- Larry Fink says sovereign wealth funds are buying BTC at $120K, $100K, and even the $80K range.

- Funds treat Bitcoin as a long-term reserve asset, not a short-term trade.

- Sovereign accumulation reflects growing global use of BTC as a macro hedge.

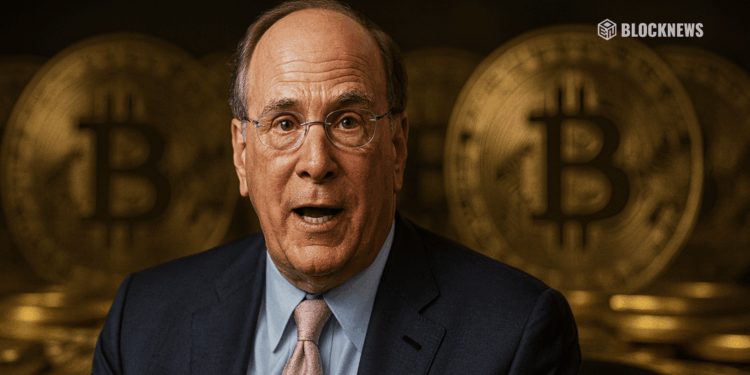

Larry Fink, CEO of BlackRock, says sovereign wealth funds aren’t trading Bitcoin for quick wins — they’re accumulating it steadily at multiple price levels. Speaking at the DealBook Summit, he explained that these funds added BTC at $120K, $100K, and even “bought more in the 80s,” treating the asset like a long-term reserve rather than a speculative trade. Fink stressed that these purchases are intentional and strategic, built to be held for years, not cycled in and out of.

A Dramatic Shift From Skeptic to Supporter

Fink’s stance marks a major turn from his earlier skepticism, back when he dismissed Bitcoin as an index of money laundering. Now, he frames BTC as a serious component of a modern portfolio, matching BlackRock’s aggressive push into digital-asset products. With the firm leading some of the world’s largest crypto ETF inflows, his comments signal how far institutional thinking has shifted.

Sovereign Funds See Bitcoin as a Hedge

Reports circulating over the past few months suggest multiple sovereign wealth funds are quietly increasing their Bitcoin reserves. These aren’t small positions either — they’re strategic accumulations, built during market volatility when prices fall into attractive zones. According to analysts, the funds are treating Bitcoin as a macro hedge, especially during a period marked by rising global debt, currency pressure, and shifting fiscal risks.

Institutions View BTC Differently in 2025

The steady pace of sovereign buying underscores how institutions now frame Bitcoin: less like a risk asset, more like a long-term insurance policy. These funds are positioning ahead of what they believe will be a multi-year structural role for BTC across global reserves. Fink’s comments add a layer of confirmation — large state-backed investors are stepping in quietly, building positions while the market still debates