• Kyrgyzstan launches its KGST stablecoin on BNB Chain, embracing blockchain at a national level.

• An Ethereum whale with a perfect trading record opens a $131M long, boosting market confidence.

• Telegram integrates yield-earning DeFi features for millions of users — here is why it matters for mass adoption.

Crypto markets moved through a lively 24 hours marked by bold government experiments, whale-sized bets, and expanding access to decentralized finance. Innovation, speculation, and strategic partnerships defined the day, keeping both traders and regulators on alert. So, let us take a closer look at what made headlines across the crypto space.

Kyrgyzstan Goes All In on Blockchain Power

Kyrgyzstan made waves by launching the KGST stablecoin on the BNB Chain, becoming the first Central Asian nation to tie its currency directly to blockchain infrastructure. The rollout includes pilot testing of the country’s digital som CBDC, with Binance Coin (BNB) now forming part of Kyrgyzstan’s official crypto reserve. Former Binance CEO Changpeng Zhao is advising the government, signaling high-level industry collaboration.

The move positions Kyrgyzstan as a regional front-runner in crypto adoption and blockchain innovation. Moreover, Binance Academy’s new partnerships with 10 Kyrgyz universities underscore a long-term push toward education, AI research, and technical development. Overall, the country’s proactive embrace of blockchain marks a shift from regulatory hesitation to state-backed innovation, setting a precedent that other emerging markets may soon follow.

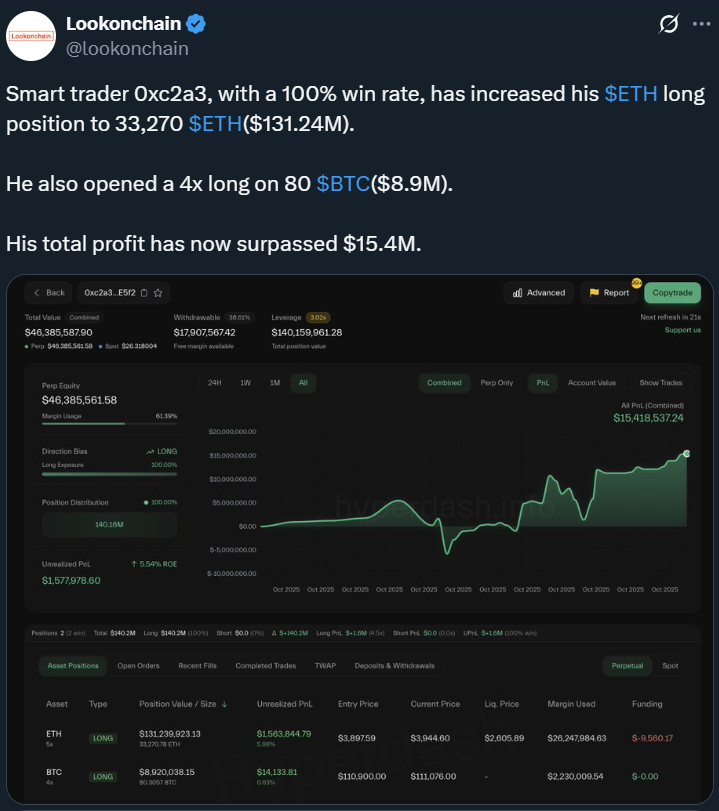

100% Win Rate Ethereum Whale Bet Signals Growing Institutional Conviction

Ethereum’s price action caught attention as a major whale with a flawless 100 percent trading record opened a $131 million long position. This bold move comes amid record-low exchange reserves, suggesting large holders are moving ETH into self-custody and reducing market liquidity. Such positioning often precedes major price movements, reinforcing bullish sentiment among professional traders.

Market analysts point to Ethereum’s strengthening fundamentals, with expanding institutional adoption and deeper DeFi integration fueling optimism. All in all, the confidence shown by top-tier investors reflects a broader trend of long-term accumulation as the next growth phase approaches.

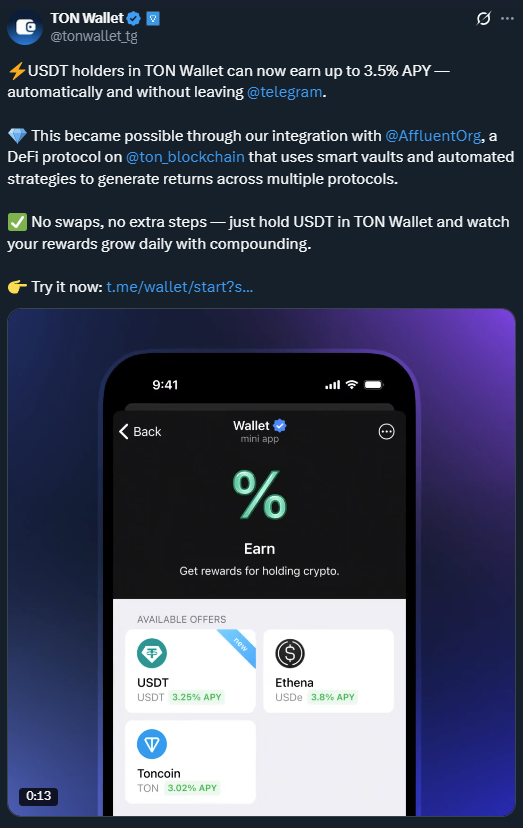

Telegram Wallet Pushes DeFi to the Masses

Telegram took a decisive step toward mainstreaming DeFi by integrating Affluent’s yield feature directly into its wallet. The update allows users to earn up to 3.5 percent on USDT within the app through TON-based vaults and a simple one-click “Earn” function. This seamless design lowers entry barriers for more than 100 million users, turning Telegram into a powerful gateway for everyday crypto engagement.

With plans to onboard 30 percent of its global user base by 2028, Telegram is positioning itself as a core player in Web3 infrastructure. Its growing ecosystem merges convenience with yield opportunities, placing financial tools directly into the hands of millions. Notably, the move could redefine how social and financial platforms converge in the next wave of digital adoption.

Final Thoughts

To conclude, the past 24 hours showcased crypto’s rapid evolution from speculative trading to structural innovation. Governments are building, whales are betting big, and platforms are bringing DeFi to the mainstream. So, as traditional and digital finance continue to blur, the next chapter of global crypto adoption is already being written — one bold move at a time.