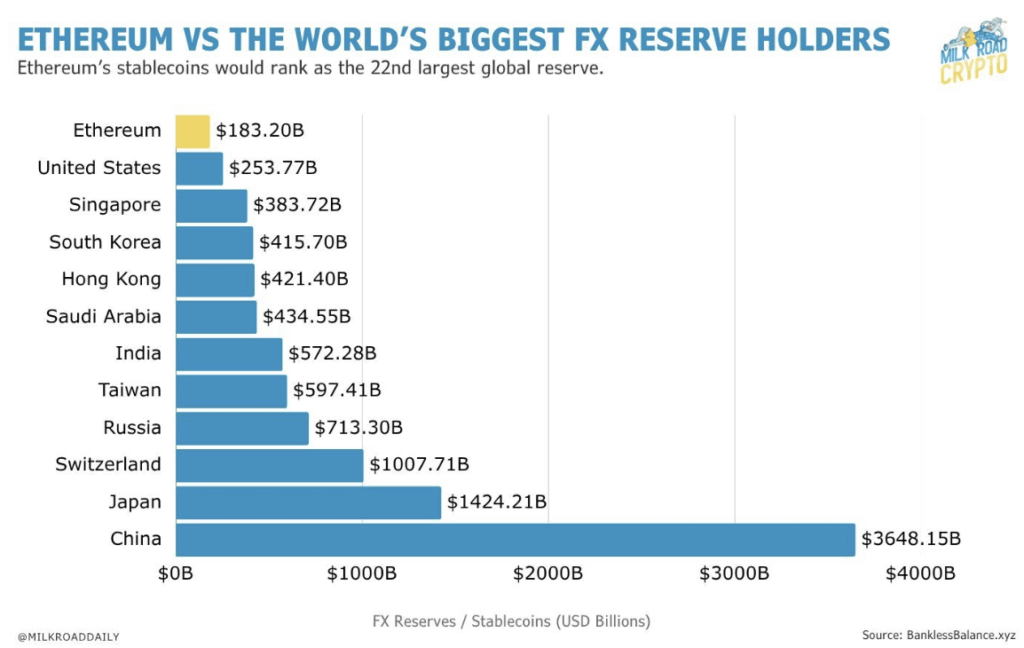

- ETH-based stablecoins now rank as the world’s 22nd largest reserve, surpassing major countries.

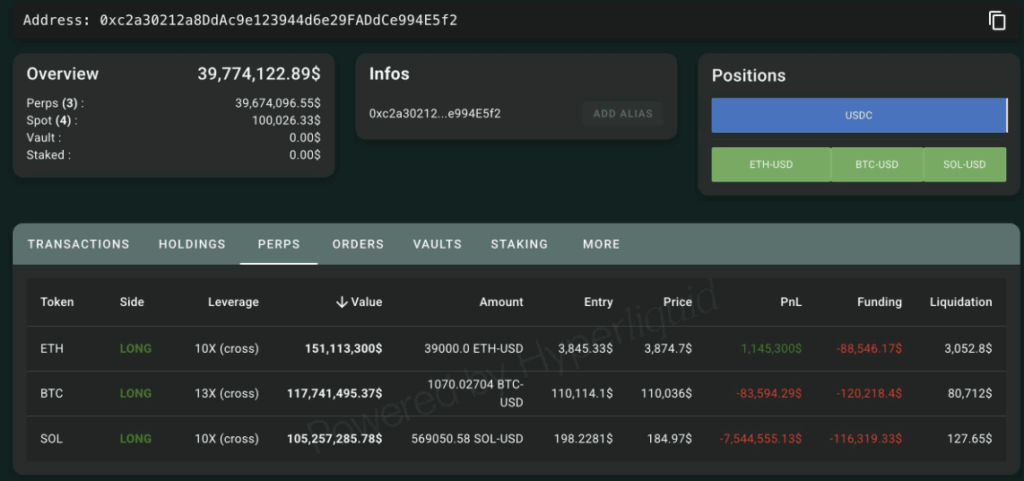

- A top trader with a 100% win record opened a $151M ETH long position.

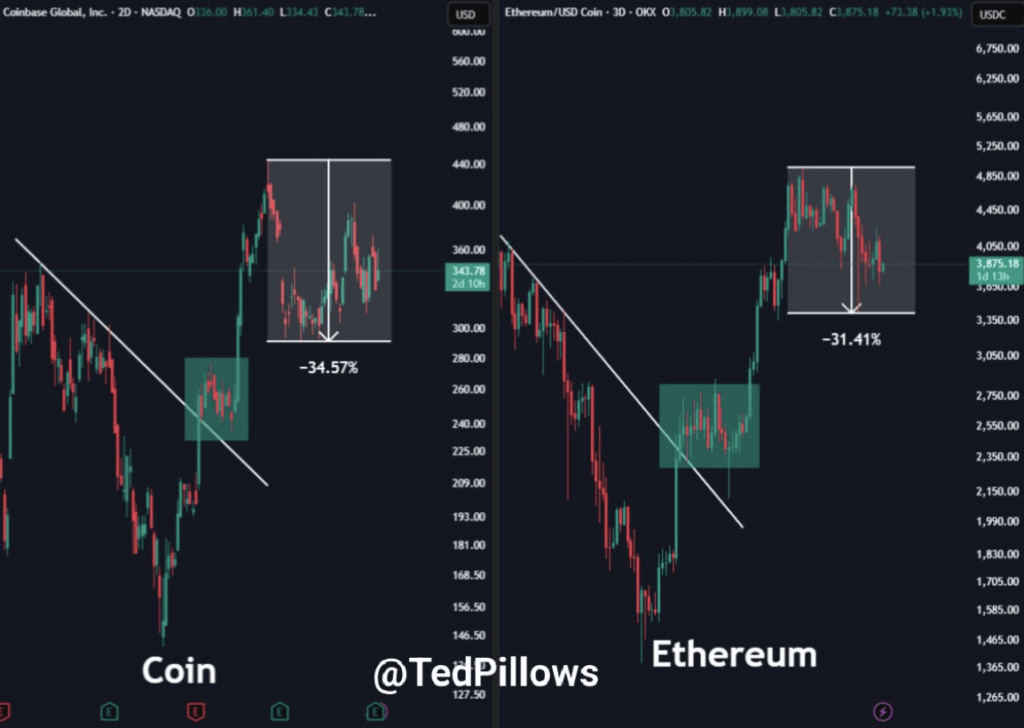

- Coinbase’s price movements continue to mirror Ethereum’s breakout structure.

Here’s the crazy part — Ethereum isn’t just a blockchain anymore. It’s turning into something bigger, something closer to a reserve currency. Sounds wild, but the data backs it up. ETH-based stablecoins now make up a reserve stack larger than what most countries hold in foreign exchange. Yeah, you read that right. Ethereum’s digital liquidity pile just ranked 22nd globally, sitting ahead of Singapore, South Korea, and even India.

Ethereum’s Global Weight Is Growing Fast

ETH’s stablecoin ecosystem now totals about $183 billion. That number doesn’t just make it a big player in crypto—it actually places it among major national reserves. For context, countries like Hong Kong and Saudi Arabia hold less in FX. Only the mega players like China ($3.6 trillion), Japan ($1.4 trillion), and Switzerland ($1 trillion) sit comfortably ahead.

That kind of scale changes the conversation. Ethereum isn’t just the “tech layer” of Web3 anymore—it’s becoming part of the global monetary system. It’s the settlement layer for value across chains, and now, potentially across economies. If ETH really is turning into a reserve denominator, then any meaningful breakout here isn’t just a crypto rally—it’s a macro event.

The Whale Betting $151M on ETH’s Comeback

Amid all the noise, one trader seems to know exactly what they’re doing. Address 0xc2a3 has opened a massive 39,000 ETH long position worth around $151 million, using 10x leverage. What’s wild is that this isn’t some reckless degenerate move — this same trader reportedly has a 100% win rate across major market swings, according to Lookonchain.

And it doesn’t stop there. They’ve also opened $118M in BTC longs and $105M in SOL positions, but the biggest bet sits squarely on Ethereum. That’s where they’re leaning the hardest. It’s like the most efficient whale of the cycle is calling the bottom on ETH — quietly, while the rest of the market still argues about “weak momentum” and “sideways price action.”

The Hidden Signal: COIN’s Price Action

There’s another pattern hiding in plain sight, and barely anyone’s talking about it. Coinbase (COIN) led the last big move, rallying first before pulling back 34%. Ethereum followed almost perfectly, mirroring the same structure with a 31% cooldown. And now, both charts are sitting inside the same kind of consolidation zone.

Analyst TedPillows pointed out that every time COIN breaks into a new all-time high, ETH has followed almost tick-for-tick. If that relationship holds again, then Ethereum’s next move might already be written in Coinbase’s chart.

Final Thoughts — A Storm Building in Silence

Right now, the headlines are about reserves, whales, and cautious traders. But underneath that, something bigger seems to be forming. Ethereum isn’t just another altcoin grinding through a dip. It’s sitting on one of the largest liquidity bases in the world — and the smartest money out there seems to be loading up quietly.

So while everyone debates short-term sentiment, the real story might be this: Ethereum is slowly taking its place in the global financial order. And if history rhymes, the next breakout won’t just be another crypto pump—it’ll be a statement.