- Over 40% of ETH is locked in staking, ETFs, and treasuries, tightening liquidity.

- Open interest has dropped to its 2025 low, clearing leverage for healthier price action.

- The Ethereum Foundation’s deposit into Morpho Vaults signals deeper trust in DeFi and open-source systems.

Ethereum (ETH) is quietly setting the stage for what could be one of its most structurally bullish cycles yet. At the time of writing, ETH trades around $3,948, still about 19.9% below its August 2025 peak of $4,953. But beneath the surface, something interesting is happening — more than 40% of all Ethereum supply is now locked up, shrinking the available liquidity in the market.

A Tighter Market Than Ever Before

On-chain analyst Taylor.eth shared that about 29.5% of ETH is currently staked in validator contracts, 7.3% is tied up in spot ETFs, and 3.4% sits in decentralized asset treasuries. That means almost half the circulating supply isn’t really circulating at all. This shift, they argue, makes the current cycle very different from those before it — less liquid, more institutionally anchored, and likely slower-moving but stronger in structure.

The institutional footprint continues to expand. Public companies now hold over 4 million ETH in treasuries, while spot ETFs collectively manage close to 9 million ETH, a huge jump from 2.5 million just a year ago. Staking, which now locks up nearly a third of the network, ensures consistent yield generation — and limits how much ETH is available for trading.

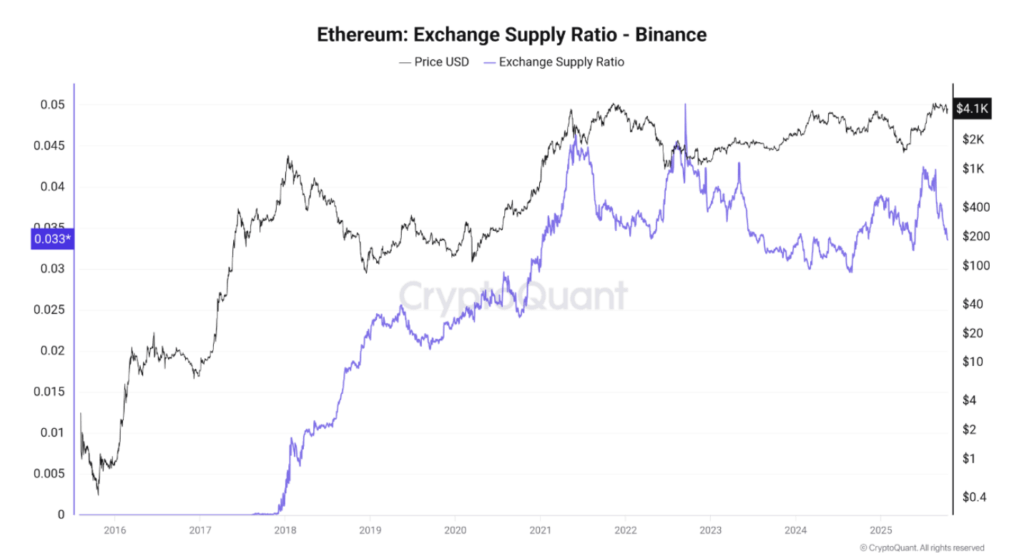

Data from CryptoQuant reinforces this trend. The exchange supply ratio on Binance has dropped to just 0.033, the lowest it’s been in months. Whenever exchange reserves shrink like this, it’s usually a sign that investors are pulling coins into self-custody or staking — often a precursor to accumulation phases and future price expansion.

Technicals Show Strength Despite Falling Open Interest

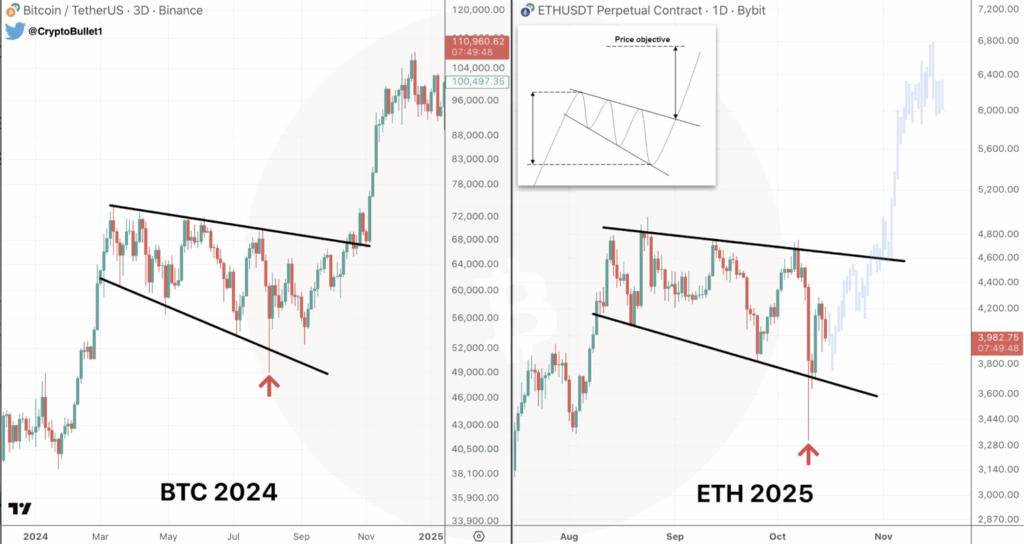

Analyst CryptoBullet compared Ethereum’s current structure to Bitcoin’s pre-breakout setup from 2024. On the chart, ETH seems to be moving within a falling wedge, with resistance sitting near $4,600–$4,800 and support around $3,200–$3,400. Historically, when these wedges break upward, it sparks explosive moves — in this case, targets between $6,000–$7,000 are on the table.

At the same time, open interest has fallen to $46 billion, its lowest since July 2025. That’s down sharply from more than $60 billion in early September, according to Coinglass. Funding rates have flattened out, and long-to-short ratios are balanced, suggesting leverage has flushed from the system. In other words — the market’s cleaned up. And a clean market tends to recover stronger once momentum returns.

Ethereum Foundation Adds 2,400 ETH to Morpho Vaults

In a quieter but meaningful move, the Ethereum Foundation deposited 2,400 ETH (roughly $9.5 million) along with $6 million in stablecoins into Morpho’s yield vaults. The move shows growing confidence in decentralized finance’s risk controls and infrastructure maturity.

Morpho is an open-source lending protocol that optimizes efficiency by pairing borrowers and lenders directly — cutting out excess spreads. With ETH and stablecoins now working as complementary assets (growth vs. yield), the Foundation seems to be diversifying both exposure and returns inside DeFi.

Even more interesting, Morpho’s tech stack — including MetaMorpho and Vault v2 — runs under the GPL-2.0 license, which allows developers to freely fork, audit, and build on the protocol. Morpho Blue (v1) will also switch to GPL-2.0 by January 1, 2026, boosting transparency and strengthening open-source DeFi ecosystems.

The Bigger Picture

Ethereum’s fundamentals look stronger than ever, even if short-term price action feels uncertain. With over 40% of supply locked, institutional adoption accelerating, and on-chain liquidity tightening, ETH might be setting up for a delayed but powerful next leg up.

The short-term might wobble — but long-term? Ethereum looks like it’s quietly building the backbone of the next crypto expansion phase.