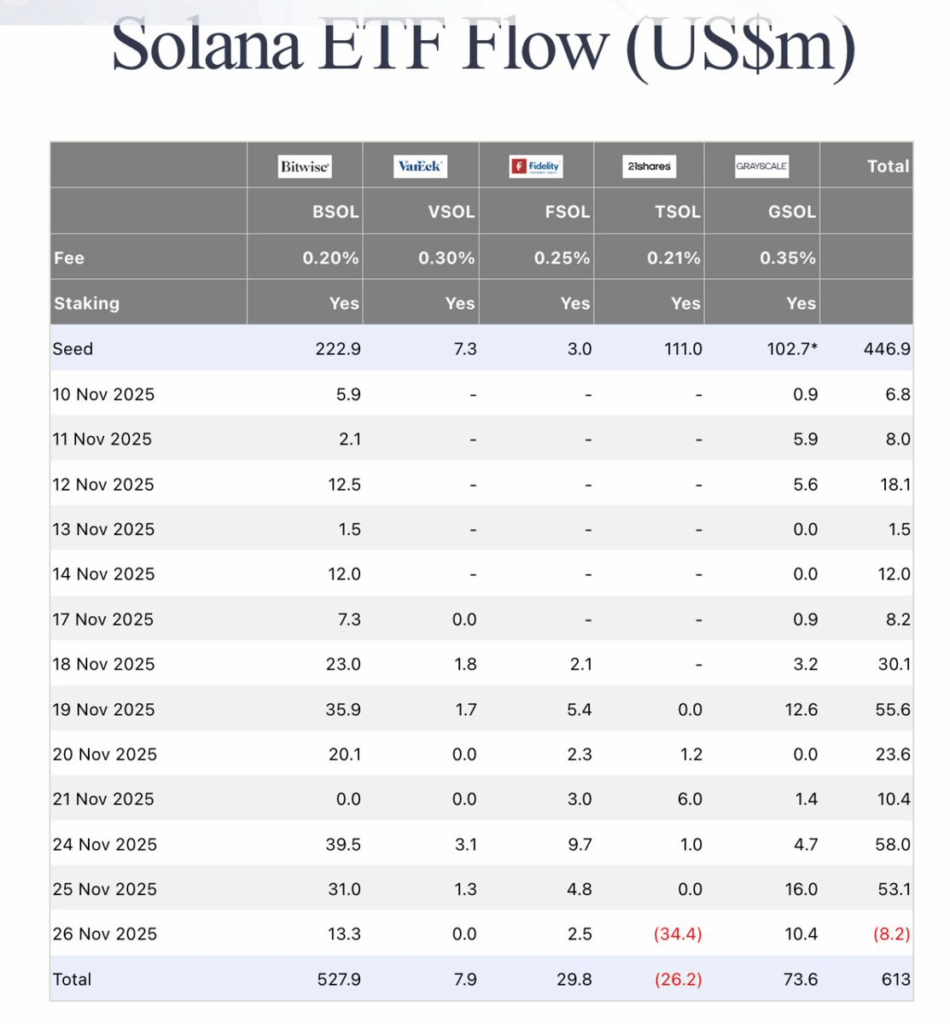

- Solana ETFs saw their first net outflows, mainly driven by a $34M withdrawal from 21Shares’ TSOL.

- SOL bounced back above $140 but still trades below key resistance levels, especially the $152 20-day SMA.

- Institutional demand remains steady, with nearly $1B in SOL ETF exposure despite the brief pullback.

Solana’s ETF narrative hit its first real speed bump, ending a 21-day run of uninterrupted inflows and signaling a subtle shift in investor appetite. After weeks of steady demand, the group of spot Solana ETFs registered $8.2 million in net outflows on Thursday, landing right as SOL fought its way back above the $140 price zone. The downturn wasn’t broad across all issuers, but it was sharp where it landed, creating a ripple that momentarily broke the sentiment streak. At the same time, the partial price rebound showed traders weren’t fully stepping back, just moving more cautiously after weeks of non-stop inflow pressure.

Most of the turbulence came from a single heavyweight: the 21Shares Solana ETF (TSOL). With $34 million pulled in one session, TSOL’s redemptions outweighed the combined inflows of every other Solana ETF on the market. This concentrated withdrawal flipped the entire Solana ETF category into the negative for the day, even though Bitwise, Grayscale, and Fidelity all continued stacking inflows. Despite this, TSOL still holds $86 million in assets under management, though its cumulative flow now sits at -$26 million — a sharp contrast to its competitors that continue attracting fresh capital.

Price Reclaims $140 but Technical Pressure Remains

Solana’s price action added another layer to the story. The asset clawed back above the $140 level for the first time since mid-November, hinting at improving demand even as ETF flows wobbled. Still, Solana remains below major technical thresholds, with the 20-day SMA near $152 and the 50-day SMA hovering around $168. These levels now act as visible barriers that traders are watching closely, especially since most ETF buyers hold an average SOL cost basis near $151. With spot trading below that level, mass selling remains unlikely, though scattered profit-taking could appear if volatility picks up.

Technical indicators reflect the cautious tone, with the RSI beginning to recover but still struggling to break into stronger momentum territory. Analysts suggest that reclaiming the $152 zone could open a path toward $168, a level that has repeatedly capped rallies. Failure to break out, however, may drag SOL back toward the $135 support region, where buyers have historically stepped in. The market appears to be in a quiet tug-of-war, with inflows and technicals pushing in different directions but neither side fully dominating the narrative.

Institutions Continue Accumulating Solana Exposure

Even with TSOL’s heavy outflows, institutional positioning hasn’t shifted dramatically. Across all Solana-linked ETFs, total holdings now sit at roughly 6.83 million SOL — nearly $964 million in exposure at current prices. Bitwise, Grayscale, and Fidelity continued posting inflows throughout the downturn, suggesting that institutional demand is still intact beneath the surface. Some treasury desks and conservative allocators appear to be increasing exposure slowly, potentially using short-term price weakness as an entry point before year-end positioning.

What makes Solana ETFs particularly unique is their staking-enabled structure offered by several issuers. These products can generate yield for holders, even in periods where SOL’s price stalls or retraces. This added incentive often encourages longer holding periods and can dampen the chances of sharp mass redemptions when volatility spikes. For now, the broader trend still leans toward accumulation rather than exit, even with the first outflow day on record since SEC approval on October 28 shook the streak.

Market Outlook as Solana’s Narrative Evolves

Although Thursday’s shift broke a nearly month-long pattern of positive flows, it didn’t signal a collapse in sentiment so much as a recalibration. Solana’s ecosystem remains one of the most heavily watched in the crypto space, and ETF behavior is increasingly tied to short-term price movements. Both retail and institutional traders are tracking the next technical trigger, waiting to see if SOL can confidently break its resistance levels or if another cooldown phase emerges. For now, the trend shows resilience, but the next few sessions will likely determine whether this outflow is a blip or the start of a new pattern — and here is where close observation becomes essential.