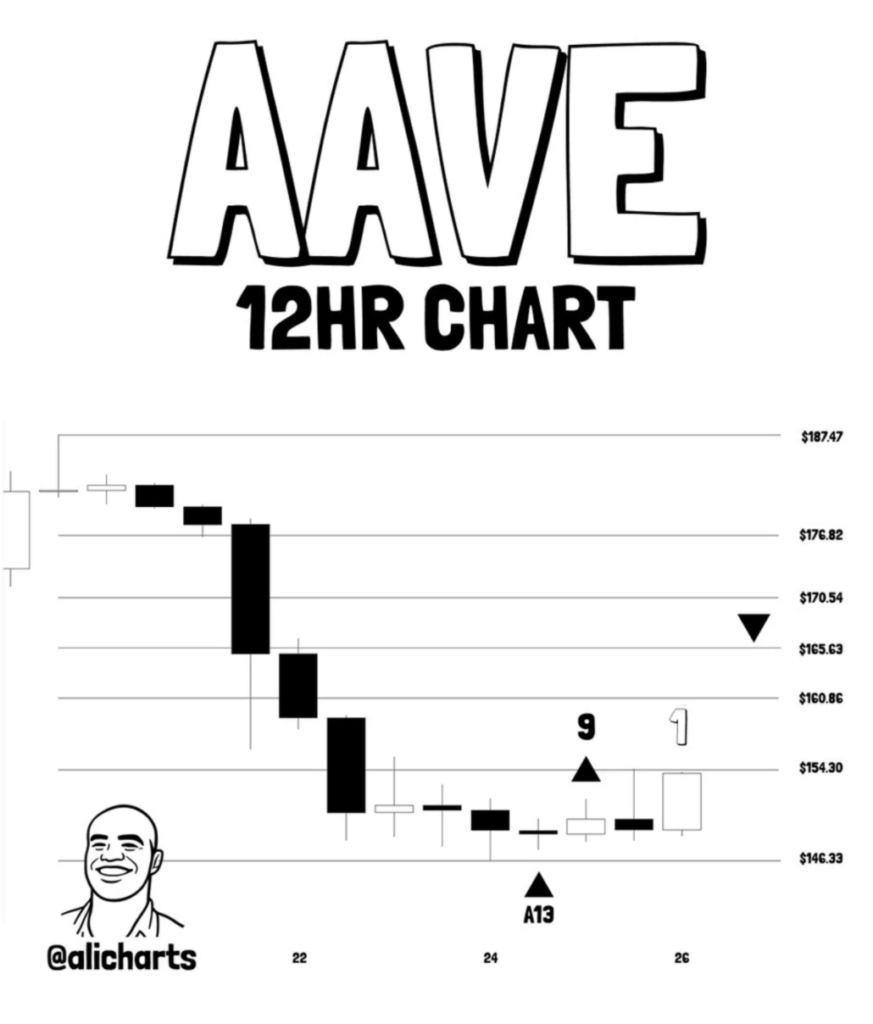

On the technical side, crypto analyst Ali pointed out that AAVE has flashed a bullish signal, with price now pressing against an important resistance zone near $154. This level has become a line in the sand for traders watching the chart closely.

If AAVE can push through that barrier and hold above it, the setup opens room for a move toward $165. That breakout would likely be viewed as confirmation that bullish momentum is building, not just another short-lived bounce. Still, given how quickly conditions can flip, traders remain cautious, stops ready, fingers hovering.

Momentum Indicators Start to Lean Bullish

Momentum tools are beginning to reflect that cautious optimism. The RSI currently sits around 53.7, placing AAVE in neutral territory. There’s no sign of extreme buying or selling pressure, which often creates space for the next directional move to develop.

Meanwhile, the MACD has printed a bullish crossover, with the MACD line pushing above the signal line. The histogram has also turned positive, reinforcing the idea that momentum is slowly shifting in favor of buyers. It’s not explosive, but it’s constructive, and that’s often how trends start, quietly.