- ETH/BTC holds support with “untapped liquidity,” suggesting stronger upside potential.

- Ethereum faces whale selling but still shows a cleaner bullish setup than Bitcoin.

- Extreme fear and technical gaps hint that both assets may be nearing a reversal point.

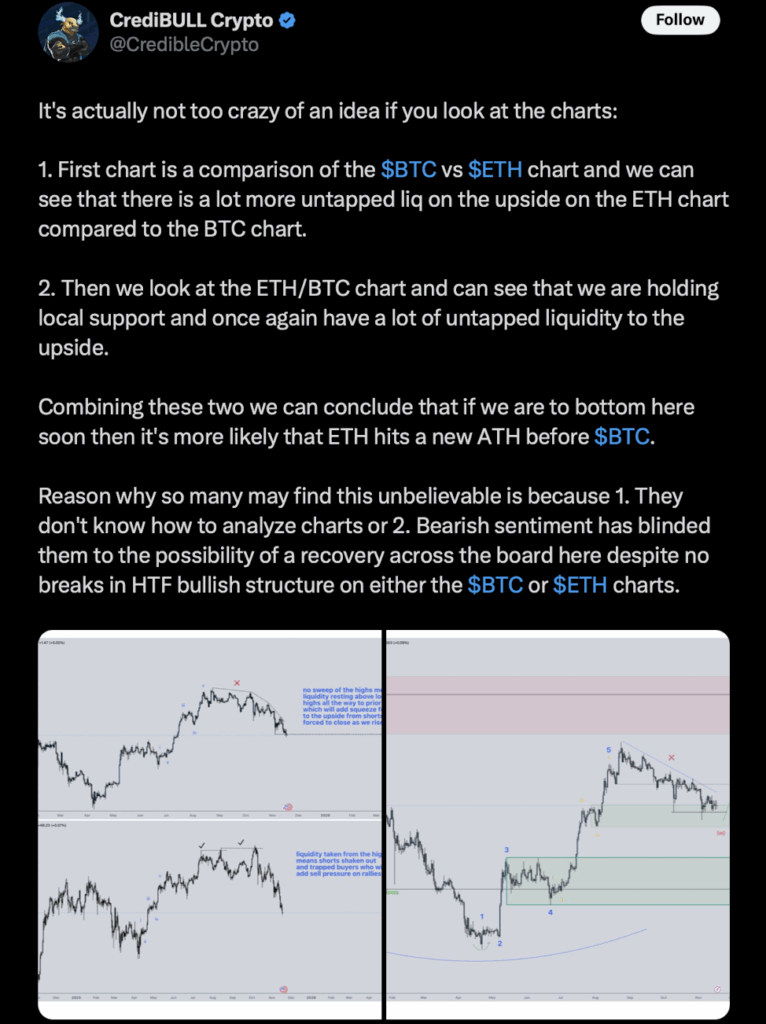

A crypto commentator has stirred things up a bit, arguing that Ethereum might actually be positioned to outperform Bitcoin and even reclaim its all-time high before BTC does. It’s a bold claim, especially with both assets wobbling around major support zones after a sharp market drawdown, but the idea is gaining traction. According to this perspective, ETH seems to have “untapped liquidity” sitting above current levels on the ETH/BTC chart, which could act like fuel once buyers finally step in. Bitcoin looks stable, sure, but Ethereum’s structure just… looks different right now. Maybe even stronger.

Technical Signals Point Toward a Possible ETH Bottom

Analyst CrediBULL Crypto broke down the argument in a thread on X, noting two key things. First, ETH/BTC is holding a local support area that hasn’t been violated, which is usually where major reversals begin forming. Second, Ethereum’s individual charts show a cleaner liquidity setup than Bitcoin’s, almost like price is waiting for an excuse to push higher. The analyst went as far as saying that if the market finds a bottom soon, “it’s more likely that ETH hits a new ATH before BTC.” Many traders, they argued, are simply too stuck in bearish sentiment to see the structure clearly — which tends to happen near market turns.

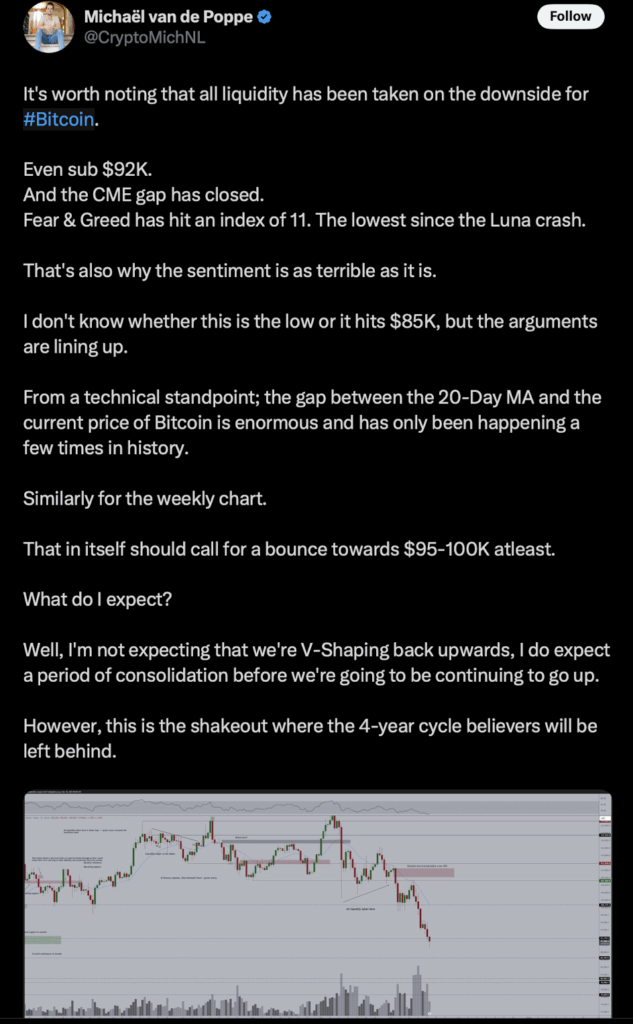

Sentiment Is Deep in Fear Territory, Hinting at Reversal

Backing this view, analyst Michaël van de Poppe pointed out that the Crypto Fear & Greed Index just dropped to its lowest level in nine months. Historically, extreme fear clusters right before markets bounce — almost like everyone panics at the exact wrong time. Van de Poppe also noted that Bitcoin filled a CME gap around $91,500 and that the gap between BTC’s current price and its 20-day moving average has stretched pretty far. Typically, that kind of distance signals an incoming bounce or at least a calm consolidation before the next move.

Sell Pressure Builds, but ETH and BTC React Differently

Right now, Bitcoin trades around $93,000, down roughly 11% on the week. Ethereum has been hit even harder, slipping to around $3,150 after a 12% slide. But the reasons behind each drop aren’t the same. Ethereum is facing heavy sell pressure from large holders: wallets with 1,000 to 10,000 ETH sold about 230,000 coins in a single week — almost perfectly aligned with the fall from $3,600 to the low $3,200s. On top of that, new depositor activity on the Ethereum network hasn’t grown at all, even when ETH touched the $4,000–$5,000 range. Without fresh demand, rallies tend to be shaky… almost hollow.

Bitcoin Faces Its Own Set of Challenges

For BTC, the issue looks different. The Coinbase Premium Gap has slipped to -$90 — one of its lowest readings this year. That means buyers on Coinbase (mostly institutions) are quieter or selling, while Binance retail traders are dominating volume. When retail leads and institutions step back, volatility usually ramps up and downside pressure increases. Markets don’t stabilize until bigger buyers return, which hasn’t happened yet.

ETH Holds the Advantage… If the Bottom Really Forms

Putting it all together, ETH/BTC maintaining support and holding untapped liquidity above gives Ethereum a slight edge — at least on paper. If the market finds a bottom soon, ETH may indeed push toward its previous highs faster than Bitcoin. But both assets face their own unique pressures, and sentiment is still fragile. The next stretch of trading will show whether fear gives way to accumulation… or if this correction still has a bit more weight to throw around.