- AAVE has fallen sharply after a rejection at $190, with whales and retail traders selling aggressively.

- Whale losses exceeding $1.5M signal deep bearish conviction and reinforce downside pressure.

- A break below $160 could send AAVE toward $155 unless the token reclaims the $178 resistance zone.

AAVE has been trapped in a steady decline since getting rejected at the $190 level just four days ago, slipping through support levels and hitting a fresh local low of $165. The selling pressure has been relentless, with the token dropping for four straight days and showing little relief on the charts. As of now, AAVE trades around $166 — down more than 10% on the daily timeframe — as whales begin exiting their positions and fueling deeper fear across the market.

Whale Activity Flashes a Strong Bearish Signal

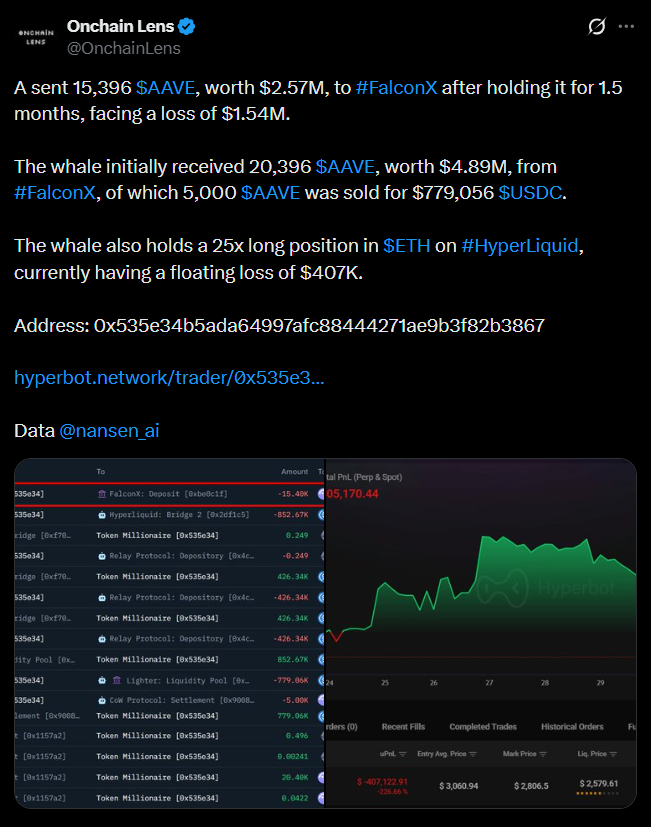

Whale activity has thinned out dramatically as AAVE’s price continues its descent. CryptoQuant data shows a sharp drop in Spot Average Order Size, meaning large buyers have mostly stepped back from the market. One whale in particular resurfaced after about 1.5 months, sending 15,396 AAVE (worth $2.57 million) back to FalconX. That same whale initially received 20,396 AAVE worth nearly $4.9 million, having sold 5,000 of it earlier. With the latest move, the whale locked in a loss of roughly $1.54 million — a clear red flag suggesting deep bearish sentiment among large holders.

Retail Traders Join the Selling Frenzy

The selling pressure hasn’t been limited to whales. Retail traders have also been offloading AAVE aggressively over the past three days. Coinalyze data shows a negative Buy Sell Delta streak, with the past 24 hours recording 165k in sell volume versus 140k buy volume. Exchange Netflow has also flipped positive for the first time in four days, sitting at +6.7k AAVE — a sign that more tokens are being deposited onto exchanges, typically hinting at further downside pressure.

Is the $160 Level About to Break?

Technical indicators paint a bleak picture for AAVE in the short term. AMBCrypto reports that AAVE recently formed a bearish cross, with the 9MA sliding beneath the 21MA. At the same time, the RSI made its own bearish crossover, signaling momentum is fully in sellers’ hands. If this intensity continues — especially from whales — AAVE is at risk of breaking below the $160 support zone and plunging toward $155. For any hope of recovery, the token needs to reclaim the $178 region by closing above both moving averages. Only then could AAVE attempt a revisit of the $189 level and recover some of its recent losses.