- Whales sold aggressively, with one realizing a $1.54M loss.

- Retail selling pushes Buy-Sell Delta negative for three days straight.

- Losing $160 could send AAVE straight toward the $155 support zone.

AAVE has been taking hit after hit ever since getting smacked down at the $190 level four days ago. What looked like a simple rejection turned into a steady slide, with the token dropping for four straight days and tagging a local low near $165. As of now, AAVE is trading around $166, down more than 10% on the daily chart — clearly under heavy bearish pressure. The mood across the market isn’t great, and whales seem to be losing confidence first.

Whales Dump Millions as Panic Selling Ramps Up

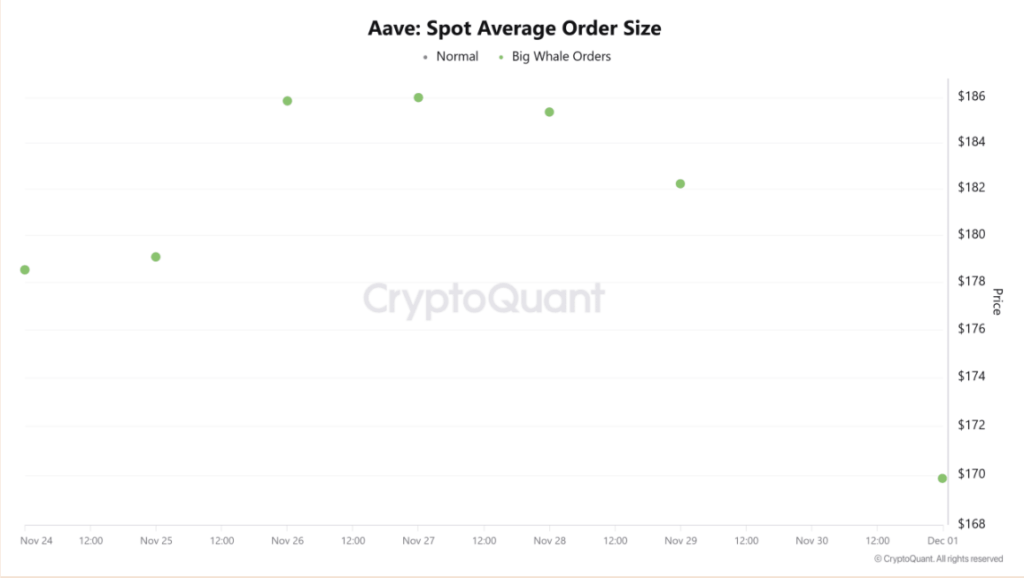

Whale activity has thinned out fast. CryptoQuant’s Spot Average Order Size shows a sharp drop in large whale orders — now sitting at a weekly low. They’re still active, but their order sizes are shrinking, which usually means they’re stepping back or unloading instead of accumulating.

And one whale in particular just took a massive loss. After disappearing for 1.5 months, the wallet sent 15,396 AAVE(around $2.57 million) back to FalconX. This wallet originally received 20,396 AAVE from FalconX worth $4.89 million, selling 5,000 AAVE earlier for roughly $779k.

Now, after this new transaction, the whale has realized a $1.54 million loss. When whales sell aggressively in a downtrend, it’s almost always a sign of fading confidence — sometimes even anticipation of deeper pain.

Retail Traders Are Selling Hard Too

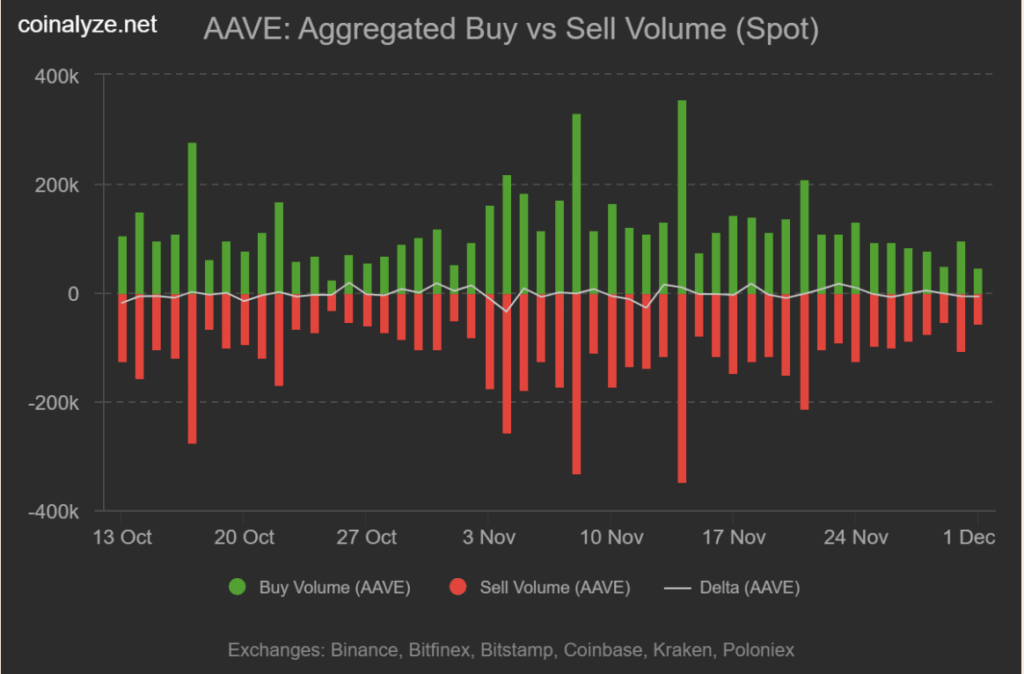

It’s not just whales. Retail traders are also dumping. Coinalyze data shows AAVE has posted a negative Buy-Sell Delta for three straight days. Over the last 24 hours, sell volume hit 165.26k, while buy volume only reached 140k, leaving a negative delta of –25.2k. That’s clear evidence of aggressive spot selling from all sides.

Exchange behavior confirms this sentiment. CryptoQuant shows exchange netflow turning positive for the first time in four days — with 6.7k AAVE flowing onto exchanges. When tokens flow into exchanges, not out, it normally means one thing: people are preparing to sell.

$160 Support: Hanging On by a Thread

AAVE is stuck under heavy pressure. Both whales and retailers are unloading, and the charts are reflecting that breakdown. On the technical side, a short-term bearish cross has already formed — the 9MA crossed below the 21MA, signaling downside momentum. Meanwhile, the RSI made a bearish crossover too, reinforcing the downward trend.

All of this puts AAVE in a vulnerable position. If sellers keep pushing — especially the whales — AAVE will likely break below $160 and drop toward $155 next. It’s not far-fetched, given how much supply is hitting the market right now.

What AAVE Needs for a Reversal

For the trend to flip even slightly bullish, the altcoin needs to reclaim the 9MA and 21MA, both hovering near $178. A close above them would strengthen AAVE’s structure and open the door to reclaiming $189, undoing part of this week’s losses.

But until then, the trend is bearish, momentum is bearish, and sentiment is… well, pretty bad. Here is where AAVE holders need to brace for more volatility in the short term.