- Ethereum held near $3,200 even as Binance and BlackRock reportedly sold around $1B in ETH, with buyers repeatedly absorbing sell pressure at support.

- Whale activity spiked, with large spot orders returning to exchanges and mirroring early 2024-style accumulation phases.

- Key levels now sit at $3,380 and $3,700 on the upside, while a drop below $3,146 could send ETH toward $3,050–$2,900 if selling resumes.

Ethereum spent most of the session hovering around the $3,200 zone, but underneath that quiet surface, the market was absolutely chaotic. Heavy flows hit major exchanges, with fresh whale demand colliding directly against aggressive selling from Binance, BlackRock, and several market-making desks.

Whale Moves Slam Into ETH Support — But Buyers Keep Absorbing the Pressure

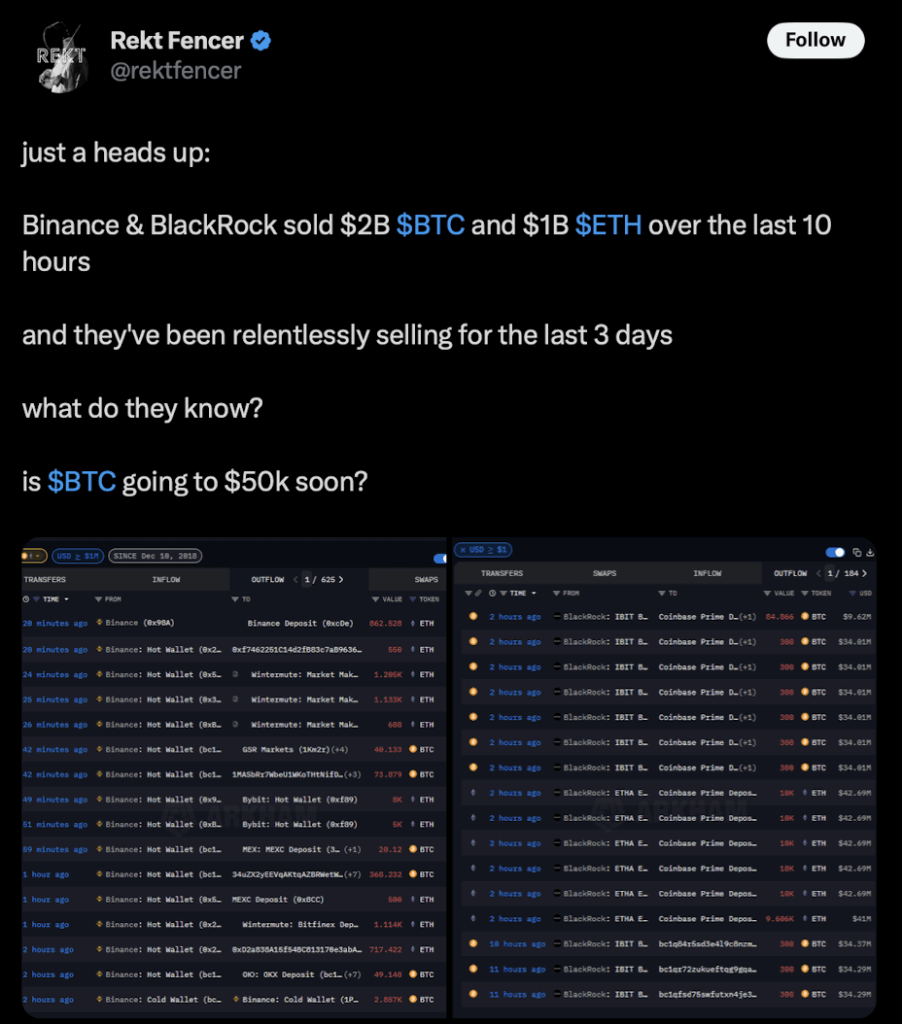

Arkham flagged a long string of large ETH transfers leaving Binance’s hot wallets and moving into well-known market-maker addresses. These hot wallets are used for active flows — not long-term storage — so seeing multiple transfers above 1,000 ETH each was a big signal that serious repositioning was underway.

Tokens were repeatedly sent to Wintermute, Bybit, and other settlement accounts, which usually happens when market makers need inventory to quote both sides of the book. According to onchain analyst Rekt Fencer, Binance and BlackRock offloaded roughly $1 billion in ETH in about ten hours — a massive amount of supply to hit the market in such a tight window.

He added that both firms had been trimming exposure for three days before this move. BlackRock’s involvement drew particular attention since the firm has become a major participant in ETH flows over the past year.

What surprised many traders is that, even with that selling wave, Ethereum barely cracked below its support zone. Every time price drifted toward the lower edge, fresh buyers stepped in — absorbing supply the moment it hit order books.

At the same time, Binance kept shipping mid-sized batches to OKX and MEXC deposits, suggesting even more sell-side liquidity was lining up. Analysts said the steady drumbeat of outflows turned ETH’s support range into a battlefield where whales and institutions kept testing each other.

Big Spot Orders Return — Whales Quietly Accumulate Again

CryptoQuant analyst CryptoGoos highlighted something different happening on the other side of the tape: unusually large spot orders started hitting exchanges again. These weren’t retail trades — they were the size that typically comes from funds and high-net-worth wallets.

His charts showed thick clusters of big buys after a mostly silent quarter, with spot orders now matching or even exceeding some of Binance’s outflows.

This pattern strongly resembled the early 2024 accumulation phase, when whales bought quietly during a flat, boring range before the next big move.

Spot buying also means whales wanted direct exposure, not futures. No leverage, no funding spikes, no forced liquidation risk — just tokens delivered immediately. That’s usually the approach whales take when they think a price zone offers a “clean entry” without excessive downside noise.

Smaller retail orders barely showed up; most of the flow was large wallets hitting size.

Technical Levels Point to a Coiled Market Before a Volatility Burst

Chart analyst TedPillows mapped out a tight structure around the current ETH range. On the four-hour and daily charts, the main support band sat right around $3,200, the same area that kept holding despite heavy selling.

He flagged reaction zones around $3,380 and $3,700 — both areas where sellers previously stepped in and forced ETH downward. Those will likely be the first ceilings bulls need to clear if momentum flips.

On the flip side, if exchange selling intensifies again, ETH could drift toward the next support layers at $3,050 and even $2,900, both zones where buyers stepped in during earlier selloffs.

For now, ETH is trading inside a compressed range, the kind of tight coil that often breaks into sudden volatility once one side overpowers the other. The question is whether the next big move belongs to the whales buying quietly in the shadows — or the institutions unloading supply into the market.