- Korea Premium Index above 8% hints at overheating retail activity.

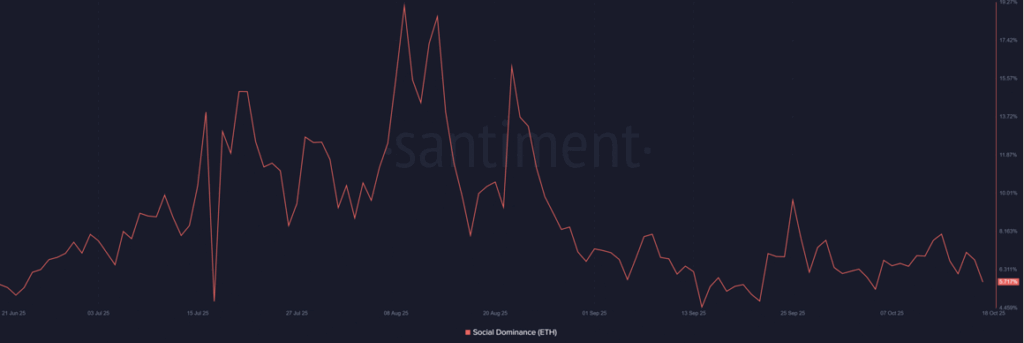

- Social Dominance for Ethereum is falling, showing weaker engagement.

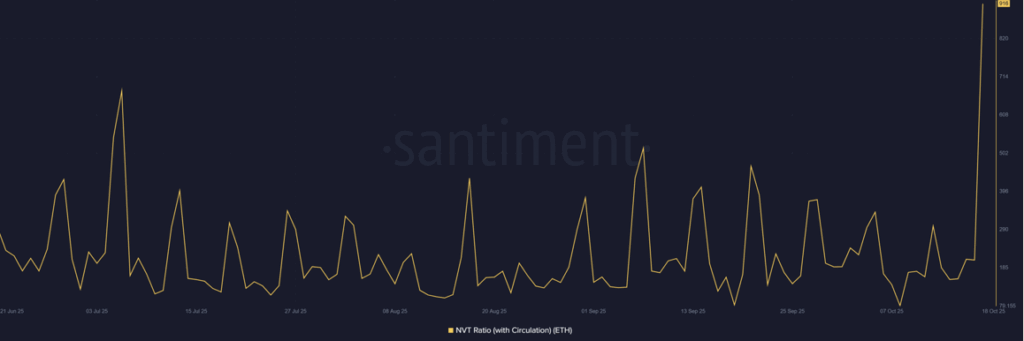

- High NVT ratio and rising taker sell dominance suggest short-term correction risks.

Ethereum’s latest rally is starting to show cracks, at least according to a mix of on-chain and social data. The Korea Premium Index — which measures how much higher ETH trades on Korean exchanges compared to global markets — has jumped past 8%, a level that’s often been associated with euphoric retail activity. When this index spikes, it usually means local traders are piling in fast, sometimes without strong fundamentals to back it up.

Historically, sharp climbs in the Korea Premium have preceded cooling phases. It happened before Ethereum’s 2022 downturn too. This time, the widening gap suggests that much of ETH’s current demand might be speculative. Larger players could start taking profits, especially if retail enthusiasm starts fading.

Social Buzz Slipping — A Warning Sign

Even as prices stayed elevated, Ethereum’s social dominance — its share of overall crypto-related conversations — has dipped to about 5.17%. That drop hints at a fading spotlight. Traders and investors aren’t talking about ETH as much as they were just a few weeks ago.

It’s not necessarily bearish on its own, but history shows that Ethereum tends to lose steam when social engagement declines. Retail traders drive a lot of short-term price action, and when they move on to the next trending altcoin, momentum dries up fast. The current disconnect between strong price movement and weak community chatter suggests conviction is thinning out.

Rising NVT Ratio Points to Weak Network Activity

Then there’s the NVT ratio, which compares Ethereum’s market cap to its on-chain transaction volume. Right now, it’s sitting at a staggering 916 — signaling that ETH’s price is rising faster than real usage on the network. High NVT values usually mean speculation’s doing the heavy lifting, not actual adoption.

To put it simply, if ETH were a company, this would be like its stock price shooting up while revenue stays flat. It doesn’t mean a crash is guaranteed, but it does suggest that a cooldown could be coming soon. Unless transaction activity picks up to match valuation, these price levels may be hard to sustain.

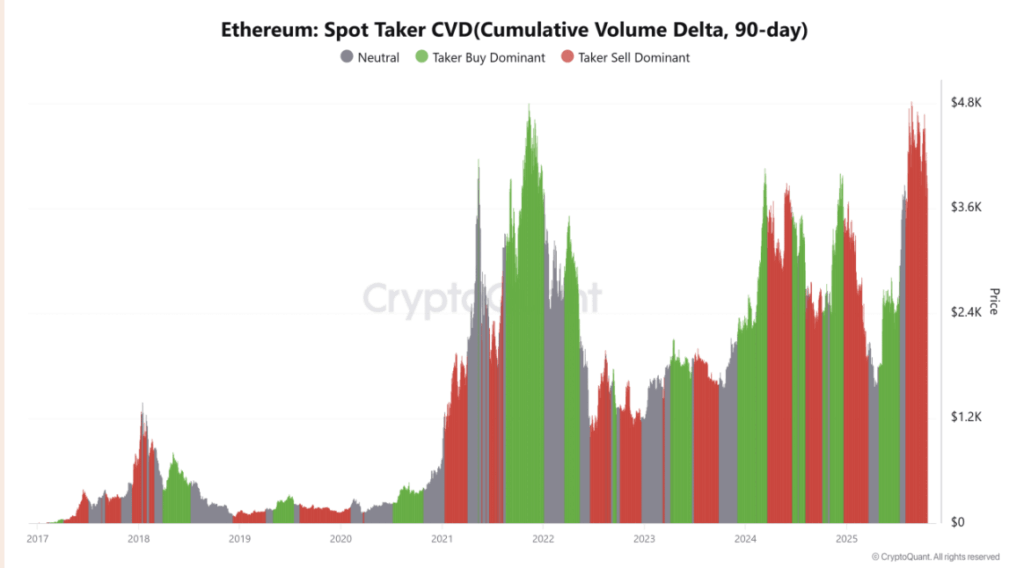

Taker Sell Dominance Signals Growing Profit-Taking

On-chain data from CryptoQuant also shows taker sell dominance rising — meaning more traders are hitting the sell button than buying on spot exchanges. It’s a subtle sign of profit-taking after the recent upswing. Tokens are gradually shifting from experienced traders to latecomers entering near the top, which often leads to short-term corrections.

Put all this together — falling social dominance, high NVT ratio, and increasing sell pressure — and you get a picture of a market that’s running hot but losing balance.

Can Ethereum Keep Its Momentum?

Right now, Ethereum still looks strong on the surface. But the data underneath hints at a rally fueled more by hype than fundamentals. The Korea Premium suggests speculative retail activity, while on-chain weakness and fading engagement point to soft underpinnings.

Unless network usage and liquidity start catching up, ETH could be due for a short-term correction. The good news? Corrections aren’t always bad — they can reset sentiment and give stronger hands a better entry point. For now, though, traders might want to tread carefully — because when the crowd starts cooling off, Ethereum usually follows.