- A spike in Japanese bond yields sparked fears of a yen carry-trade unwind, triggering a global selloff.

- Crypto lost $240B as Bitcoin fell below $85K and liquidations hit nearly $700M.

- Traders now face US ISM data and a Powell speech that could reshape rate-cut expectations.

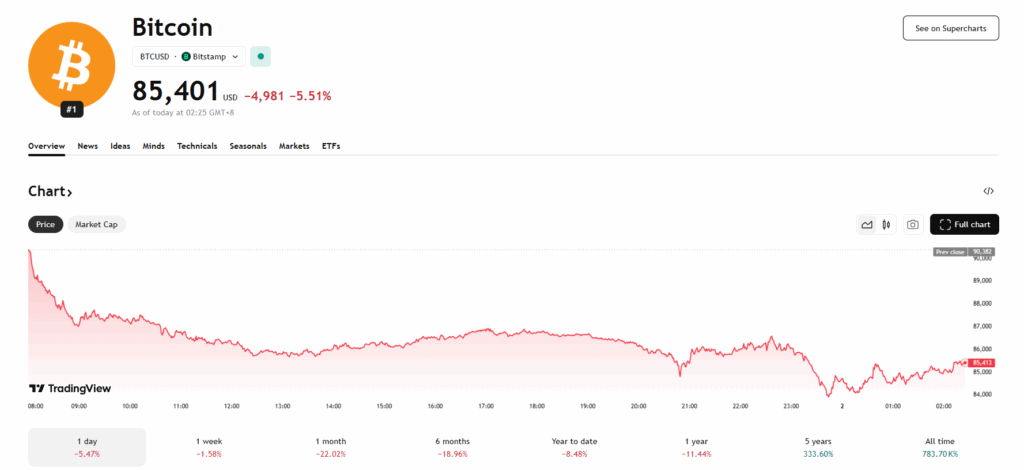

Crypto markets were hit with another violent selloff, wiping out nearly $240 billion in just 24 hours, as a sudden shift in Japan’s bond market triggered a global risk-off wave. Bitcoin slipped under $85,000, erasing days of gains, while major altcoins followed in a steep slide. What looked like a steady rebound quickly turned into a macro-driven flush as traders rushed to unwind leverage and de-risk ahead of key U.S. economic events.

Japanese Bond Yields Spark a Global Risk Unwind

The selloff began when Japan’s 10-year government bond yield spiked to 1.84%, the highest in years. Comments from Bank of Japan Governor Kazuo Ueda hinted that another rate hike could come as early as December, enough to rattle global markets. Higher Japanese yields triggered fears of a yen carry-trade unwind — a massive position estimated to have nearly $20 trillion in global exposure. As the yen strengthened, investors across all risk markets began pulling back, and crypto was one of the fastest to react.

Bitcoin and Altcoins Wipe Out Recent Gains

Bitcoin fell more than 6% after failing to break above $92,000, dropping to roughly $85,653. Ethereum slid about 8% to $2,807. Altcoins were hit even harder: XRP, BNB, Solana, DOGE, ADA, and HYPE plunged between 6–10%, while Zcash collapsed by 21%, leading the downside. What’s striking is how quickly sentiment shifted. The Fear & Greed Index climbed from 11 last week to 24 yesterday — yet macro pressure overpowered any attempt at recovery.

Liquidations Surge as Traders Brace for More Event Risk

With leverage running hot, liquidations cascaded fast. Nearly $700 million in positions were liquidated within a day, and roughly $600 million of that came from longs. One Binance ETHUSDC liquidation alone reached $14.48 million. The market was already fragile heading into today’s U.S. ISM Manufacturing PMI and Jerome Powell’s upcoming speech — two events that could influence December rate-cut expectations. Fresh concerns around Tether also added even more fear to an already shaky environment.

A Global Macro Shock, Not Just a Crypto Story

This move wasn’t just crypto reacting to itself. It was a macro shock rippling through every risk asset that relies on stable liquidity and predictable central bank policy. Yen volatility, U.S. economic data, and Fed communication all converged at the same time — leaving the crypto market exposed and overextended. Until this macro storm clears, volatility is likely to remain elevated across the board.