- VanEck’s final SEC filing (Form 8-A) signals its Solana ETF could launch within days, marking a major step for U.S. investors.

- Solana ETFs have attracted $370M in total inflows, including 13 consecutive days of new investments despite market volatility.

- SOL price dipped to $143, but institutional interest is climbing with new products like Grayscale’s GSOL options trading.

Solana ETFs just got a major boost. VanEck has officially filed its Form 8-A with the U.S. Securities and Exchange Commission, which is basically the final green light before a new financial product hits the market. In other words… the VanEck Solana ETF might begin trading any moment now

.

VanEck Moves Into Launch Position

This latest filing is the last procedural step before an ETF begins trading on U.S. exchanges. It follows VanEck’s updated S-1 form from earlier, which revealed a 0.30% management fee and laid out the fund’s plan to stake Solana (SOL) to generate yield for investors.

With the Form 8-A now locked in, analysts say the ETF could technically launch today — all that’s left is the SEC’s final nod. VanEck’s urgency shows they’re leaning fully into the rising demand for Solana-based investment products.

Solana ETF Demand Stays Hot — Even While Prices Drop

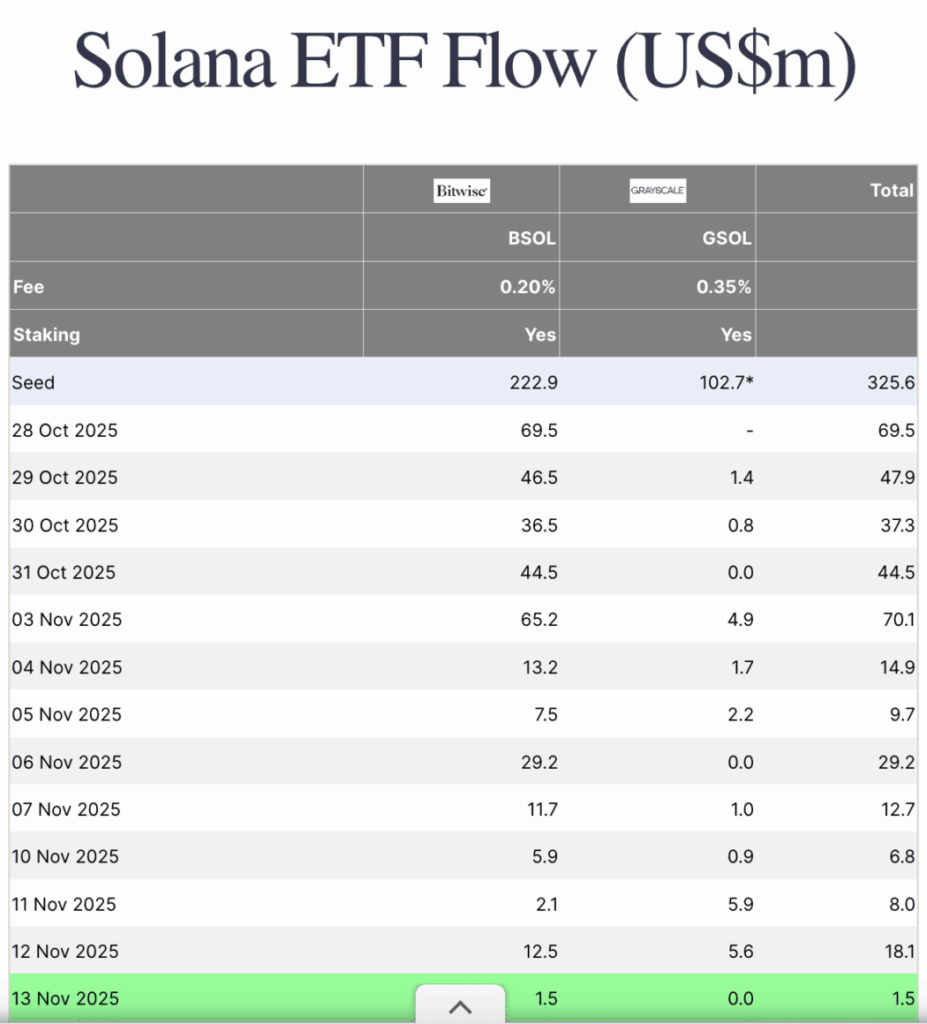

What’s wild is that Solana ETFs continue seeing inflows despite the recent market dip. According to Farside Investors, Solana funds saw $1.49 million of new money on Thursday alone, marking 13 straight days of inflows.

Since Bitwise launched the very first Solana ETF (BSOL) on October 28, the total inflows across all Solana ETFs have climbed to $370 million. Nearly $200 million arrived in the first week of trading.

Nick Ruck from LVRG Research called Solana ETFs a “high-beta complement” to Bitcoin and Ethereum ETFs — meaning they’re built for sharper upside during bullish conditions (and yeah, sharper downside during corrections).

Grayscale also expanded its Solana offerings by launching options trading for GSOL, giving institutional investors even more tools to play with. This could push Solana deeper into the institutional spotlight.

SOL Price Dips to $143, But Long-Term Confidence Holds

Even with all this ETF excitement, Solana’s price slipped about 6% today, landing near $143. Still, SOL sits comfortably with a $79 billion market cap — a sign that long-term belief in the ecosystem remains strong.

If the VanEck ETF officially launches in the coming days, it could bring another wave of attention, liquidity, and institutional demand into Solana’s orbit.