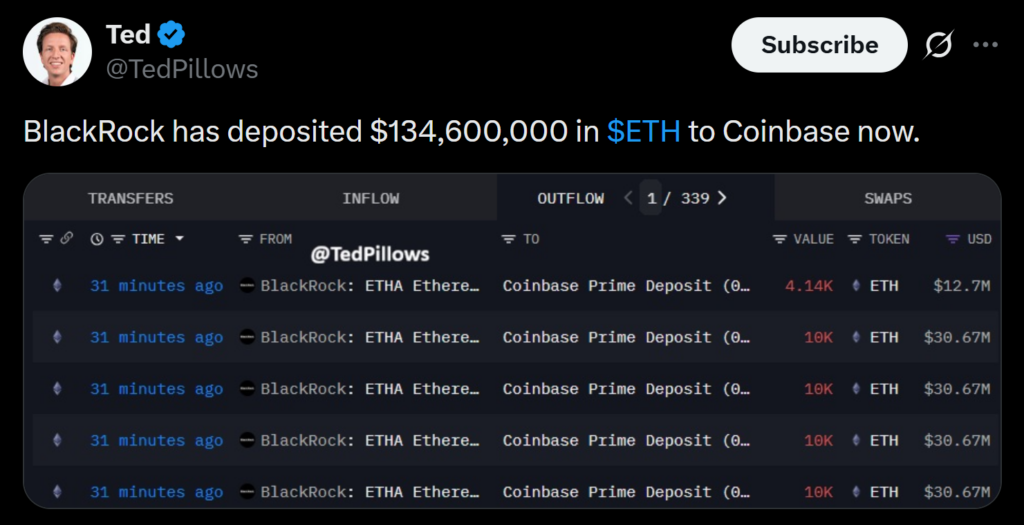

- BlackRock transferred 44,140 ETH (~$135M) to Coinbase Prime for ETF-related operations.

- BlackRock’s ETHA ETF saw $89M in outflows, while Fidelity and Grayscale recorded gains.

- Coinbase Prime remains the go-to institutional platform for secure crypto custody and trading.

BlackRock made a notable on-chain move today, sending 44,140 ETH — roughly $135 million — to Coinbase Prime. The transfer marks the latest activity tied to the firm’s expanding crypto ETF infrastructure and ongoing portfolio rebalancing across its digital-asset products.

Why BlackRock Is Moving ETH

The investment giant manages both spot Bitcoin and Ethereum ETFs, and these transfers often reflect internal balancing as funds adjust exposure, liquidity, or redemption pipelines. Coinbase Prime, which acts as an institutional-grade custody and trading venue, handles the operational backbone for many ETF-related transfers. For BlackRock, it’s the logical landing spot for storing, allocating, or repositioning crypto assets in a regulated environment.

ETF Flows Show Mixed Sentiment

BlackRock’s Ethereum ETF (ETHA) recorded around $89 million in net outflows yesterday — a sharp contrast to the inflows seen by competing funds from Fidelity and Grayscale. The split highlights how investor sentiment is still rotating across issuers, especially as macro uncertainty remains elevated. These crossflows often lead to repositioning on-chain as large managers keep their ETF backing assets synced with market demand.

Institutional Infrastructure Keeps Expanding

Coinbase Prime continues to cement itself as the hub for institutional crypto activity, particularly for ETF issuers that need highly regulated custody and fast execution. BlackRock’s repeated use of the platform underscores how seamlessly traditional finance is starting to blend with digital-asset plumbing. Even during volatile stretches, institutional-grade operations like these suggest long-term integration is still accelerating behind the scenes.