- Strategy bought $980M worth of bitcoin, marking its second straight $1B-scale weekly purchase.

- Total holdings now exceed 671,000 BTC with an average cost near $75,000.

- The buying spree comes alongside stock sales and renewed confidence in Strategy’s index status.

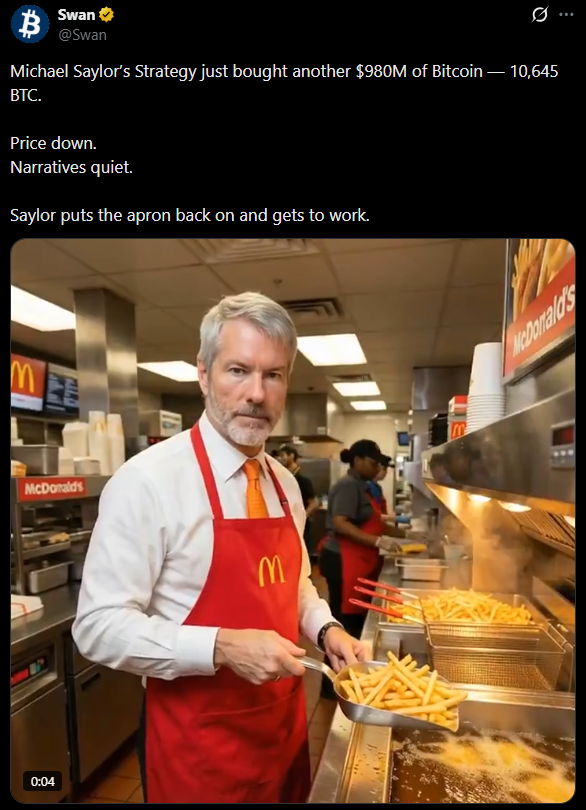

Strategy, the largest publicly traded holder of bitcoin, has once again leaned into the dip. For the second consecutive week, the company added a massive amount of BTC to its balance sheet, purchasing 10,645 bitcoin for roughly $980 million. The average purchase price came in at $92,098 per coin, according to a Monday filing.

Total Bitcoin Holdings Push Past 670,000 BTC

With the latest acquisition, Strategy’s total bitcoin holdings now stand at 671,268 BTC. The company has spent approximately $50.33 billion accumulating its position, with an average cost basis of $74,972 per bitcoin. That scale further cements Strategy’s role as the most aggressive corporate accumulator in the market.

Stock Sales Fund the Latest Purchase

The majority of last week’s purchase was funded through the sale of $888.2 million in common stock. Additional capital came from sales of Strategy’s STRD preferred shares. While the firm has remained a consistent buyer throughout 2025, purchases had recently slowed due to fundraising limits. Over the past two weeks, however, Michael Saylor and his team appear willing to push past dilution concerns to keep adding bitcoin.

Index Status and Market Reaction

Despite the aggressive buying, Strategy shares were flat in premarket trading as bitcoin pulled back toward the $89,600 level. Separately, the company confirmed it will remain a constituent of the Nasdaq 100 and also sent a letter to MSCI last week opposing a proposal that would exclude digital-asset-heavy firms from certain indices.