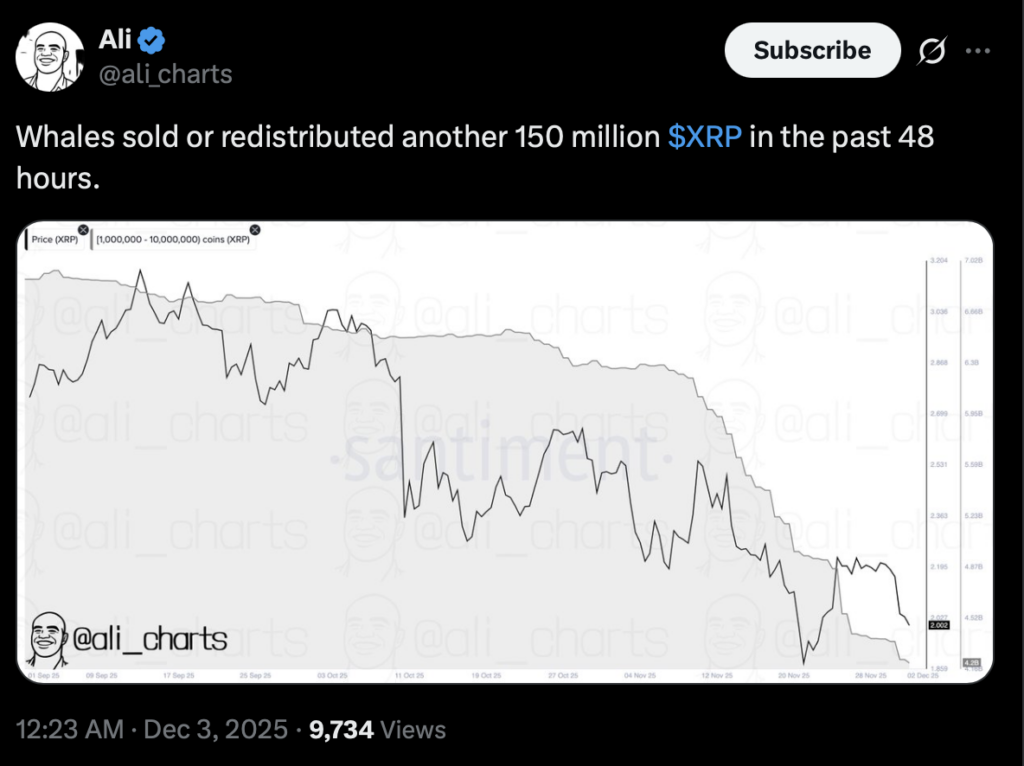

- Whales sold roughly 150 million XRP (over $300M) in 48 hours, as large wallet holdings in the 1M–10M range sharply declined.

- Despite the massive sell pressure, XRP surged nearly 9% to $2.15, suggesting strong new demand absorbing the supply shock.

- Institutional appetite from newly launched XRP ETFs and ongoing Ripple developments continues driving momentum toward the key $3 level.

XRP has kicked back into an uptrend again, almost snapping upward with a kind of unexpected force. But even with the price looking strong, fresh on-chain data from analyst Ali Martinez paints a totally different picture underneath the surface. According to him, XRP whales have unloaded a massive amount of tokens in just the last two days—around 150 million XRP, which is more than $300 million casually dumped into the market. It’s the kind of move that usually hints at cooling investor confidence, or at least whales repositioning themselves for whatever they think comes next.

Looking deeper, the data tracked wallets holding between 1 million and 10 million XRP, and that group shows the most dramatic decline. These large holders have been trimming their bags aggressively, almost like they’re stepping aside while everyone else argues about where the market is going. The motive behind the sell-off isn’t super clear yet, and that mystery has only added more noise to the conversation. But oddly enough, even with hundreds of millions sold off, the price has done the opposite of what you’d expect.

XRP pops nearly 9% despite heavy selling

In one of those weird crypto moments where the chart doesn’t care about the narrative, XRP has actually surged. Over the last day alone, the token jumped about 8.7%, absorbing the whale sell pressure like it was nothing. It almost feels like new demand stepped in right on cue, scooping up whatever supply those whales pushed out. CoinMarketCap shows XRP trading near $2.15 at the time of writing, which is a pretty sharp turn considering how much selling hit the market.

This rapid move could be less about whales and more about the broader energy across the market right now. Sometimes the macro momentum is so strong that it just bulldozes over whatever the whales are trying to do. And that might be exactly what we’re watching play out here.

XRP ETFs might be fueling the rebound

A big part of the renewed momentum seems tied to XRP ETFs, which have been pulling in institutional money at a steady pace ever since launching in November. The first spot XRP ETF opened the door for bigger, more conservative flows into the ecosystem, and the daily performance numbers coming out of these funds have been surprisingly strong. That, plus Ripple rolling out new developments left and right, has kept institutional eyes locked on the asset.

Even though XRP hasn’t fully recovered from the wave of corrections it’s dealt with lately, analysts still lean bullish. Many of them say the altcoin is gearing up for another attempt at that crucial $3 level—a price it hasn’t been able to reclaim in a long while. If ETF demand keeps building, and if the market keeps ignoring whale sell-offs the way it just did, that target doesn’t feel as far off as it did a month ago.