- CZ highlighted Predict.fun, a new BNB Chain prediction market offering yield on open bets.

- The platform has 12,000 users and $300K volume but trails far behind Polymarket and Kalshi.

- BNB Chain’s massive user base helps, but limited stablecoin liquidity remains a major obstacle.

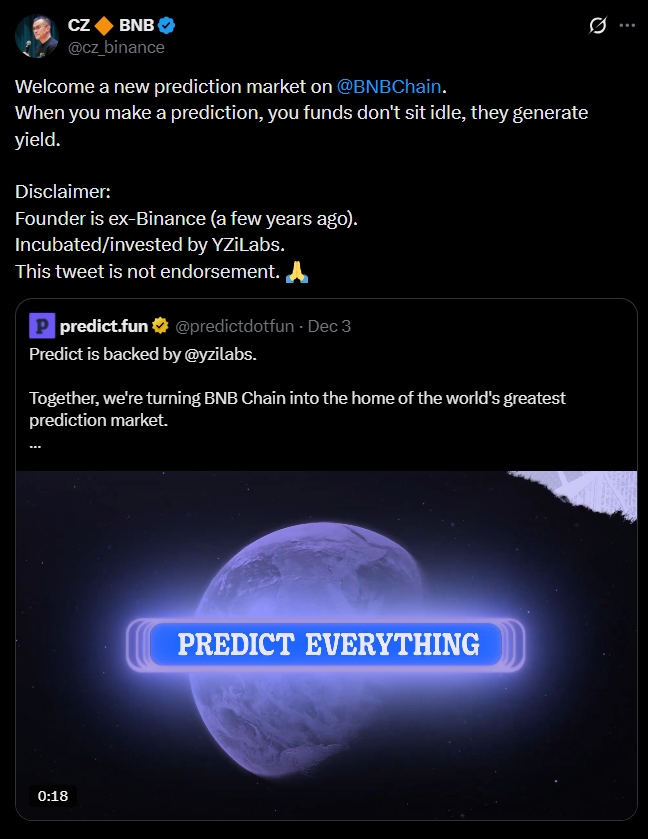

Binance founder Changpeng “CZ” Zhao has spotlighted a new prediction market launching on BNB Chain, calling attention to predict.fun, a platform created by a former Binance employee. Unlike traditional forecasting markets where user funds sit idle until the event resolves, Predict.fun introduces a twist: open positions earn yield while users wait — a growing trend across the prediction-market space.

Yield on Idle Funds: A Fix for a Major Market Inefficiency

Prediction markets have historically forced traders to lock capital without earning anything, a frustrating opportunity cost for long-running markets. The new BNB Chain platform tackles that problem directly by generating passive income from the funds backing each prediction.

CZ himself summarized it simply:

“When you make a prediction, your funds don’t sit idle, they generate yield.”

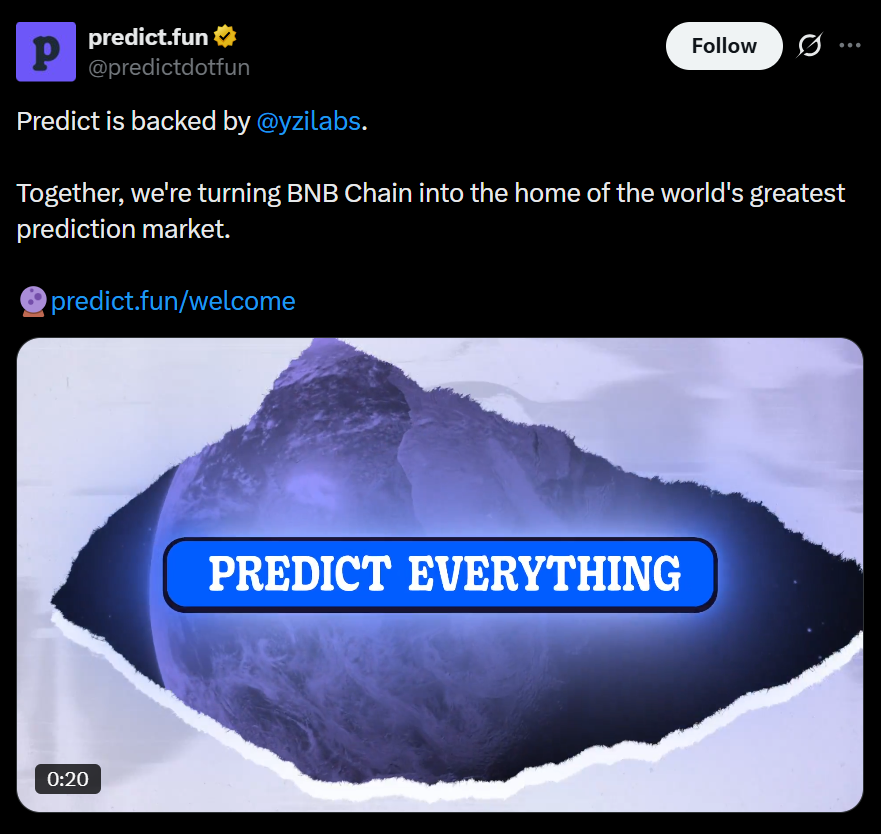

This aligns Predict.fun with platforms like Polymarket and Kalshi, which have added staking rewards, treasury incentives, or points systems to offset long-duration bet lockups. It reflects the broader industry trend of merging forecasting markets with DeFi mechanics to make participation more appealing — and more profitable.

Early Traction and User Base

Predict.fun currently lists only two active markets, but combined volume is already around $300,000. The platform claims over 12,000 users and nearly 300,000 bets, respectable early figures for a new entrant on BNB Chain.

Still, the gap between Predict.fun and the industry leaders is massive:

• Polymarket: $3B+ total volume

• Kalshi: ~$587M

• Limitless: ~$10.9M

Liquidity concentration heavily favors established venues, meaning newcomers usually see early spikes from reward campaigns but struggle to retain traders once incentives cool off.

BNB Chain Support Could Be an Advantage — but Not a Guarantee

Predict.fun is leaning on BNB Chain’s enormous user base. BNB Chain currently leads all blockchains in active wallets, with active addresses nearly doubling in the last year and claiming roughly 25% market share, according to Token Terminal. This gives the platform access to millions of potential users and a thriving retail ecosystem.

But there’s a catch: BNB Chain suffers from weak stablecoin issuance, as shown by DeFiLlama data. Low stablecoin liquidity limits how much capital can flow easily into prediction markets, potentially slowing growth compared to chains like Ethereum or Solana, where stablecoin flows are deeper and more consistent.

Can Predict.fun Compete With Limitless and Others?

The next test is simple: can Predict.fun build steady, organic volume?

Its user-friendly UX and BNB Chain’s traffic advantage may help, but liquidity tends to compound around established leaders. For now, Predict.fun is positioned better than most small-market competitors — yet far from challenging Polymarket or Kalshi.

If its yield-generating model resonates with BNB Chain’s huge community, Predict.fun could rise quickly. But in prediction markets, liquidity is everything, and breaking into the top tier will require more than hype alone.