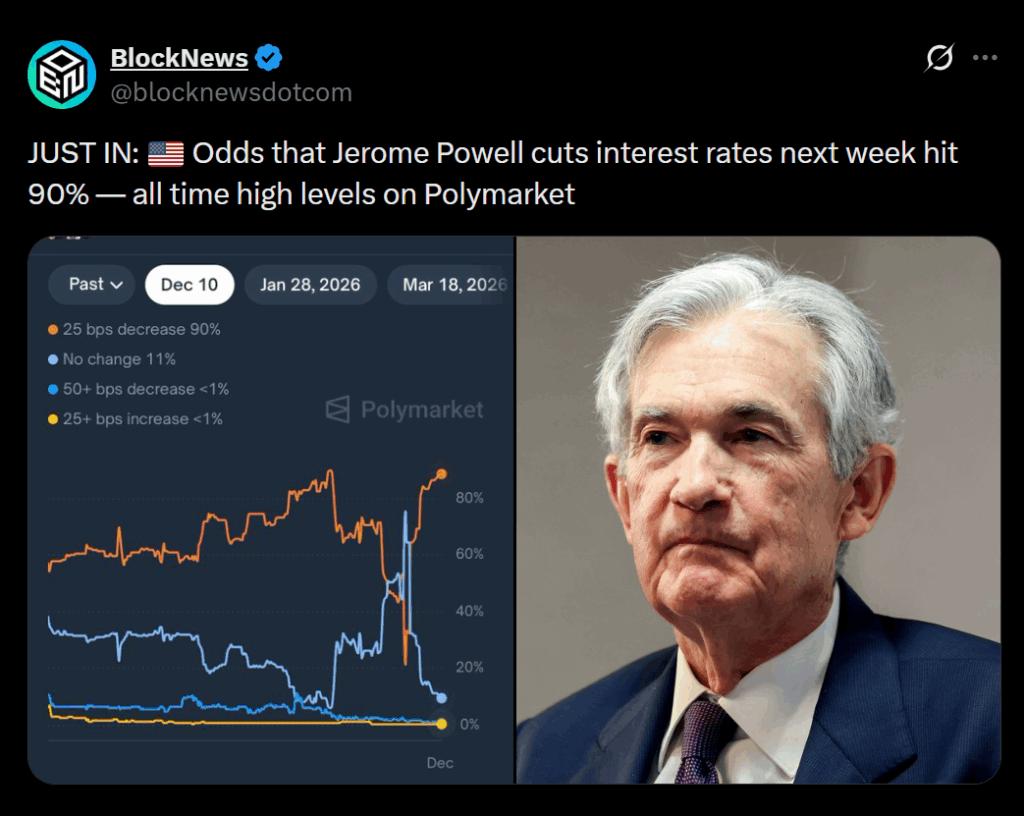

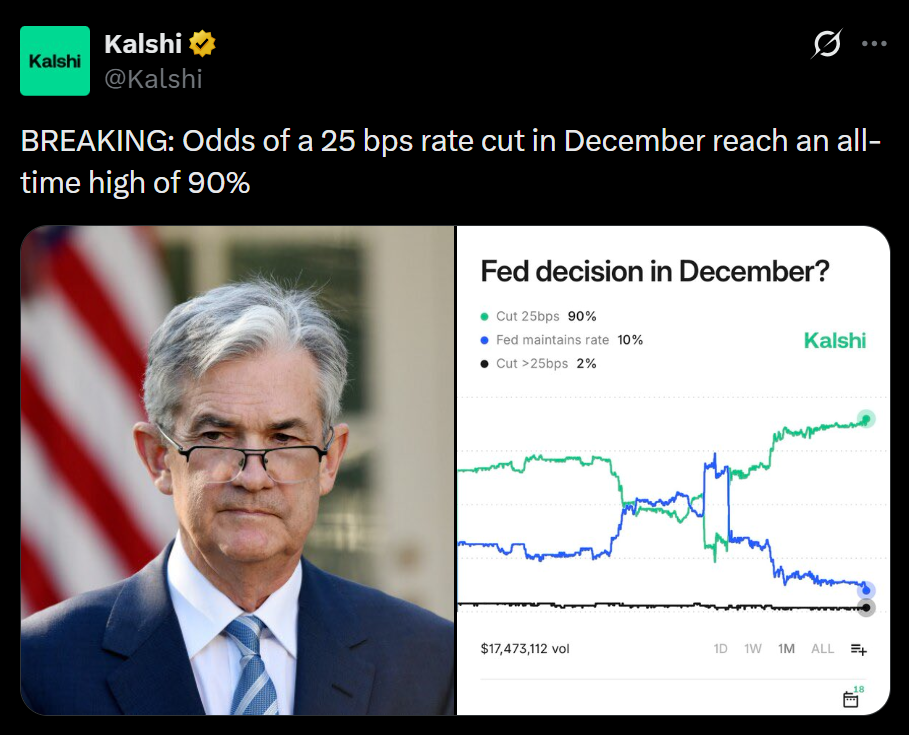

- Markets now price in a ~92% chance of a Fed rate cut next week with no pushback from policymakers.

- No upcoming jobs or inflation data means fewer variables that could disrupt expectations.

- The Fed appears poised to deliver one final cut before year-end, shaping sentiment heading into 2025.

The market mood is settling into a pretty firm consensus now, especially with policymakers offering no meaningful pushback before the Federal Reserve’s blackout period. As things stand, traders are pricing in roughly a 92% chance of a rate cut at next week’s meeting — a level that barely leaves room for surprise. With no US non-farm payrolls or CPI data scheduled to shake things up, conditions seem set for the Fed to deliver one final cut before the year closes. The sentiment echoes Justin Low’s analysis from InvestingLive, and the markets appear to be responding exactly as expected.

Policymakers’ Silence Leaves Markets Confident

Normally, heading into a Fed decision, some policymakers will float comments hinting at hesitation or tightening bias. This time, none of that happened. The absence of hawkish pushback allowed markets to form a clean narrative: the Fed is prepared to move forward with an additional cut. As the blackout rules kicked in, that silence essentially locked the expectation in place, putting the odds overwhelmingly in favor of easing.

Lack of Key Data Removes Potential Roadblocks

What makes next week’s meeting even more predictable is the lack of major data releases. With no fresh labor or inflation numbers on the calendar — two of the Fed’s biggest catalysts — there’s simply nothing left to challenge the dominant market thesis. Traders aren’t bracing for surprises; rather, they’re preparing for a final policy adjustment that matches the gradual cooling already seen across economic indicators.

The Final Cut Before Year-End Looks Likely

If the Fed follows through, this would likely be the last rate cut before the year turns over, positioning monetary policy for a more cautious stance heading into 2025. For risk markets, that could mean a short-term boost, but much depends on how the Fed communicates its forward guidance. Even a slight hint toward a more neutral or wait-and-see posture could influence how equities, bonds, and crypto behave into early January.