- BNB is hovering near $850 after a 1.5% daily decline.

- Volume suggests defensive trading rather than aggressive buying.

- Traders are focused on a $850–$870 consolidation range.

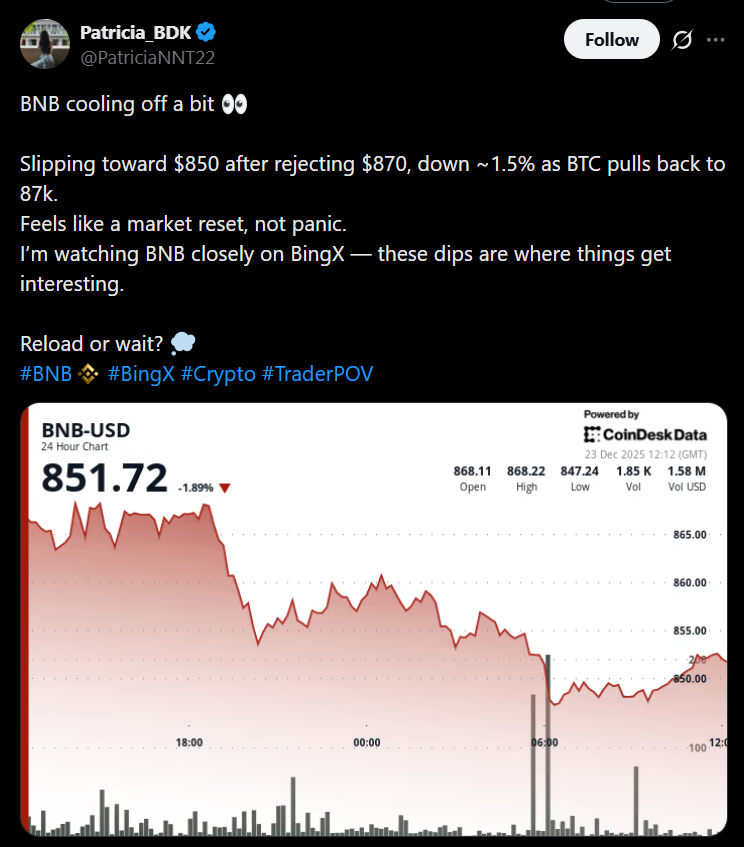

BNB is trading around the $850 level after slipping more than 1.5% over the past 24 hours, reflecting a broader pullback across the crypto market. The token has eased from a recent high near $870, moving in step with bitcoin’s drop from above $90,000 back toward the $87,000 range earlier Tuesday. The tone across markets feels cautious again, with traders opting to protect capital rather than chase upside.

Selling Pressure Caps the Latest Bounce

Price action showed early signs of strength when BNB briefly pushed above $860 on elevated volume. That move, however, failed to hold. Sellers stepped in quickly and capped gains, reinforcing resistance in that zone. The broader CoinDesk 20 index also weakened, falling about 2.5% over the same period, underscoring that the move lower wasn’t isolated to BNB alone.

Volume Signals Defensive Positioning

According to CoinDesk Research’s technical analysis model, recent volume spikes appear tied more to defensive repositioning than fresh risk-on activity. Traders seem to be reacting to volatility rather than expressing strong directional conviction. That behavior often accompanies consolidation phases, where markets wait for clearer macro or technical signals before committing.

Adoption Continues in the Background

Not everything has turned bearish. On the adoption front, prediction market Kalshi announced support for deposits and withdrawals in BNB and stablecoins on BNB Chain. While the news didn’t spark an immediate price reaction, it adds to the longer-term narrative of steady network usage growth even during periods of market stress.

Key Levels Define the Near-Term Outlook

For now, traders are watching a tight range between $850 and $870. A sustained break above that zone could revive talk of a move toward $900 later in the year. On the downside, a drop below $820 would likely signal deeper losses and a shift toward a more defensive market posture.