- Bitcoin rebounded from $86,561 to above $88,600 during holiday trading

- Spot Bitcoin ETFs recorded five consecutive days of net outflows

- Aave governance tensions resurfaced as a key proposal was voted down

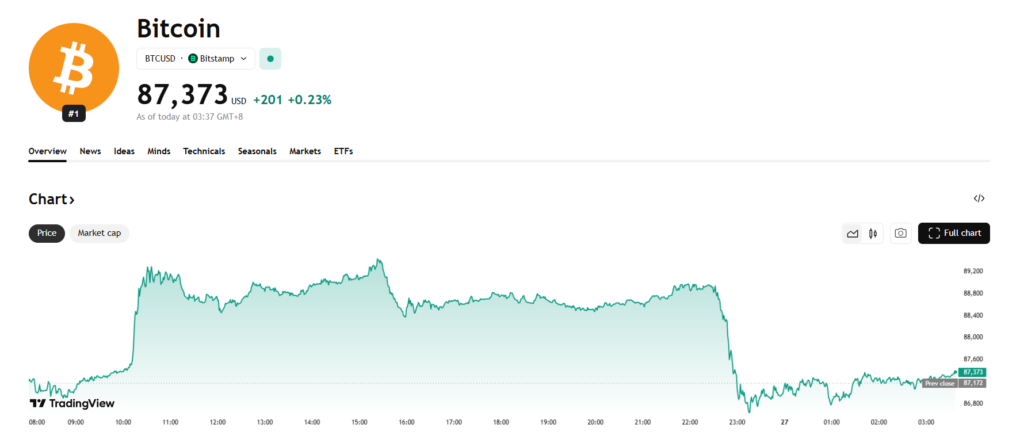

Cryptocurrency markets saw a mild rebound late last week as trading activity slowed during the holiday period, offering a brief pause after recent downside pressure. Bitcoin dipped to a weekly low near $86,561 on Tuesday before recovering above $88,600 by Friday, according to TradingView data. While the bounce provided some short-term relief, underlying signals suggest sentiment remains fragile.

Bitcoin Rebounds, but ETF Demand Stays Weak

Bitcoin’s recovery came after a relatively sharp midweek dip, but the move lacked strong conviction. Spot Bitcoin ETFs continued to see capital leaving the space, with $175 million in net outflows recorded on Wednesday alone. That marked the fifth straight day of ETF outflows, according to Farside Investors, reinforcing the view that institutional demand remains cautious heading into year-end.

The combination of light holiday liquidity and persistent ETF selling suggests the rebound was more technical than demand-driven. Without renewed inflows, Bitcoin’s upside may remain capped in the near term.

Altcoin Developments Add to Market Unease

Beyond Bitcoin, tensions surfaced within the Aave ecosystem. Members of the Aave community pushed back against what they viewed as a rushed attempt to advance a governance proposal related to brand assets and intellectual property. The proposal aimed to shift control of these assets back to a DAO-managed structure.

After debate, the proposal was rejected on Friday, with a majority voting against it. While the decision resolved the immediate issue, it highlighted ongoing governance friction within major DeFi protocols at a time when investor confidence is already under pressure.

A Cautious Pause, Not a Clear Turnaround

Overall, the market’s late-week bounce appears more like a temporary stabilization than the start of a broader recovery. Thin holiday trading, continued ETF outflows, and internal disputes across DeFi point to a market still searching for direction. As liquidity returns after the holidays, traders will be watching closely to see whether this rebound holds or fades.