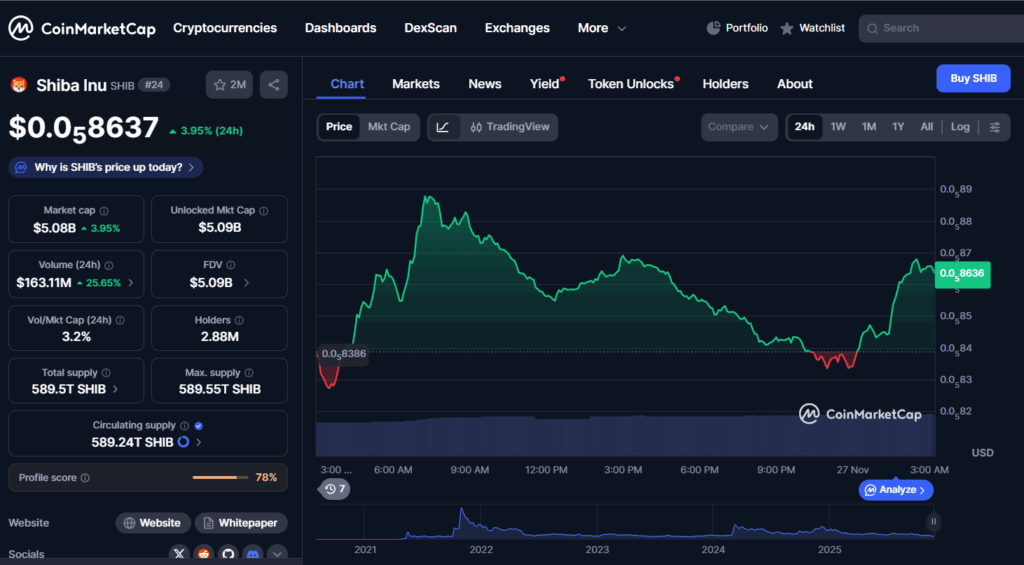

- SHIB saw a 1.36 trillion volume spike, forming its strongest reversal signal since October.

- Analysts say SHIB could attempt a major breakout, with some targeting a 200% move if momentum continues.

- A real reversal is possible, but SHIB must climb back above key moving averages to confirm strength.

Shiba Inu just printed one of its strongest reversal signals in months after a 1.36 trillion SHIB volume spike hit the charts. The token had been sliding toward the $0.0000080 region for weeks, but the sudden flood of buy-side volume arrived exactly at a major support level. What stood out was the clear reversal candle — backed by the highest buying pressure since October’s market collapse.

Heavy volume at the bottom usually means two things are happening at the same time: exhausted holders are capitulating, and stronger hands are stepping in to accumulate. That combination often marks the early stages of a trend shift.

Analysts Spot Momentum Building Behind the SHIB Reversal

The Shiba Inu bounce caught the attention of several analysts. TraderSZ pointed out that SHIB finally broke out of its recent downward structure, signaling that a deeper uptrend may be forming — especially as the broader crypto market went through a relief rally.

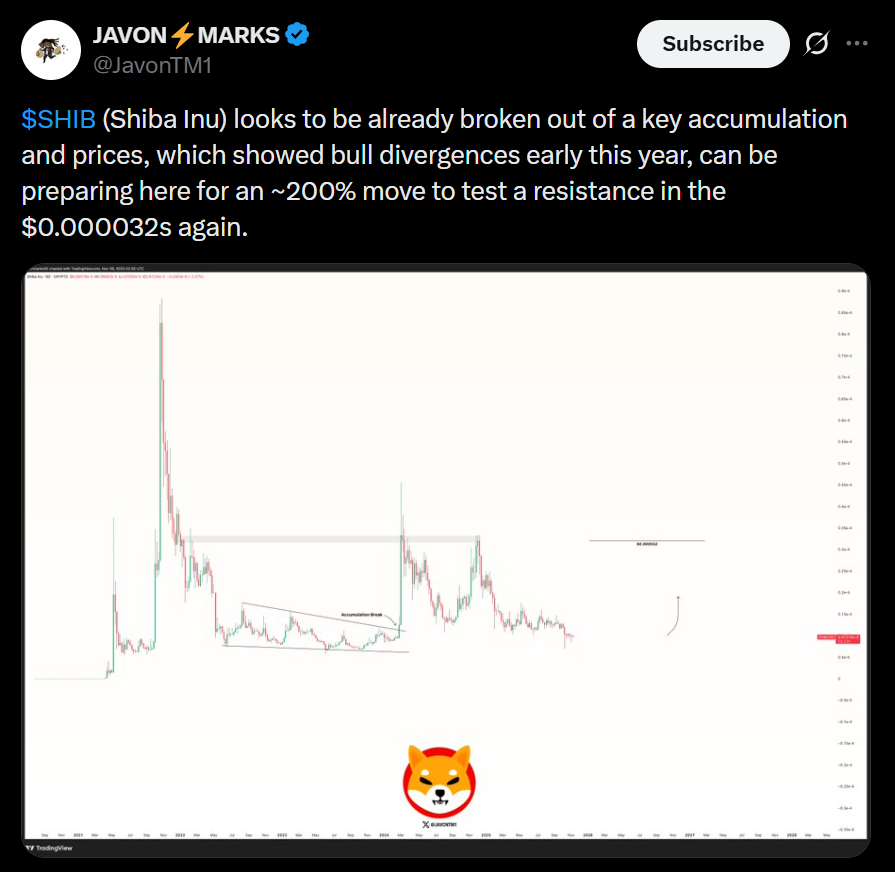

Analyst Javon Marks has been even more bullish. He noted that SHIB has broken above what he considers a key accumulation zone, backed by bullish divergences that first appeared earlier this year. In his outlook, SHIB could be gearing up for a 200% upside move, potentially retesting the $0.000032 level if momentum continues to build.

The Technical Foundation for the SHIB Price Surge

This wasn’t just a random burst of trading activity. The 1.36T SHIB spike was what traders call a flush-and-absorption event, where aggressive selling is met with even stronger buying. That tends to happen at major pivot levels — and in this case, the bounce aligned with deeply oversold RSI readings.

SHIB also carved out a higher low, the first structural requirement for a true trend reversal. But there’s still work to do. The token sits below all major moving averages — the 20, 50, 100, and 200 — creating a stacked overhead resistance cluster. That doesn’t cancel the Shiba Inu bounce, but it does mean a sustained rally will need additional high-volume confirmation candles.

What This Volume Spike Means Going Forward

This Shiba Inu bounce finally introduced real liquidity and momentum after weeks of slow bleeding. The downtrend isn’t fully broken yet, but the token now has a legitimate shot at a broader reversal. Much depends on whether bulls show follow-through in the upcoming sessions.

Traders should expect volatility — high volume at lows usually brings sharp swings in both directions — but the pressure that crushed SHIB throughout November appears to have reached its limit. The next few days will determine whether this bounce becomes a full trend shift or just a temporary relief rally.