- VeChain has dropped 75% since December 2024 and slipped to 97th in market cap.

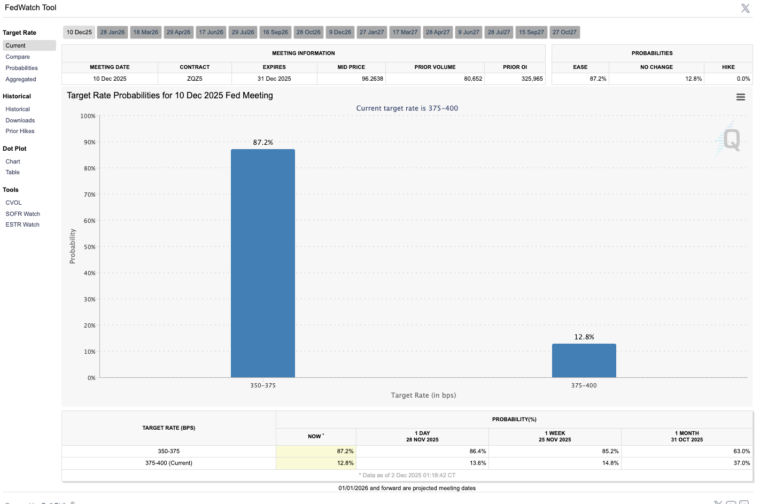

- An 87% chance of a December rate cut could spark a broader crypto rebound.

- ETF inflows and dip-buying may give VET short-term support if market sentiment improves.

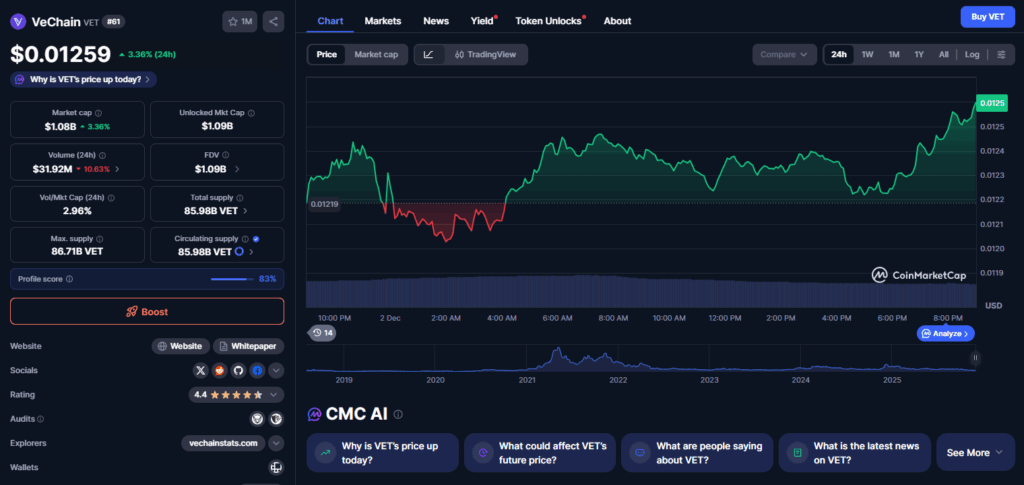

The latest market downturn has taken a serious toll on VeChain (VET), pushing the project into one of its weakest positions in years. Once a top-tier supply-chain blockchain, VET has now slipped to the 97th spot by market cap, with its valuation shrinking to just over $1 billion. And while the token saw a slight 2.2% bounce in the last 24 hours, nearly every broader timeframe is still deep in the red. VET has dropped 8.4% on the week, 14.8% over the last 14 days, 23.8% on the month, and a staggering 75.4% since December 2024.

What Triggered VET’s Collapse?

The broader market crash seems driven by a fresh wave of volatility and fear, uncertainty, and doubt. Last week saw optimism return as expectations rose for another interest rate cut in December, but markets reversed sharply on Dec. 1. Bitcoin’s drop from $92,000 to $86,000 dragged most altcoins down with it, and VeChain was no exception. VET has historically followed macro sentiment closely, especially BTC’s price direction, which explains the steep downside.

Could VET Bounce if the Fed Cuts Rates Again?

Despite the rough start to the month, there is still room for a rebound. CME FedWatch data shows an 87.2% probability of another 25-basis-point rate cut this month. If the Federal Reserve does move ahead with additional easing, risk-on assets — including altcoins like VET — could see renewed inflows. Lower rates typically improve liquidity conditions, giving beaten-down projects a better chance at recovery. If crypto sentiment improves across the board, VET could catch a relief bid.

ETF Inflows and Dip-Buying May Help VET Find Support

The recent downturn may also encourage dip-buyers to step back in, and the crypto market has seen a flurry of ETF launches over the past month. Any rise in ETF inflows could filter into broader market confidence, potentially helping VET recover some of its lost ground. While there’s no guarantee of an immediate turnaround, VeChain could benefit from a broader risk-on shift if macro conditions stabilize and Bitcoin regains its upward momentum.