- Crypto saw roughly US$300B in inflows as U.S. liquidity improved and Treasury conditions eased.

- Oversold technicals and cleared-out leverage created a cleaner setup for a strong rebound.

- Institutional and whale participation returned, helping Bitcoin reclaim $90K and Ethereum break above $3K.

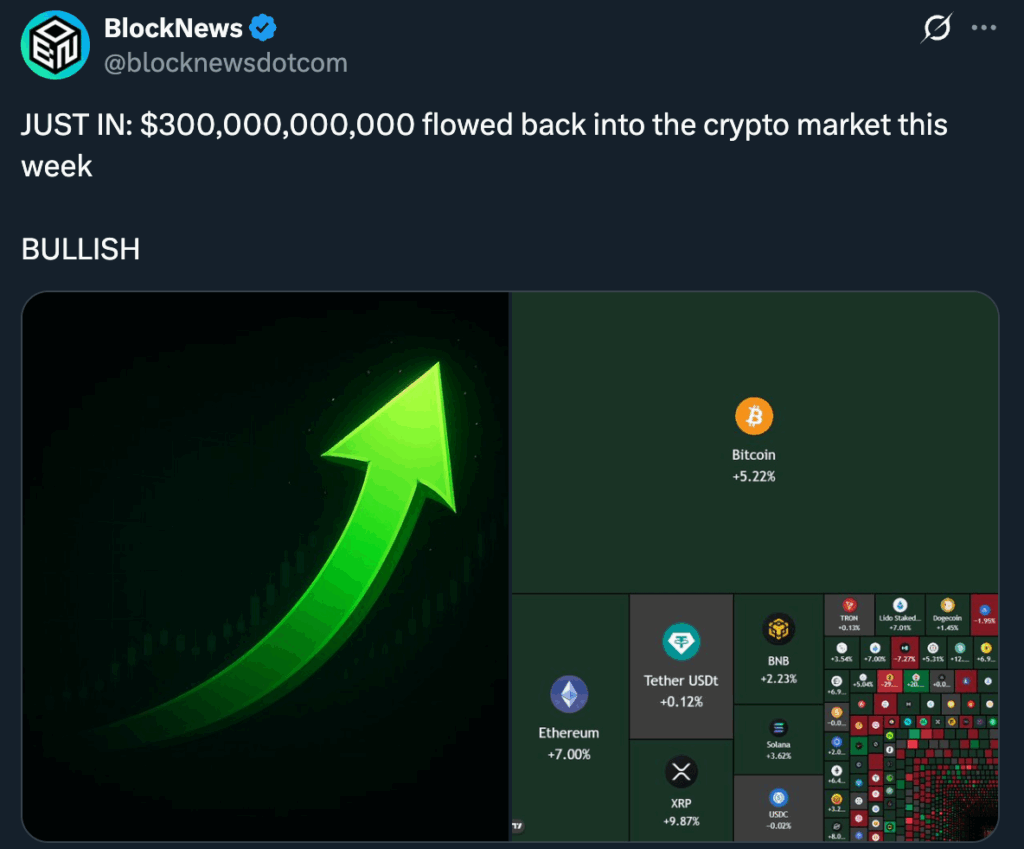

This past week marked one of the strongest reversals the market has seen in months, with roughly US$300 billion flowing back into digital assets. It came right after multiple weeks of aggressive selling, leverage wipeouts, and panic-driven exits. The fresh inflows helped stabilize prices that had been pushed far below fair-value zones, sparking a broader recovery across majors like Bitcoin and Ethereum. A big part of the turnaround came from U.S. liquidity conditions improving — Treasury inflows and shifting expectations around monetary policy gave traders confidence to rotate back into risk assets, and crypto was one of the first beneficiaries.

Technical Reset + Oversold Conditions

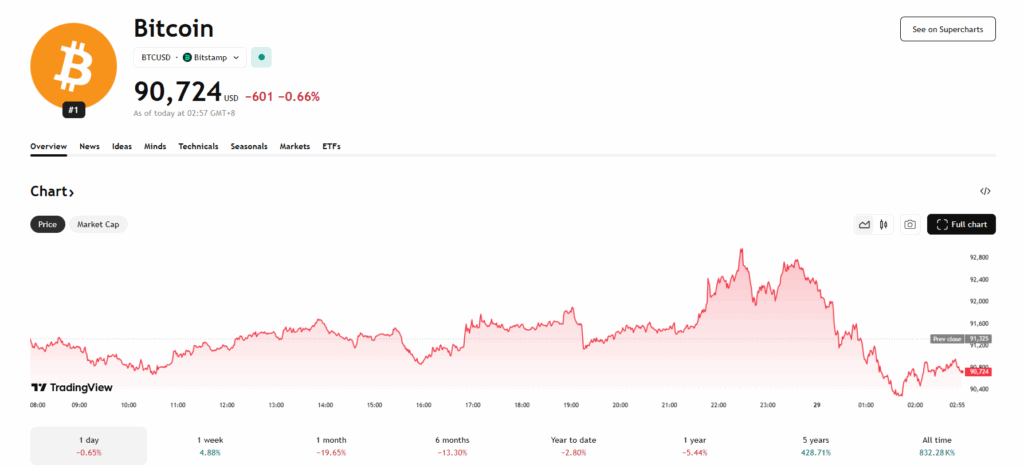

Momentum didn’t just come from macro signals. Many assets were deeply oversold, and the market had just gone through one of the largest leverage flushes of the year. Long positions had been wiped out, funding rates flipped deeply negative, and forced liquidations had cleared out a lot of speculative excess. When Bitcoin pushed back above US$90,000 and Ethereum reclaimed the US$3,000 zone, it signaled that buyers were finally stepping in without the burden of overwhelming leverage dragging prices lower. With a cleaner backdrop, even moderate buying was enough to trigger strong upward moves.

Institutions and Whales Step Back In

Once the initial rebound took shape, larger players began to re-enter the market. Institutional flows picked up, whale wallets became active again, and ETF demand returned after two rough weeks. This added fuel to the recovery and helped reinforce the idea that the downtrend might be losing momentum. The move wasn’t explosive or euphoric — more of a steady return of strategic buyers who saw attractive entries after the crash.

What Comes Next

This bounce shows that crypto still has deep latent demand when conditions shift, but sustaining it depends heavily on macro stability. If liquidity keeps loosening and major risk assets remain supported, upside continuation is very possible. If conditions tighten again or a macro shock hits, the rally could fade as quickly as it arrived. For now, though, the market finally has breathing room — something it hasn’t had in weeks.