- The SEC halted filings for 3–5x leveraged crypto ETFs, citing the 1940 Act’s 200% leverage cap.

- Direxion, ProShares, and Tidal must revise their proposals before consideration.

- Leverage has surged this cycle, with liquidations nearly tripling compared to the last.

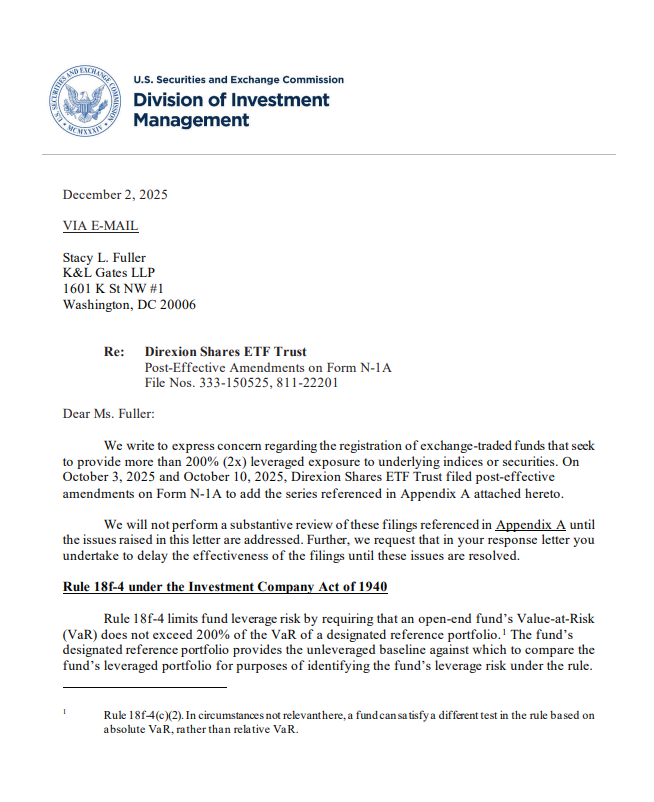

The U.S. Securities and Exchange Commission just hit the brakes on a wave of highly leveraged ETF proposals, sending formal warning letters to several major issuers and effectively stopping 3–5x crypto leveraged ETFs from moving forward — at least for now. Direxion, ProShares, and Tidal were all instructed to revise their filings after the SEC ruled that the products would violate leverage limits established under the Investment Company Act of 1940.

SEC Says Leverage Above 200% Breaches Existing Law

The SEC pointed directly to the 1940 Act, which restricts how much exposure a fund can take on relative to its unleveraged “reference portfolio.” Regulators reminded applicants that exposure cannot exceed 200% value-at-risk, meaning any ETF designed to deliver triple or quintuple returns is automatically out of bounds.

In the SEC’s words: the reference portfolio sets “the unleveraged baseline” used to measure risk, and anything above a 2x multiplier crosses regulatory lines. The agency told issuers they must reduce leverage within allowed limits before their filings can proceed.

A Rare Same-Day Warning From Regulators

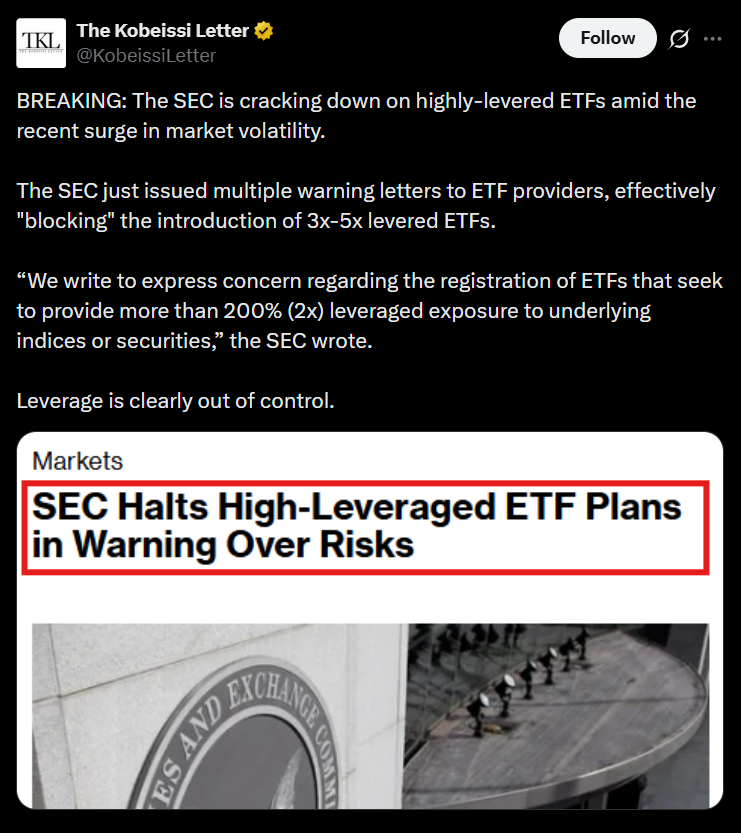

In an unusually fast move, the SEC publicly posted the warning letters the same day they were issued. Bloomberg analysts highlighted the immediacy of the release, calling it a clear sign the agency wants investors to understand its concerns about amplified products — especially after a volatile stretch for digital assets.

The timing isn’t subtle. In October, crypto markets saw a violent flash crash that erased $20 billion in leveraged positions in a single day, the largest liquidation event in crypto’s history. That incident triggered industry-wide discussions about excessive leverage and the systemic risks it creates.

Leverage Is Skyrocketing This Cycle

Analysts say leverage is running hotter than ever. According to Glassnode data, liquidations in this market cycle have nearly tripled compared to the previous one.

Average daily liquidations last cycle:

• Longs – $28M

• Shorts – $15M

Current cycle:

• Longs – $68M

• Shorts – $45M

The Kobeissi Letter summarized the state of things bluntly: “Leverage is clearly out of control.”

Demand for Leveraged ETFs Is Surging — and That’s the Problem

After the 2024 U.S. election, expectations of a friendlier regulatory environment sent demand for leveraged crypto ETFs soaring. These products offer amplified exposure without the margin calls and forced liquidations that plague futures markets. But the SEC’s concern is still the same: even without margin calls, leveraged ETFs can destroy investor capital quickly, especially during downturns or even sideways price action.

What Happens Next

ETF issuers will need to revise their products to comply with 2x leverage limits if they want to refile. The move also signals the SEC’s broader stance: even as the U.S. opens the door to spot ETFs and tokenization, regulators are unwilling to loosen leverage rules that they see as essential for protecting retail investors.