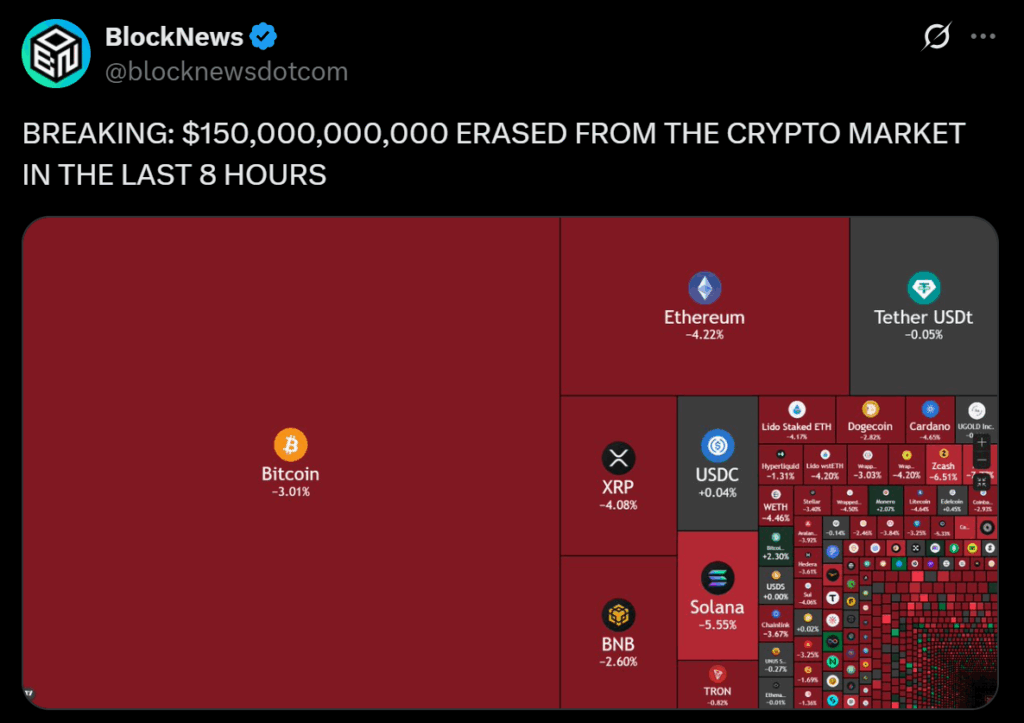

- Bitcoin’s slide toward the 90K region helped erase over $150B from the crypto market in just eight hours.

- Breaking below 100K confirmed a descending channel, with traders now watching the 89K–94K and 72K–74K zones as critical levels.

- Analysts are split between calling this a violent but “healthy” flush or the beginning of a deeper, multi-leg correction.

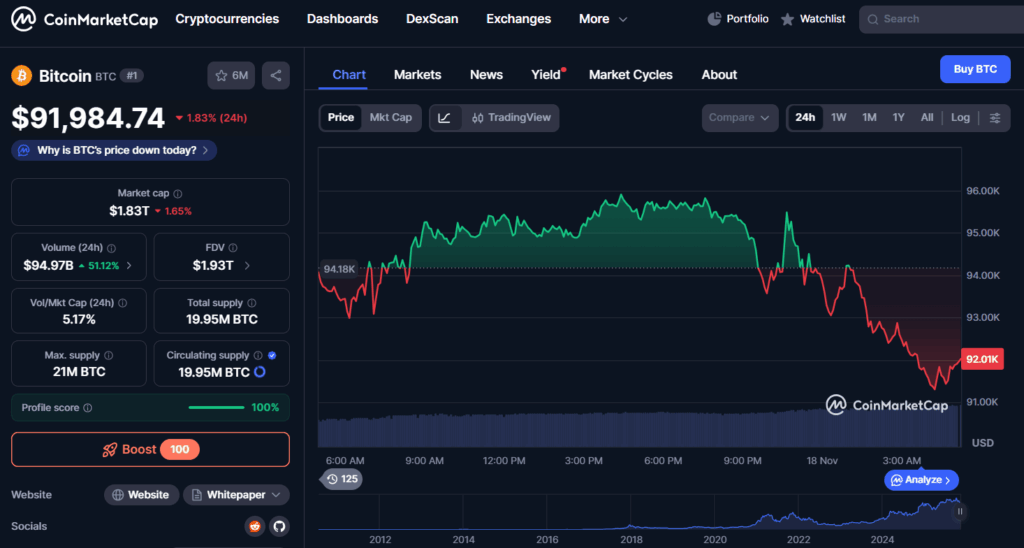

The crypto market just had one of those brutal sessions that people remember for a long time. In barely eight hours, more than $150 billion was wiped out from total market value as Bitcoin slid toward the 90K region and fear spread across every major asset. BTC has now fallen hard from its $126,000 all-time high in October, and what started as a normal-looking pullback has turned into a fast, synchronized sell-off. Liquidity is being pulled on both centralized exchanges and DeFi venues, which is making every leg down feel heavier than the last.

A Steady Decline That Finally Snapped

This crash didn’t just appear out of nowhere. Analysts have been pointing out for weeks that the entire market has been grinding lower since early October. Total crypto market cap now sits near $3.26 trillion, its lowest point since midsummer. That slow series of lower lows has finally added up, pushing Bitcoin almost 30 percent below its peak and technically into bear-market territory. Once you combine that with shaky macro sentiment, it’s not surprising that a “normal” dip flipped into a rush for the exits.

The Key Levels Everyone Is Watching Now

The real emotional break came when Bitcoin lost the $100,000 level. That line was more psychological than anything, but once price closed convincingly below it, it confirmed a descending channel that has been forming since the October liquidations. Right now, traders are laser-focused on the $89,000–$94,000 range. It’s a liquidity-heavy zone and acts like a decision point: if buyers defend it, we might see a relief bounce; if they don’t, things could get ugly fast. Below that, some analysts are already eyeing the $72,000–$74,000 area as a potential retest — the same region where BTC began its huge run to new highs earlier this year.

Is This the Start of a Full Breakdown or Just a Violent Flush?

Even with $150 billion erased in a single window, not everyone is calling for doom just yet. A few analysts are still framing this as “healthy consolidation” after an overheated run, as long as Bitcoin doesn’t lose its major structural supports. That said, the longer the market stays pinned near the lows, the harder it becomes to argue for an easy bounce. Right now, crypto is stuck in an awkward middle zone: way off the highs, but not yet in total free-fall. Sentiment feels fragile, and the next move out of this range is likely to set the tone for the rest of the cycle.

The Bigger Picture Going Forward

In the end, today’s move is a combination of stretched valuations, fading liquidity, and traders finally losing their nerve after weeks of slow bleed. Whether this sharp $150 billion drop turns out to be a final flush before recovery, or the opening act of a deeper leg down, depends on how Bitcoin behaves around those key support zones.