- VanEck files with the SEC to launch the first staked Ethereum ETF, tracking Lido’s stETH.

- Ethereum faces resistance near $4,100, despite easing regulatory sentiment and ETF buzz.

- Technicals show mild improvement, but RSI and MACD still lean slightly bearish.

Ethereum’s been under a bit of stress lately, hovering near that $4,100 resistance mark — even after some pretty big news. Asset manager VanEck just filed with the U.S. Securities and Exchange Commission (SEC) to launch what could become the country’s first staked Ethereum ETF. Still, price action hasn’t shown much excitement so far, with traders cautious and technical signals looking mixed.

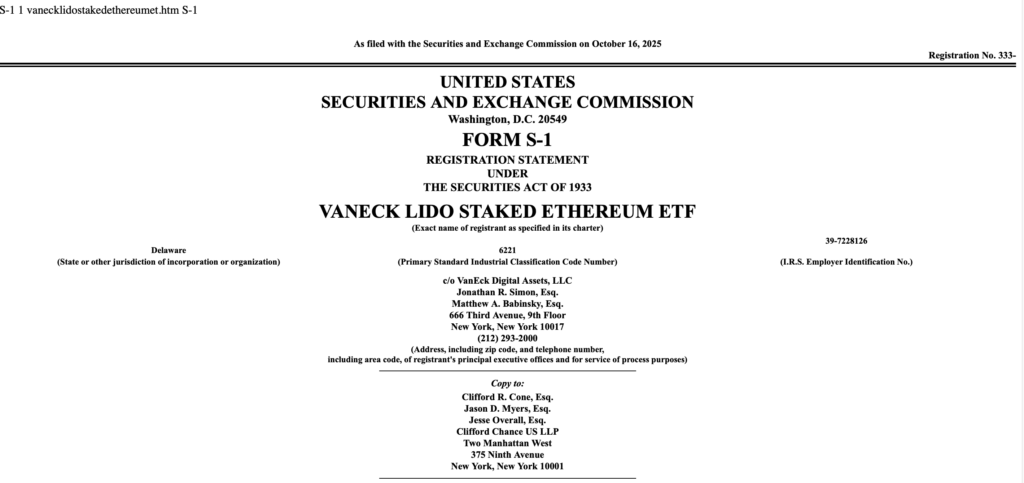

VanEck Moves Toward First Staked ETH ETF

VanEck’s latest filing proposes a fund called the VanEck Lido Staked Ethereum ETF, designed to track the price performance of Lido’s liquid staking token, stETH, while also capturing staking rewards. Basically, it’d give institutional investors a way to gain exposure to Ethereum staking — without needing to actually stake ETH themselves.

In a Monday statement, Lido Finance said that if approved, the ETF would give institutions “a compliant, tax-efficient way” to access ETH staking yields inside a regulated investment product. They also noted that stETH allows for smooth creations and redemptions while avoiding Ethereum’s sometimes lengthy withdrawal process.

The timing looks interesting too. Since the Trump administration’s new SEC leadership took over, crypto regulation in the U.S. has been loosening — a bit. Recent guidance from the SEC clarified that proof-of-stake and liquid staking activity generally don’t fall under securities laws, which makes it easier for firms to launch staking-linked products like this.

Lido pointed out that under the new framework, “staking receipt tokens, though evidencing ownership of deposited assets, are not securities because the underlying assets themselves are not securities.” Still, the SEC hasn’t made a final call on VanEck’s application — or on similar ETF filings that include staking components.

Ethereum Price Outlook: Testing Resistance at $4,100

Ethereum’s price action has been choppy. According to Coinglass, over $144 million in ETH futures were liquidated in the last 24 hours — about $62.6 million from longs and $81.7 million from shorts. After rebounding from the $3,815 support level, ETH managed to break a short-term downtrend from October 7, but that $4,100 zone is acting as a real wall right now.

If ETH can finally clear that resistance, the next targets lie around $4,270 and $4,500, both historical levels tied to previous uptrends. But if momentum fades and ETH drops back below $3,815, things could get slippery fast — a move toward $3,500 isn’t off the table.

The RSI is hanging below the midpoint at 50, and the MACD histogram still shows bearish momentum — though both indicators hint at a slow recovery forming. It’s not full-on bullish yet, but the selling pressure seems to be cooling off.

The Bigger Picture

So far, Ethereum’s reaction to the ETF news has been muted, suggesting traders want to see actual approval before pricing in any optimism. If VanEck’s product gets the green light, it could open a new chapter for ETH staking exposure in the U.S. — and maybe bring some fresh institutional liquidity into the mix.

For now, though, $4,100 remains the line in the sand. Break it cleanly, and Ethereum might have a real shot at climbing back toward $4,500. Fail to hold above $3,800, and we might be looking at another short-term dip before the next leg up.