- CZ says Bitcoin will eventually replace gold as the top store of value.

- His comments came after Peter Schiff’s claim that BTC “lost value” vs. gold.

- The debate highlights a growing shift from traditional to digital wealth.

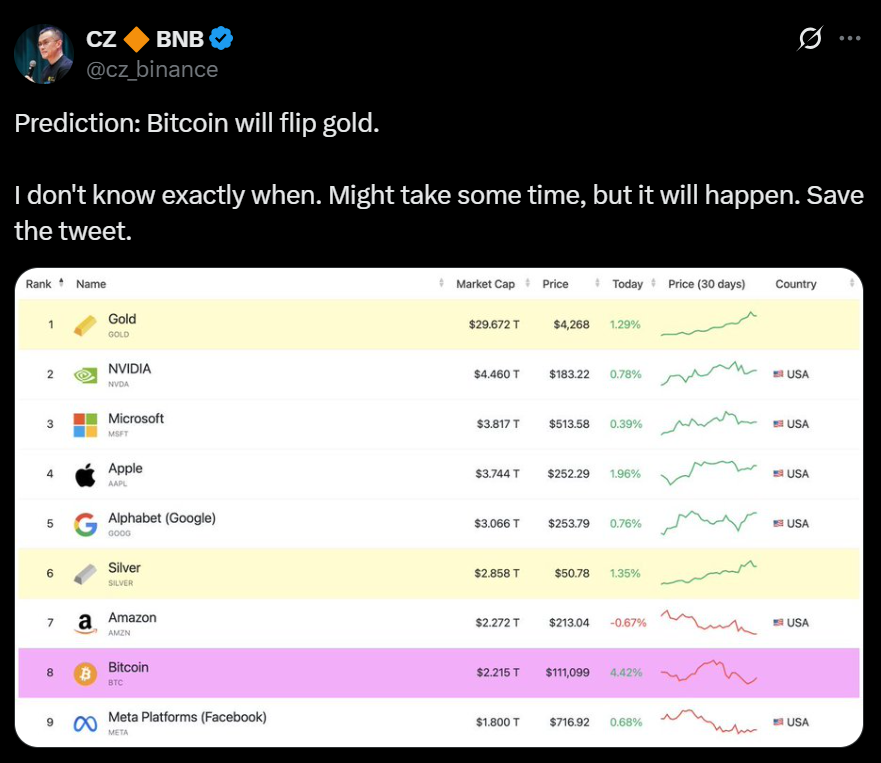

Binance founder Changpeng Zhao (CZ) believes that Bitcoin will one day replace gold as the world’s most valuable store of wealth. While he didn’t give a timeline, CZ said the shift is inevitable given Bitcoin’s explosive growth and expanding global adoption. His comments came in response to long-time Bitcoin critic Peter Schiff, who argued that BTC has lost over 30% of its value relative to gold since August and called it “fake gold.” CZ fired back, pointing out that Bitcoin’s rise from $0.004 to over $110,000 in just 16 years tells a much stronger story than short-term market ratios.

The Long-Term Vision

CZ’s view underscores how far digital assets have come in challenging traditional safe-haven investments. He argued that Bitcoin’s technological design, scarcity, and borderless nature make it a superior alternative to gold in the long run. While volatility remains a concern, he suggested that continued adoption, institutional participation, and improved financial infrastructure could pave the way for Bitcoin to become the dominant reserve asset of the future.

Gold Loyalists vs. Crypto Believers

The debate between gold advocates like Schiff and Bitcoin believers like CZ is as old as crypto itself. Gold backers see the metal’s physical presence and historical trust as unbeatable, while Bitcoin supporters highlight digital scarcity and decentralized security as the new era of value. Schiff’s criticism that Bitcoin is speculative “fake gold” sparked a familiar back-and-forth—one that reflects a deeper generational divide in how people define safety, value, and wealth preservation.

The Bigger Picture

Whether or not Bitcoin overtakes gold, the fact that such a debate exists at all shows how rapidly the financial world is evolving. Bitcoin has already captured the attention of major institutions, and its role as a store of value continues to grow despite volatility. CZ’s prediction might sound bold, but in a world moving toward digitized finance, it’s getting harder to dismiss the idea entirely.